Scottish Widows Showcase Page

Scottish Widows Showcase Page

Website

Contact details

SCOTTISH WIDOWS IN THEIR OWN WORDS

At Scottish Widows we’re here to support customers for the long term. Established in 1815, we paid our first claim in 1816.

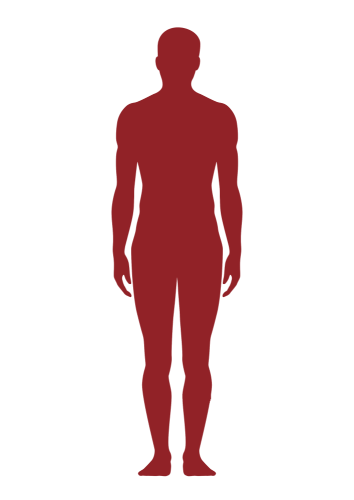

We provide comprehensive cover with simplicity at its heart. To make it simpler to explain our comprehensive cover, we’ve grouped our conditions into 5 categories using our innovative body concept. This makes it easier for advisers to explain and means that clients can see at a glance what they are covered for.

Our research has shown that only 2% of the UK public believe between 91-100% of all claims are paid out. The reality is we paid out on over 98% of claims in 2019.

On 6 August 2023 its 40 years since the creation of Critical Illness, its creator Dr Marius Barnard explains how it came about and the need for Critical Illness Cover

Key Benefits

Life Protection

- Excellent Mental Health Support

- Good separation options on joint life policies

- Wide range of Guaranteed Insurability Options

- Excellent underwriting acceptance rates

- Available as a lump sum or income (family income benefit)

Critical Illness

- Simple, clear and concise critical illness wordings

- Broad critical illness coverage

- Excellent Mental Health Support

- Wide eligibility criteria for children

- Available as a lump sum or income (family income benefit)

Transparent & Inclusive Approach to Underwriting

Did you know…

Roll your mouse over or touch to see the details behind the stats

0%

95%

91%

9%

Business Protection Hub

Business protection and relevant life cover policies account for only 2.1% of protection sales, with pure business protection less than 1%. With over 1.4million small to medium sized businesses in the UK with employees, there’s a clear need for protection should something happen to a key employee

Scottish Widows Business Protection Hub helps advisers understand the opportunity and how to Protect clients business

Enter Scottish Widows’ Business Protection Hub

Scottish Widows Care

RedArc provides a support service that gives clients and their immediate family practical advice and emotional support to get them through difficult times.

All pre-existing illnesses are covered even if they have been excluded from the Scottish Widows policy and cover is available from the moment the policy goes on risk.

The service includes where possible a face-to-face second medical opinion service which provides a specialist report in the post as well as support for mental health through counselling sessions.

Clinic in a Pocket

Square health’s mobile app gives those taking a SW policy from 22 March 2021 free and unlimited access to GP Services via the Clinic in a Pocket™ app.

Digital GP Services

Specialist Referral

Repeat Prescription

Price Lock Promise

To help clients where their application is delayed due to medical requirements or any other reason, Scottish Widows provide a price lock promise where the rates applied to their quote remain valid for up to 12 months once the terms have been offered.

This price lock promise is applicable even if the client passes a quarter birthday.

Claim Statistics

Brain and neurological

18.1%

Cancer

63%

Heart & Arteries

14%

Organs

2%

Senses

1%

Mental Health Support

Scottish Widows’ Mental Health support…

- Can provide Cognitive Behavioural Therapy, Cognitive Analytical Therapy, Phobia Therapy, Trauma Focused Therapy and Eye Movement Desensitisation Reprograming

- Can be offered Face to Face, via telephone, video conferencing or email

- Covers the full cost of therapy

- Is available to the life assured(s), their spouse/civil partner/partner, their children and the plan holder if different to the life assured(s)

Protection Guru has worked with Scottish Widows to create a concise objective analysis of their product range. Scottish Widows have had input to the design of this page and contributed to the cost of this construction maintenance, however Protection Guru have maintained editorial control over the content to ensure objectivity.

Critical Illness page

Care page

Business Protection page