What joint life insurance separation options do insurers currently offer?

In reading this article you will understand:

- Why separation options might be necessary for clients

- What options insurers offer for clients wishing to split a joint life insurance policy

- What restrictions or limitations insurers impose on separation options.

The debate around the suitability of two single plans versus a joint life policy has been one of recent focus, the consensus being that two singles will meet the need for “lifestyle” needs.

But when it comes to covering a mortgage or a similar debt then the commonly held view is that a joint life plan will be the most appropriate recommendation to avoid the possibility of the client’s being over insured at an additional cost. However, not every marriage or civil partnership will work out, ONS statistics from 2016 cite the average marriage ending in divorce was 12 years with a divorce rate of 42%, meaning separation options can’t be readily discounted.

For two single plans, the parties can simply part ways, taking their cover with them, but the situation is more complex where the parties hold a joint life plan, in this scenario they’ll need to split the plan. In this insight we look at which insurers offer separation options that’ll allow a joint life policy to be split, highlighting the differences between them.

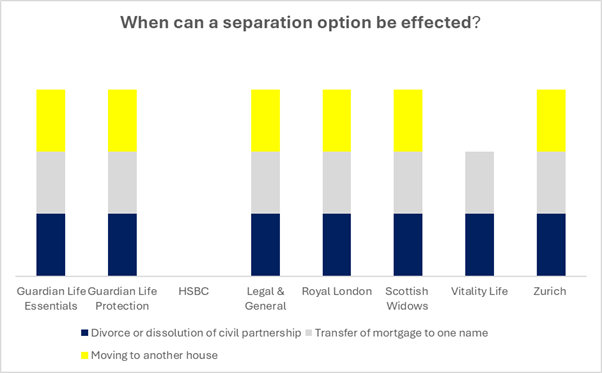

Separation options are usually exercised in three situations:

- Where a couple divorces or their civil partnership is dissolved

- Where a mortgage is transferred to one name

- When one partner moves out of the shared home and into another house.

With the exception of Aviva’s Simple Life Plan and HSBC’s Life Protection Plan, all insurer’s life products include separation options. Instant Life and Simple Life are designed for simplicity and therefore don’t include a separation option, HSBC, although a traditional plan doesn’t include separation options.

Are there age limits on separation options?

In the main there are no limitations on the maximum age for exercising a separation option, with exception of Legal & General and Vitality, as you’ll see in the table below. As there is no requirement for medical underwriting, the process will be straightforward.

Provider |

Maximum Age |

Guardian Life Essentials |

No Maximum Age |

Guardian |

No Maximum Age |

HSBC |

Not Offered on Life Products |

Legal & General |

69 |

Royal London |

No Maximum Age |

Scottish Widows |

No Maximum Age |

Vitality Life |

54 |

Zurich |

No Maximum Age |

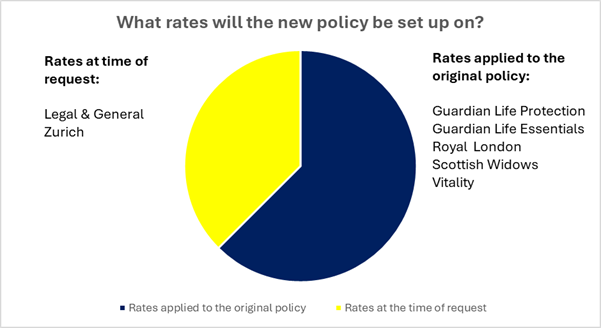

Once a separation option has been agreed, a new policy will either be set up using the premium rates that applied when the original policy was taken out, or the rates at the time of the request.

Legal & General and Zurich both write a new policy based on the rates at the time of the request. Other insurers – Guardian, Royal London, Scottish Widows and Vitality – will apply the rates from when the client’s original policy was set up.

Are there circumstances when separation options won’t be offered?

A client accepted on non-standard terms, won’t be able to exercise the separation option.

How long does the client have to exercise the separation option?

With the exception of Vitality, all insurers allow the client up to six months following their divorce or dissolution of civil partnership to exercise the continuation option. Aviva and Vitality offer a shorter period of up to three months following the divorce or dissolution of civil partnership.

Overall, Guardian, Royal London and Scottish Widows stand out, with a uniform approach to maximum age limits and circumstances for the separation they rightly lead the pack. Coupled with application of original premium rates at the point of separation and the inclusion of those with a rating on the original plan they are to be commended for delivering good consumer outcomes required by the Consumer Duty framework.

It’s worth noting that Guardian don’t offer a joint life option, rather a dual life where cover is kept separate from the outset but only requiring a single quote, application and direct debit. We have included them in our insight as their approach significantly simplifies the separation conundrum.

Things to reflect on for CPD:

- How might each insurers approach to separation options influence your recommendations?

- Are there any factors you would consider before recommending a joint plan in the first place?