Protection Advice Redefined

Provide a “consumer duty ready” value assessment today!

OPEN PROTECTIONGURUPRO

SIGN UP

7-DAY FREE TRIAL

NOTE: If you have already registered for the ProtectionGuru site, you can use these same login credentials to sign up to ProtectionGuruPro or access the free trial

USER GUIDE

FAQs

Quick links

KEY FEATURES

HOW IT WORKS

WEBINARS

COSTS

CONTACT

NEW

Compare quality alongside fully underwritten pricing

Provide your clients with more comfort that the price you give them is the price they will pay!

A better experience for your client.

Putting the control back in your hands. Build trust by giving your client clear outcomes. Have confidence that you have made the right recommendations.

Be more compliant

A variety of reports providing comprehensive compliance records and justifying product selection.

Better consumer outcomes

Compare features and benefits alongside fully underwritten premiums to get the best outcome foryour client.

Understand if you can put your client in a better position

Show whether a newer policy can provide better critical illness cover based on what the client is likely to suffer from

Save time

UnderwriteMe’s Protection Platform allows you to compare fully underwritten premiums to help you manage customer expectations as early as possible.

Increase confidence

Practising medical professionals assessing critical illness wordings and analysis of features most relevant to your clients’ specific scenarios.

DOWNLOAD FACTSHEET

Compare historic CIC policies

Demonstrate whether a new plan can provide better cover for your client or if they are better off keeping their current plan in place.

Doctors assessment

Detailed assessment of the quality of cover conducted by our panel of qualified medics

Based on your client

All scores are unique to the client and based on their age, gender and smoker status.

Highlights the differences

Identifies conditions where the historic policy provides better cover

"Protection Guru has transformed how we are able to present clients with their options for protection products. The cheapest plans are rarely the best value. Using Protection Guru we have found that around 75% of people would rather pay a little more to get a better value plan.

Adopting the system is a key part of our preparation for Consumer Duty. The addition of replacement business comparisons for critical illness, including all historic Vitality plans, is a huge bonus. Over the last decade, critical illness plans have got better and better, so there is frequently a compelling case for putting new products in place. When it is the right thing to do, the system gives us all the evidence we need to compliantly justify changing providers. Equally it makes it clear which plans need to be left in place.

Add to this, the fact that Critical illness definitions both historic and new, are continually assessed and rated by practicing doctors, it really is the perfect journey for Critical Illness Advice"

Charly Higman

Protection Guru has made a real difference to how I'm able to present protection options to clients. Letting me have a conversation around best value, rather than simply price.

By having the ability to source by best quality, as well as lowest price, it allows the client to see for themselves the additional value they can gain by spending just a few pounds more. This is invaluable as Consumer Duty requires us all to think in terms of best value for clients, not just lowest price. Price only comparisons will struggle to meet this new standard without additonal work from the adviser, so it’s great to have a new system in place now that takes the stress away from the research process. The modest increases in premium that results from taking better value products will also generate additional revenue, so the service could literally pay for itself.

The extension to offer a comparison of historic critical illness plans based on an analysis by qualified medical professionals, including the complex PruProtect and Vitality plans that not been included on legacy comparison systems in the past, is a massive step forward. The complexity of critical illness wordings is such that these can really only be fully assessed by doctors, as no adviser would want to jeopardize a cleints ability to claim by replacing a plan with something that offers less protection than they currently enjoy. This opens the door for us to provide better quality reviews of in-force plans, all using one system, rather than having premium, quality and legacy plan information spread across multiple systems. Given the major enhancements to policy wording is in recent years this is a great extra benefit we can offer our clients to ensure they are paying for the best protection they can comfortably afford.

Scott Taylor-Barr DipMAP MLIBF

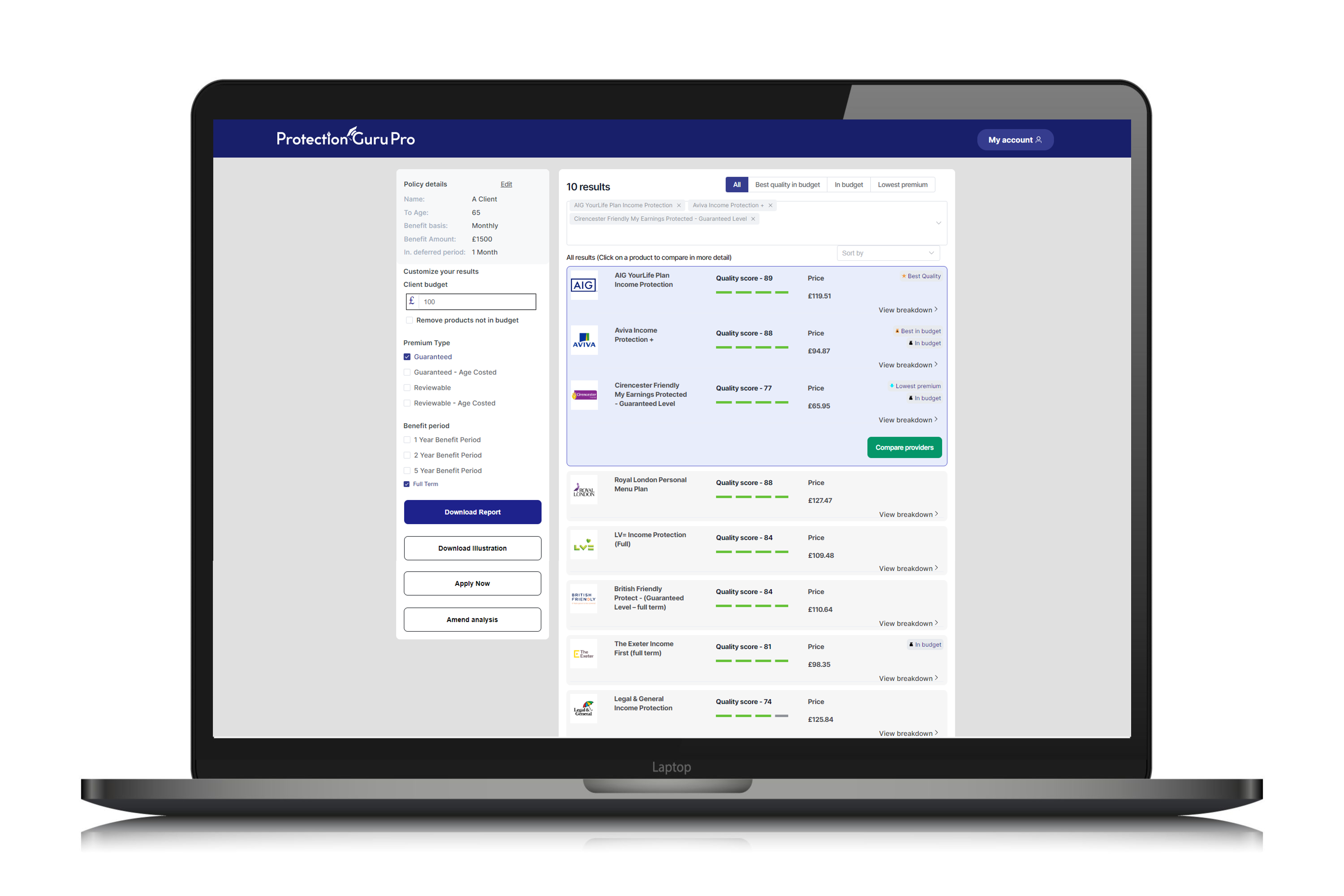

Fast and easy analysis

Demonstrate the best plan for your client and meet your consumer duty obligations with ProtectionGuruPro

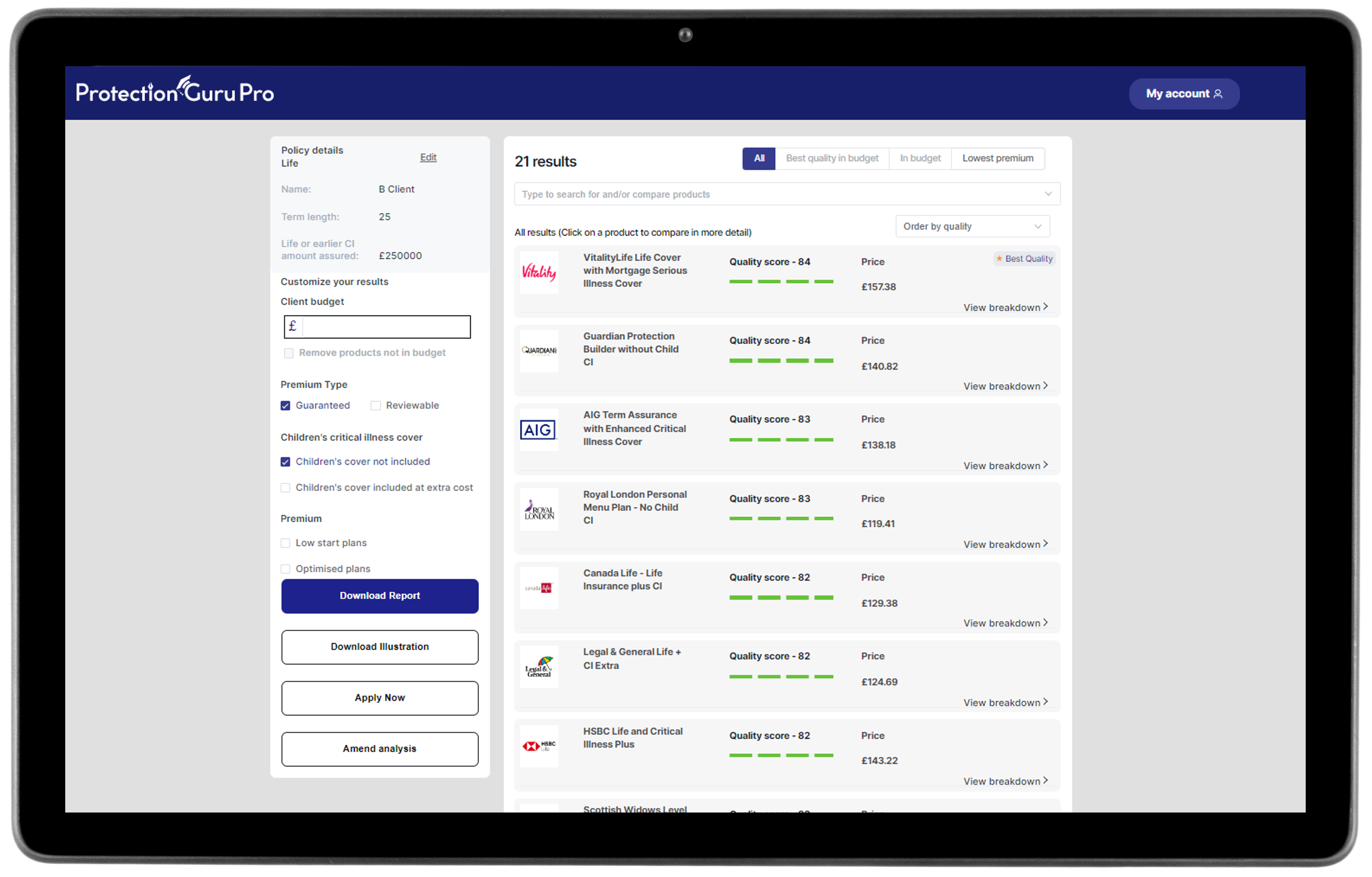

Quality assessment

Detailed quality assessment based on your clients’ specific needs

Critical illness

Independent medical practitioners assessment of critical illness wordings

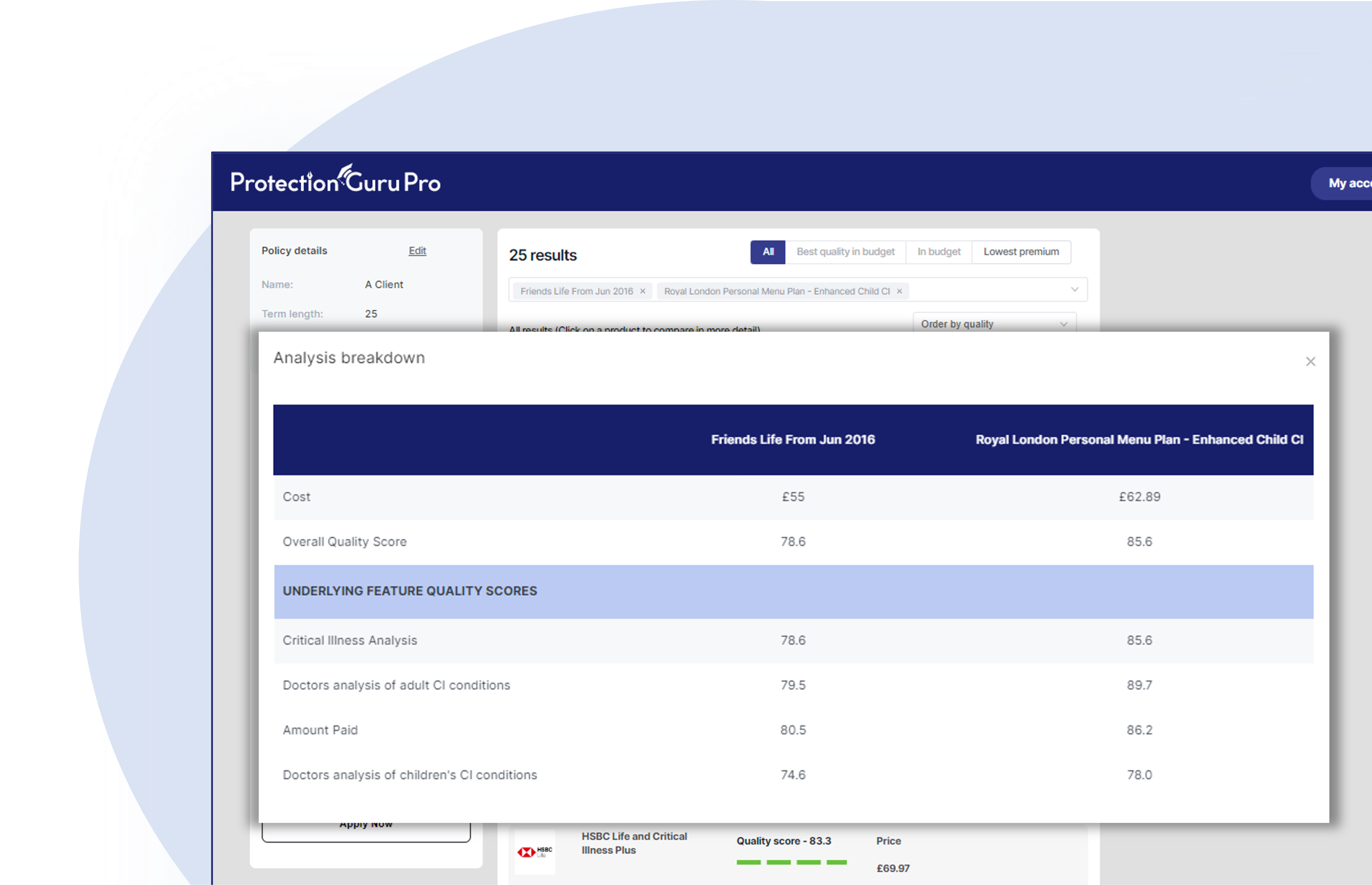

Comparison of cost

Compare actual costs side by side with quality and download illustrations

Filterable results

Focus on plans that are relevant and remove those that are not

Replacement business

Compare older CIC policies to identify if a new policy provides better cover

Consumer duty

Assess the value of protection plans by combining quality and cost

Compliance

Download a short or full compliance report to justify recommendations

Benefit types that can be anaylsed

Life protection

Critical Illness

Income Protection

Family Income Benefit

Business Protection

How it works

USER GUIDE

FAQs

Where we get pricing from

Upcoming webinars

Protection Guru Pro have added a new comparison service highlighting the exact changes between existing critical illness policies and new protection plans.

The service benchmarks legacy plans from all major UK insurers over 20+ years Uniquely the benchmarking is undertaken by a panel of practicing medical professionals best placed to understand the detailed and complex medical language used. This process has never previously been applied to legacy product comparison.

In this session we will demonstrate how ProtectionGuruPro works and how advisers can use it to demonstrate the best possible critical illness recommendation for the client.

Watch a recent webinar (current plan comparisons)

Our awards

What does it cost?

Single license

- 10 credits per month (120 across a year)

- £40 plus VAT per month

- £2 per additional credit (see explanation of a credit below)

- 12 month contract

Multiple licenses

1 to 4 licenses |

£40 plus VAT per license |

5 to 9 licenses |

£38 plus VAT per license |

10 to 19 licenses |

£36 plus VAT per license |

20 or more licenses |

For each license purchased 120 credits will be provided in a pooled pot which can be used across all licenses.

Part of a network or support group? Find out if you could obtain a discount here

A credit will be deducted for each historic policy compared. If comparing current policies only, a credit will be deducted when you generate a report. Each credit entitles the user to unlimited additional current policy analyses for that same client on the benefit type that the comparison has been run on.

(i.e. if an Income Protection report has been downloaded for Mr Smith, you can download as many additional Income Protection reports for Mr Smith without any further credits being deducted. If you go on to download a term assurance report – life only, critical illness only or life with critical illness – an additional credit will be deducted, however you will then be able to generate as many additional term assurance reports for Mr Smith without any credits being taken).

Want to know more?

If you would like to learn more about ProtectionGuruPro, understand how the tool may support you with your consumer duty requirements or arrange a demonstration please do not hesitate to get in contact with us.