The year’s best claims stats and stories… so far

One of the remarks we hear repeatedly, is the need for the industry to do more to share positive claim stories. Sharing positive claim stories, of which there are undoubtedly many, is also a vital way of helping build trust with clients and can hit home the value of protection in a way that perhaps generic %age claims paid statistics can’t. Telling a client that 98% of policies pay out is far less effective than sharing with them a video, of someone similar to them, recalling their experiences of ill health and the positive claim journey they went through.

At Protection Guru we’ve been collecting as many stories and case studies as we can, giving advisers an easy to access, single place where they can locate these vital resources. Our work is not done though and we will continue to gather more stories and information on claims, which we will share with the industry and we hope advisers in turn will share with their clients.

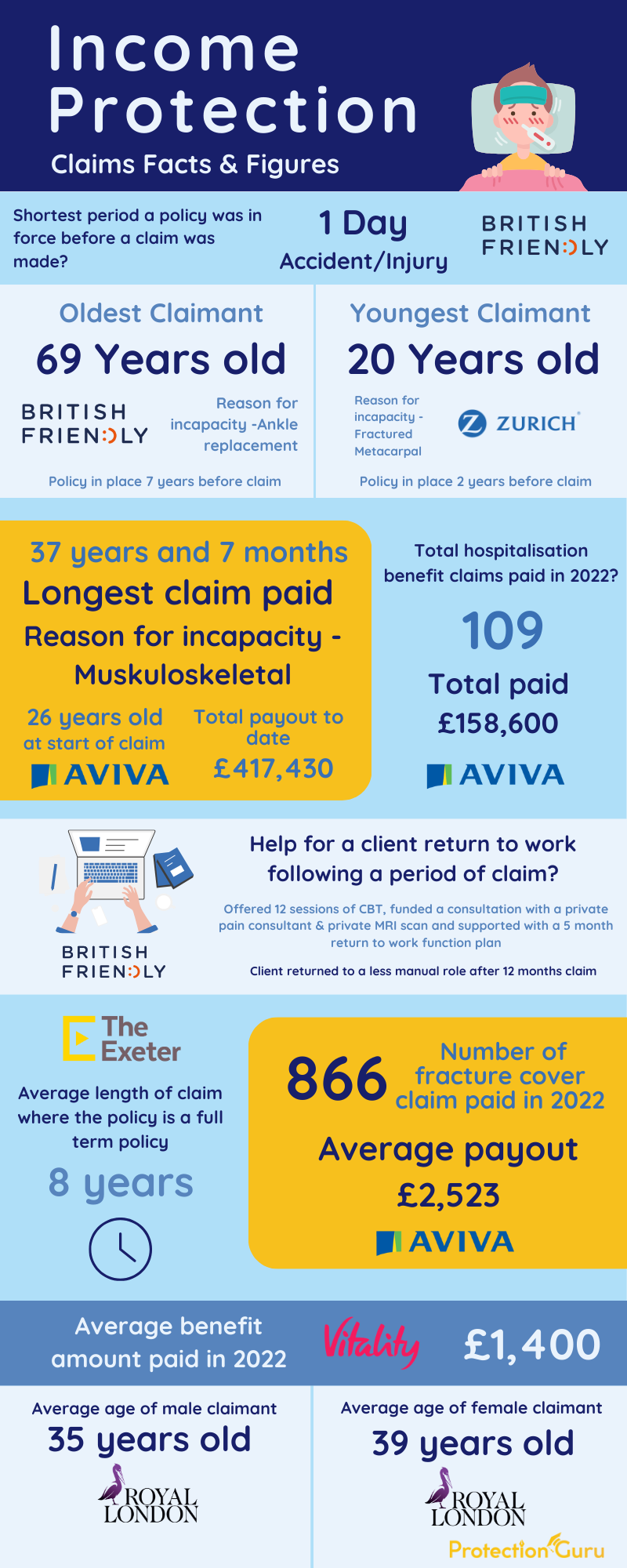

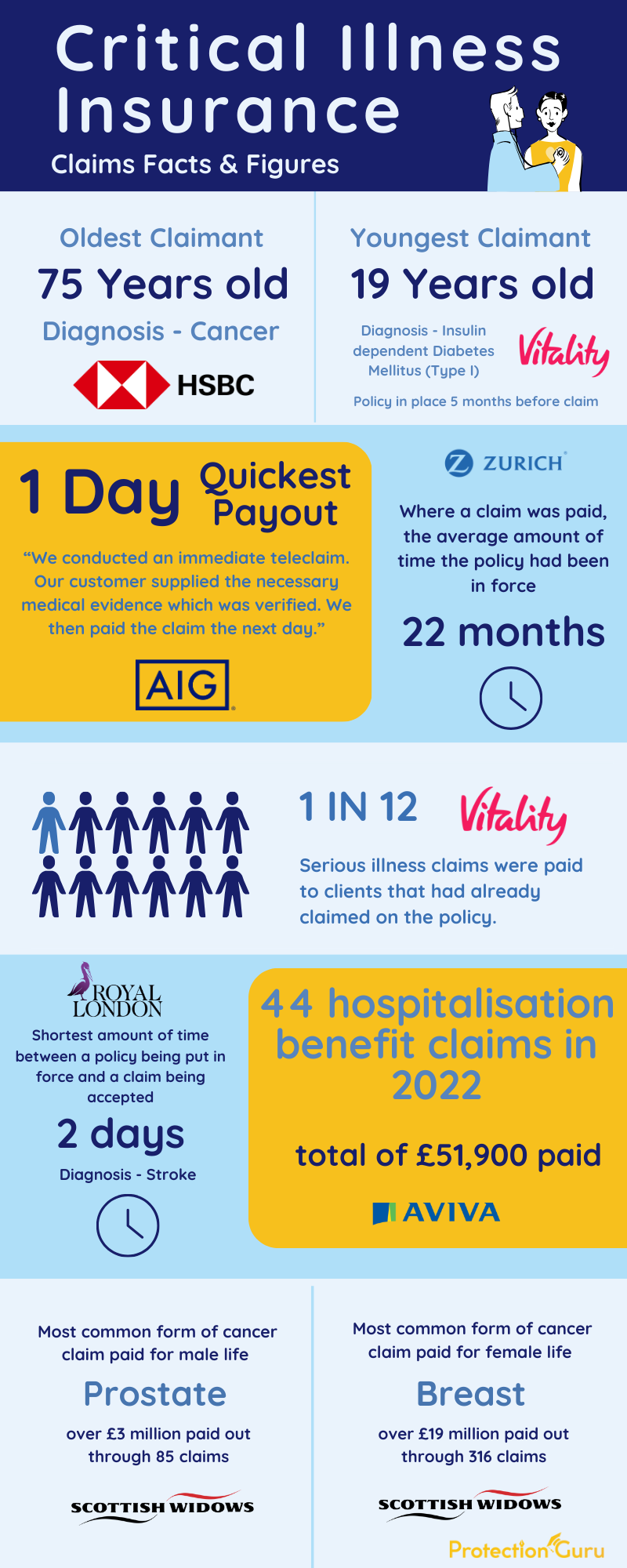

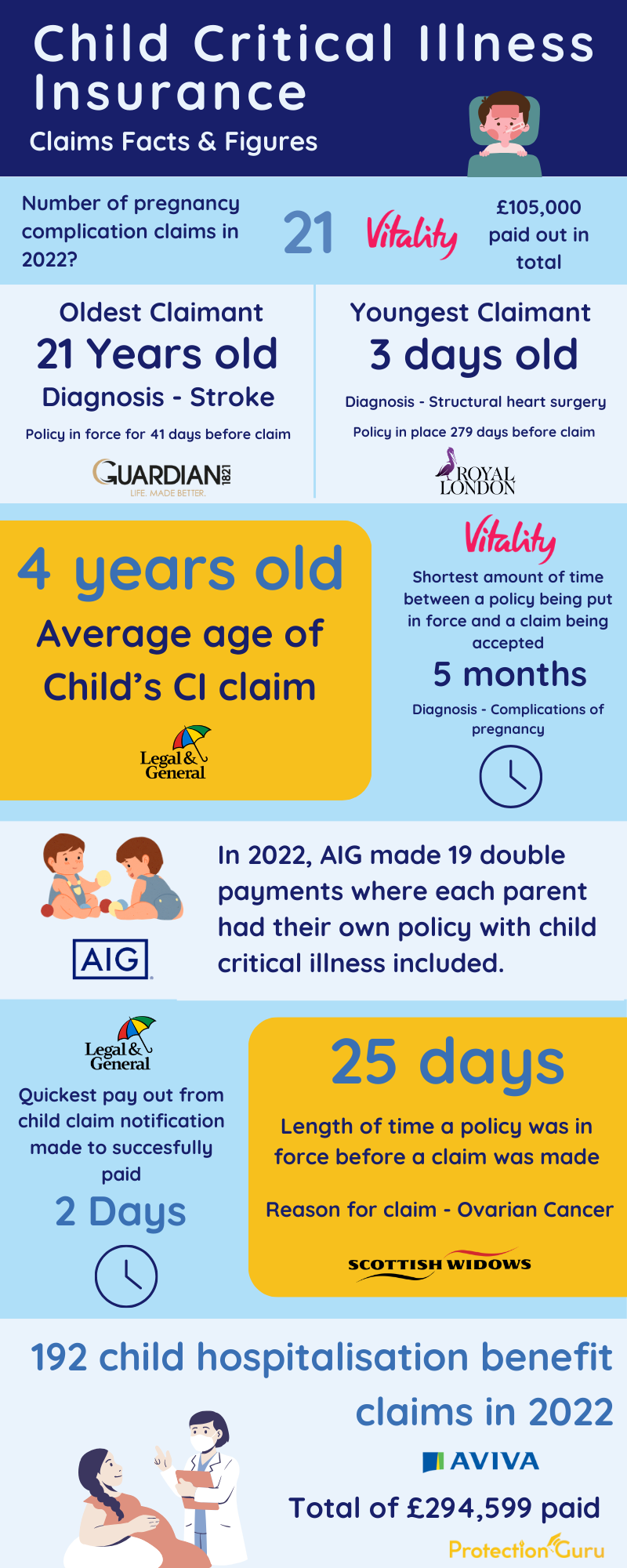

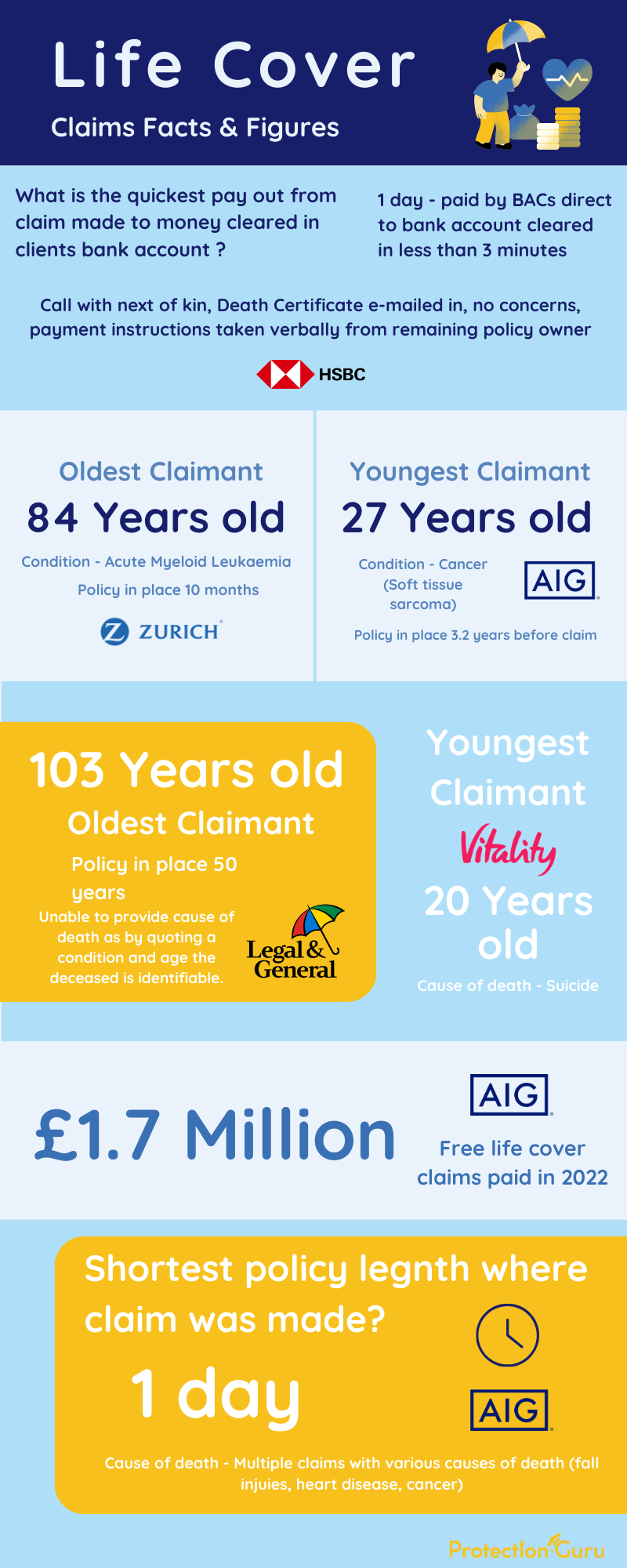

We bring you a round-up below of some of the stories and content we’ve published so far. You can also follow the links to our claims infographics, which are single sheet infographics packed with some of the most powerful stats we’ve obtained from insurers.

(Click the images below to view and download our IP, CI,Child CI and Life claims infographics)

HOW HOLLOWAY FRIENDLY HELPED A CLIENT ACHIEVE THE BEST POSSIBLE OUTCOME

One of the benefits of working as closely with insurers as we do is that, during claims stats season, we are often provided with far more information than insurers generally expose through their claims literature. More often than not when we delve into this detail we come across statistics or stories that we believe need to be shared with advisers and their clients. In a recent discussion with Holloway Friendly we came across an astounding story that not only highlights why income protection is so important, but also the fantastic ongoing support that they provide to their clients that many do not see or appreciate.

THE STORIES BEHIND INCOME PROTECTION CLAIMS

Income Protection provides far more than just financial support to those that are unable to work due to injury or ill health. Within this page we have brought together a selection of videos that explore the impact that having income protection has had on a number of clients and some of the families supported by the 7 Families initiative.

THE STORIES BEHIND CRITICAL ILLNESS CLAIMS

It is well publicised that consumers have a misconception that the protection industry does not pay claims. All insurers now publish their claims paid stats that highlight claims paid are often well in excess of 90% and this data is freely available for advisers to pass on to their clients. Whilst this can help build consumer confidence it only tells part of the story and nothing quite highlights the importance of protection like a real-life example of a client benefiting from their protection plan. Many insurers now release case studies on their websites which tell the stories of claimants, how their scenario has affected them and their family and how having protection has benefitted them. We have brought together a collection of case studies from across the market telling such stories.

Support SERVICES CLAIM STORIES

Protection plans offer so much more than just a financial pay out. Across the industry added value benefits such as second medical opinion services, counselling, virtual GP services etc. have rightly become a core part of plans with use of such services increasing massively during the pandemic. Within this page we have brought together a selection of videos that highlight how such services have helped clients and the impact they have made on not only them but their families as well.