How is kidney disease covered in critical illness plans and what preventative benefits do insurers offer?

Today marks World Kidney Day, a global health awareness day intended to shine a spotlight on kidney health and chronic kidney disease. The theme of this years day is ‘bridge the knowledge gap to better kidney care’, with the aim being to highlight the need for a better understanding of kidney disease. Part of the campaign’s focus is on educating people on the health risks that can lead to kidney disease, particularly the importance of a healthy diet and lifestyle. Other areas of focus include empowering patients diagnosed with the disease to better understand their condition and the treatment options available.

To mark certain health awareness days we turn to our independent expert panel of doctors to explain the condition from a medical perspective and examine how conditions are covered in protection policies. The aim of these insights is to educate advisers on certain conditions and build a better understanding of how their clients are covered for those conditions. To mark World Kidney Day we focus on kidney disease and critical illness cover. We also provide some information on support benefits that can help clients maintain a healthy lifestyle and hopefully avoid getting such conditions.

What are the kidneys and how does kidney disease affect them?

The kidneys are obviously vital organs and crucial to a persons health. Below our doctors explain exactly what function they carry out, how kidney disease can affect their ability to do their job and the associated issues:

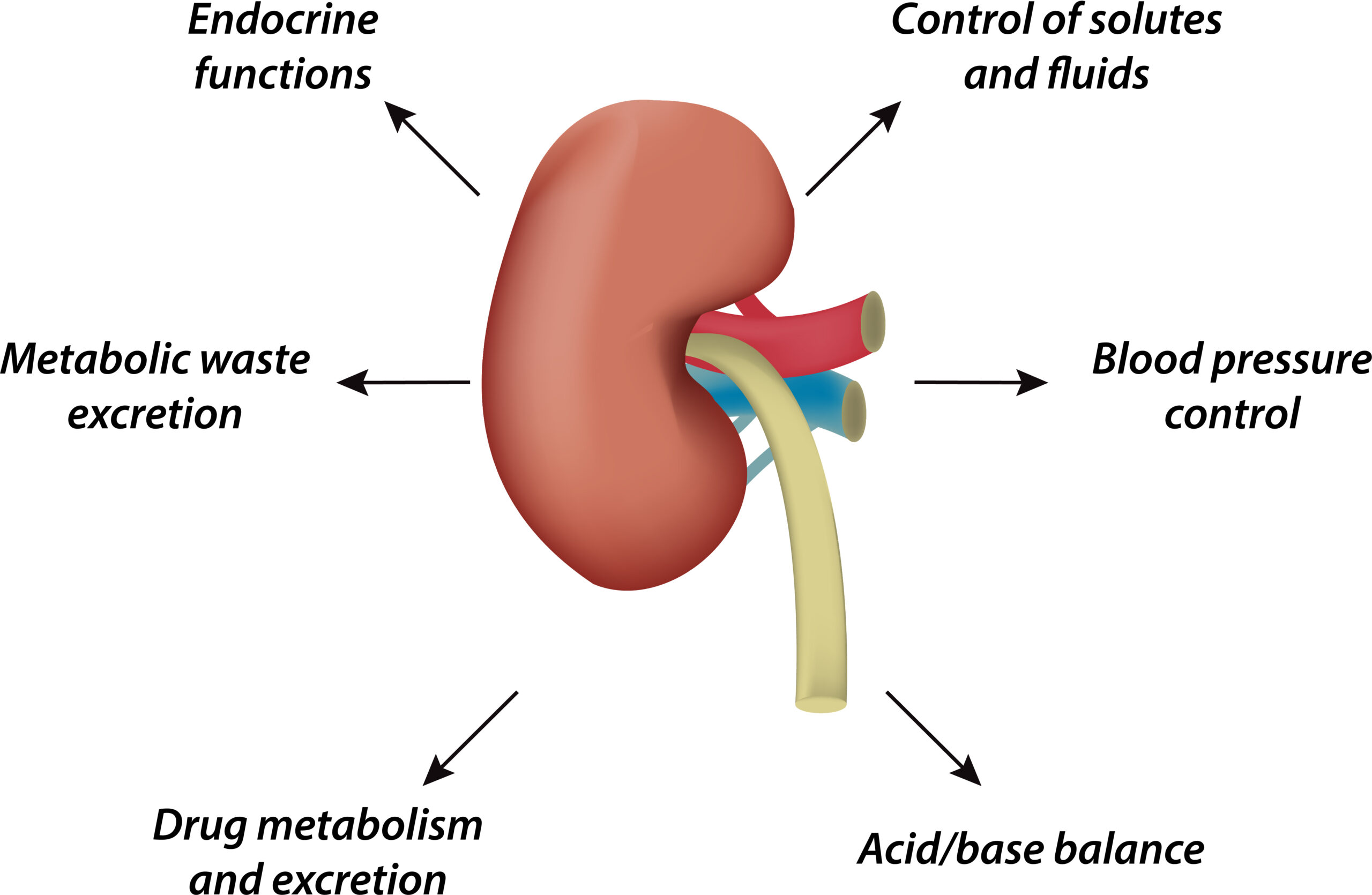

“The kidneys are a pair of organs that sit on the upper part of the tummy, towards the back, on the left and right side. They are extremely important and have several different roles. The most important two are to remove waste products and to maintain the right amount of fluid and blood pressure in the body. Chronic kidney disease is where there is a gradual loss of function of the kidneys over time. This is a common condition and is often not recognised until a later phase as it rarely causes any symptoms earlier on.

End stage kidney disease is when the kidneys have deteriorated to an advanced stage and are struggling to remove enough waste products and fluids to meet the body’s overall needs. This is associated with decreased quality-of-life, higher rates of cardiovascular disease and deaths.”

What are the major causes of kidney disease?

As with many health conditions, there are a number of factors that might lead to an increased risk of kidney disease. Whilst some of these are preventable lifestyle choices, others are not as our doctors explain:

“The two main causes of chronic kidney disease are diabetes and high blood pressure, although there are several other common causes. Certain factors that increase the risk of kidney disease include increasing age, tobacco use, males and certain ethnicities (for example Afro-Caribbeans).

When kidney disease reaches this severe stage, it can be associated with several issues. These include:

- Poor nutrition, with decreased appetite and weight loss.

- Fluid building up within the body (for example leg swelling) with an associated increase in blood pressure.

- Fatigue and malaise.

- Cognitive impairment

Problems with the acidity of the blood and raised salt levels, such as potassium.”

How is kidney disease covered in critical illness plans?

All critical illness plans (with the exception of AIG’s Key3) cover end stage kidney disease through one of two full payment definitions, either Kidney Failure or Major Organ Transplant.

Another condition covered within critical illness plans that can affect the kidneys is systemic lupus erythematosus. Again, where covered this will be a full payment definition and our doctors explain the requirements for a claim below

“End-stage kidney disease has a significant impact on health and well-being and is rightly included in critical illness policies. It is covered through a number of different wordings and definitions. The two wordings that provide most of the coverage are through dialysis and major organ transplant, the main forms of treatment for this severe form of kidney disease.

“Insurer’s kidney failure definitions provide coverage if end-stage failure has resulted in regular dialysis requirement. It is difficult for both doctors and patients to decide when to start dialysis, as it can be lifelong and associated with discomfort and certain health risks. It can also be inconvenient and have a significant effect on quality of life. For example, dialysis in hospital is often three days a week, four hours at a time.”

“A kidney transplant is where a healthy kidney is transferred from one person into another person with end-stage kidney disease. Unlike other organ transplants, in kidney disease this can be from a living donor as the body only requires one kidney to survive. The NHS transplant report from 2016/17 showed over 5,000 patients registered on the kidney transplant list, with the average waiting time for a kidney transplant being 864 days for an adult. Due to this waiting time, the majority (78%) of adults have already gone through the process of dialysis prior to their kidney transplant, so there is significant cross coverage with the dialysis wording in CI policies.”

“Insurers also provide coverage for impaired kidney function in those suffering from systemic lupus erythematosus (SLE), often simply referred to as lupus. This is a condition whereby the body’s own immune system attacks healthy organs and tissues, known as an autoimmune disease. One of the organs that can be affected are the kidneys, causing inflammation within them known as a nephritis. It is estimated that over 50% of lupus sufferers will develop this at some point in their condition.

Insurers stipulate that SLE must have affected the kidneys and impaired kidney function to a certain extent. This is measured through something known as the estimated glomerular filtration rate (eGFR). This shows how well the kidneys are filtering the blood, with healthy kidneys being able to filter more than 90ml/min. To qualify for a payment, most insurers require that a figure of less than 30 ml/min must have been reached. This would provide additional benefits to SLE sufferers above other wordings, as dialysis is usually only considered when symptomatic and the eGFR is below 15ml/min.”

How can ‘added value benefits’ help?

As well as providing coverage through critical illness insurance for when a client is diagnosed with kidney disease, many insurers now include an extensive range of additional support benefits and services to help clients maintain or improve their health. The services can play a vital role in preventing illness and should increasingly be seen as valuable as the core cover itself.

Almost every insurer includes some additional benefits and services, but for managing kidney health some particularly stand out.

Aegon, AIG, Aviva, British Friendly, Cirencester Friendly, Legal & General, Royal London, The Exeter Scottish Widows and Vitality all include access to nutritional support in some form, usually through their third party service providers such as Red Arc nurses.

Similar access to fitness advice and support services is also included. Notably, Royal London recently enhanced their Helping Hand proposition by adding a range of wellbeing and fitness services, available through various smartphone apps. Of everyone Vitality arguably take this to the next level by building their entire protection proposition around the concept of health and wellbeing. Clients are rewarded for making healthy lifestyle choices and given the tools and information to achieve this, whether it be access to services to help them quit smoking, discounts to attend Weight Watchers, shopping discounts on healthy food, discounted fitness trackers etc.

Raised blood pressure can be a contributing factor in causing kidney disease, so health checks to help clients understand their health can also be a useful benefit in making appropriate lifestyle changes. Many clients may not know they have raised blood pressure or other health issues and with routine medical screening not typically available through the NHS, insurer provided health MOTs can in some cases be a life saver. Click the link below to read our dedicated insight on which insurers offer health MOTs.

Kidney Care UK report that every day 20 people in the UK will develop kidney failure with around 63,000 people currently suffering from the condition with 3,000 kidney transplants taking place every year. As highlighted by our doctors this can unfortunately lead to a decreased quality-of-life, higher rates of cardiovascular disease and deaths. Critical illness plans on the whole provide excellent coverage for this condition where dialysis or a transplant is required to help provide added financial support in at this difficult time.