What safety net do income protection plans offer if a client’s income drops?

It’s fair to say that everyone expects their earnings to rise over time, not fall. However, there are times when a client’s earnings can dip – perhaps through a career change, of if they’re self-employed because of a downturn in trading. If the client did experience a drop in earnings and claimed on their income protection policy, they may find the monthly benefit amount reduced. This is because the benefit is based on the client’s pre-incapacity earnings, usually the 12 months immediately prior to a claim.

This is arguably one of the main problems with income protection policies: that of the client arranging a policy based on their earnings at the time of applying and insuring themselves for a benefit amount, with the risk that the actual amount they’re paid in the event of a claim is less they’re insured for (and have been paying for). This over-insurance scenario is certainly not uncommon and can lead to serious client detriment if the over-insurance is entirely innocent and understandably anger, particularly as there is no obligation for the insurer to refund premiums.

There are features offered by insurers to provide some protection against over-insurance, ranging from minimum benefit guarantees, upfront financial assessment and cover with no link to the client’s earnings. In this insight we examine minimum benefit guarantees, how they work and how insurers compare. We’ll also look at how ProtectionGuruPro helps advisers quickly compare these features and produce evidence to support a recommendation.

What is a minimum benefit guarantee and how does it work?

A minimum benefit guarantee will provide a safety net for clients who are earning less than they used to, as insurer will pay either the minimum benefit guarantee monetary amount, or the client’s insured-for benefit, whichever is lower.

It’s important to be aware that minimum benefit guarantees only apply as a safety net in the event of a claim. This doesn’t mean the client can apply for a level of cover higher than they’re eligible for based on their income at the applying. If they need a policy without a link to their earnings, they’d need to arrange a non-financially underwritten income protection policy.

Example: the client has an income protection policy covering them for £1,800 a month, originally set up based on an income of £40,000. They experience a drop in earnings and subsequently fall ill, with their income at the time of claiming now being £30,000.

Their income protection policy covers them for 55% of their earnings, so based on their lower income they are now only eligible for a monthly benefit of £1,375. Their policy includes a minimum benefit guarantee of £1,500, so the insurer pays them this amount instead. It’s still less than their original benefit, but the minimum benefit guarantee provides this minimum safety net.

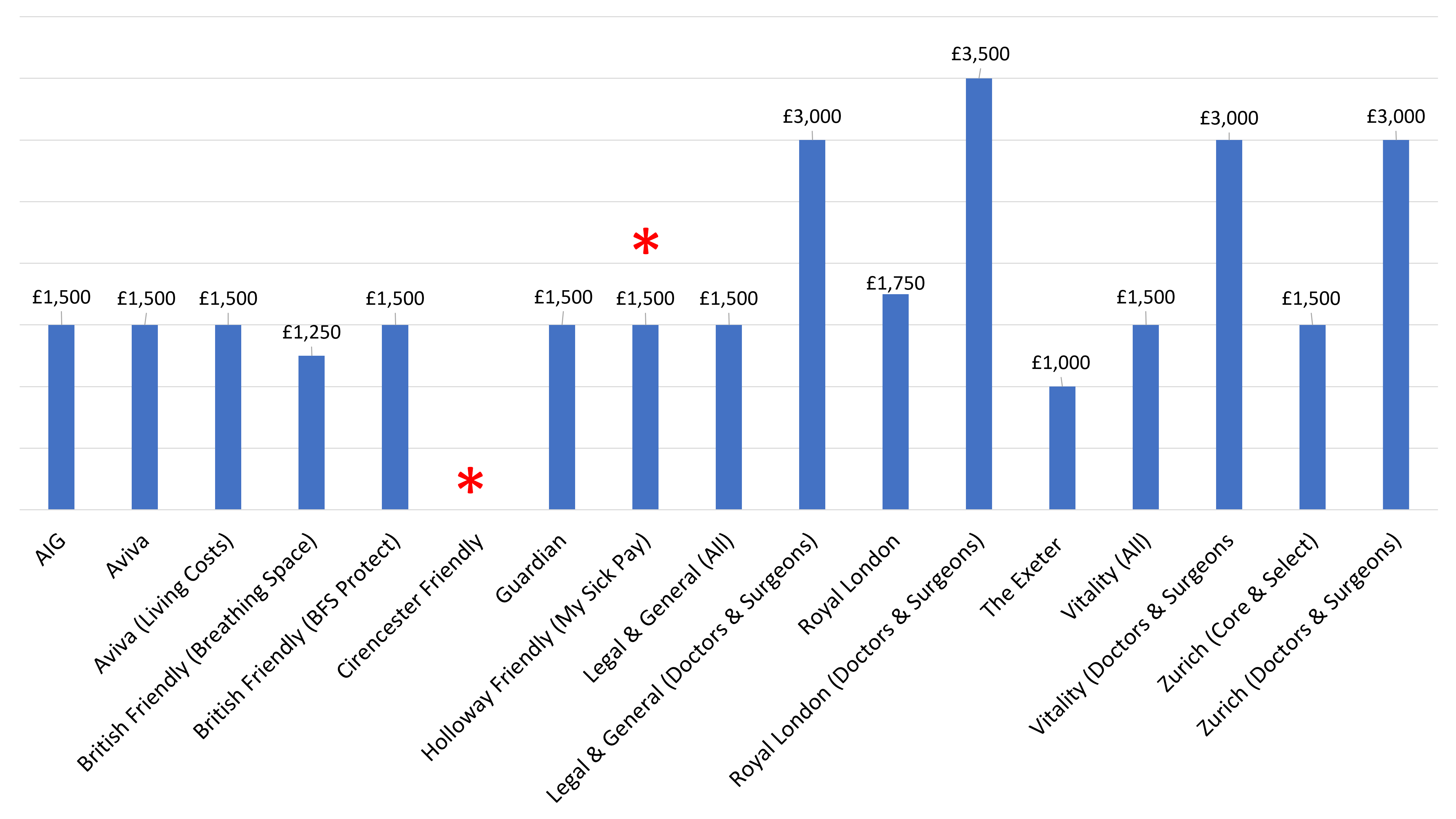

Minimum Benefit Guarantee Amount

The actual benefit guarantee amount varies slightly between insurers, but in most cases is set at £1,500.

Some insurers offer a much higher amount of £3,000 (£3,500 for Royal London) for their ‘doctors & surgeons’ cover. These are not separate policies that need to be specifically applied for, instead if the client works as a doctor or surgeon (or in some cases other medical professional role as accepted by the insurer), then a higher minimum benefit guarantee is applied (along with some other features in some cases).

* Cirencester Friendly do not include a minimum benefit guarantee.

† Holloway Friendly will offer most clients a minimum benefit guarantee of £1,500, however some occupations have a lower guarantee of £1,000. Holloway state the guarantee amount on the client’s illustration.

Advisers should be aware that The Exeter’s minimum benefit guarantee is not automatically included and instead must be selected at an additional cost when the policy is applied for. They do however include an upfront financial underwriting option as standard and at no cost, allowing client’s to fix 75% of their benefit from the outset by providing financial evidence. This means any client with a monthly benefit higher than £2,000 could ultimately secure a higher minimum benefit than offered

The Aviva Living Costs and British Friendly Breathing Space products highlighted in the table are all non-financially underwritten income protection plans, you can find out more about those here. The limits shown in this table are the maximum benefit amount allowable under these plans

Minimum Working Hours

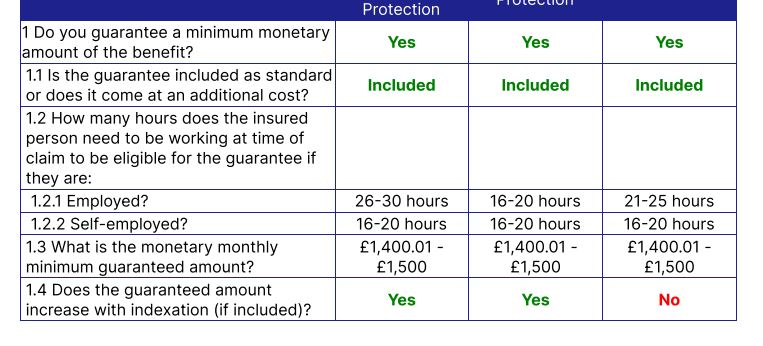

In most cases insurers impose a minimum working hours requirement, meaning the client must have been working a certain number of hours before claiming in order to be eligible for the minimum benefit guarantee (these requirements usually apply at the time of the client applying for the policy as well).

The exception to this requirement are British Friendly’s Breathing Space, where there is no minimum working hours requirement.

We’ve included them in this insight as they’re still technically income protection products with a guaranteed minimum benefit, however they’re slightly different plans (alongside Aviva Living Costs) in that the benefit has no link to the client’s earnings at all. You can find out more about non-financially underwritten income protection here.

How many hours does the insurer person need to be working at claim to be eligible for the guarantee?

| Insurer (Product) | Employed | Self-Employed |

| AIG | 16 hours | 16 hours |

| Aviva | 16 hours | 16 hours |

| Aviva (Living Costs) | 16 hours | 16 hours |

| British Friendly Breathing Space | No minimum working hours requirement | |

| British Friendly (Protect) | 25 hours | 16 hours |

| Guardian | 30 hours | 24 hours |

| Holloway Friendly (My Sick Pay) | 16 hours | 16 hours |

| Legal & General | 16 hours | 16 hours |

| Royal London | No minimum working hours requirement but must meet one of their serious illness definitions if working less than 16 hours | |

| The Exeter | 30 hours | 30 hours |

| Vitality | 30 hours | 20 hours |

| Zurich (Core & Select) | 16 hours | 16 hours |

Using ProtectionGuruPro to Compare the quality of minimum benefit guarantees

ProtectionGuruPro allows advisers to quickly compare the quality and cost of income protection plans, including the minimum benefit guarantee feature.

Our express comparison questions are designed to find out more about the client, to then personalise the quality comparison to the specific needs of that individual. Based on the responses to these questions, ProtectionGuruPro will do the hard work and select the product features that are most likely to be relevant and then include them within the overall benchmarking.

Here we see one of the IP specific express questions relating to the client’s income. If the response is that the client’s earnings fluctuate (perhaps because they’re self-employed), minimum benefit guarantees and upfront financial underwriting will be included in the comparison. Each insurer will then be benchmarked and scored based on the quality of how these features are offered.

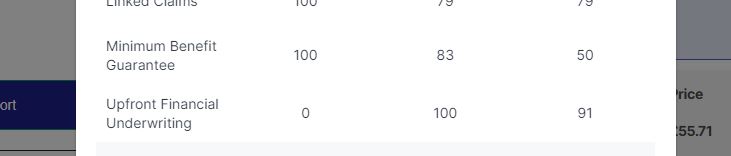

On the ProtectionGuruPro results screen advisers can then compare products in more detail and review the underlying scores for the various features and benefits included in the quality comparison. Here we see an example of how three insurers have scored for their minimum benefit guarantee and upfront financial underwriting, which have been included based on the express question response.

To provide supporting evidence for a recommendation for compliance or to share details of why a product has been selected with a client, advisers can download either a summary or detailed report on ProtectionGuruPro. The more extensive detailed report includes tables of the underlying data, that have been used to drive the quality scores.

In Summary:

- Minimum benefit guarantees provide a safety net against the risk of over insurance, if the client experiences a drop in earnings and subsequently claims on their income protection policy.

- Overall, AIG, Aviva, Holloway Friendly, Legal & General and Zurich fair well as they only require the client to be working a minimum of 16 hours immediately before incapacity in order to qualify for the minimum benefit guarantee. In monetary terms all those providers pay a guaranteed minimum benefit of £1,500, which is the market norm and the highest amount available unless a client qualifies for enhanced terms under a doctors and surgeons plan. Royal London has no minimum working hour requirement but clients need to meet its serious illness definition if working less than 16 hours.

- The Exeter and Vitality should be commended for being the only insurers on the market to offer up-front financial underwriting. Rather than provide a minimum benefit, this feature helps guarantee the benefit amount paid in the event of a claim.

- ProtectionGuruPro helps advisers quickly compare the quality of income protection plans, including features like the minimum benefit guarantee by using the simple express question responses.

very useful information in this article