Why the FCA Consumer Duty rules will transform protection advice and how to meet their requirements

The highlight of my week was an excellent Protection Guru Forum session we had on Tuesday morning with two very important guest speakers. Johnny Timpson, the Cabinet Office Disability and Access Ambassador for the UK insurance industry and Robert Sinclair of the Association of Mortgage Intermediaries. You would be hard pressed to find two people with a better understanding of the likely future direction of protection regulation. During the session they explored the dramatic impact the new Consumer Duty will have on giving protection advice. This will affect advisers in all sectors, mortgages, protection specialists, financial planners and wealth advisers.

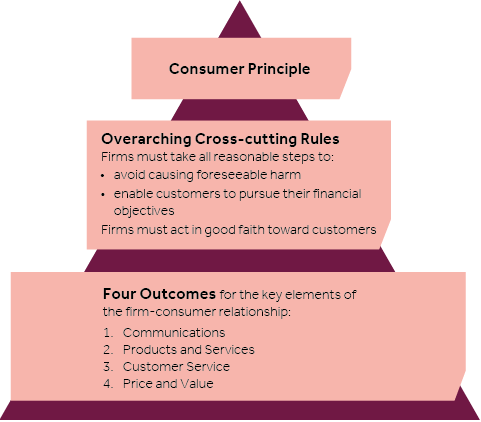

It is very clear that the FCA are putting customer value at the heart of everything they do. Take for example their savage criticism of the Asset Management community this week. As you can see from the diagram below, assessment of price and value are now becoming a core requirement of the regulator. I would urge everybody in the protection industry to read the recent FCA consultation paper CP21-13 New Consumer Duty and to provide a response before the 31st July deadline.

The full transcript of the meeting will be put online shortly but in the meantime it is worth noting that currently the only whole of market service that can deliver real-time analysis of both price and quality i.e. to identify value across all protection products including income protection, critical illness mortgage protection term life and family income benefit and business protection is the Product Features Report within iPipeline’s Solution Builder service, powered by data from Protection Guru. This is free of charge to all Solution Builder users.

This week Adam Higgs created a video entitled How you can measure value in just 60 seconds showing how this important new regulatory requirement can be addressed by adding just one minute to the advice process. Feedback from existing users of the system tells us that it’s significantly moved the conversation on from does the client need protection to which protection product is right for them.

In addition, recent analysis by iPipeline has identified that users of the product features report are 1.4 times more likely to arrange a better quality product for their client as opposed to the cheapest. The service of course provides the necessary evidence to justify why a plan costing a few pennies or a few pounds more may represent far better value for the customer

In our normal content on Protection Guru this week Rob Harvey started by looking at Which insurers provide guaranteed fixed income protection benefit options.

On Tuesday, Amanda Newman Smith asked Which income protection providers offer the best minimum benefit guarantee?

Amanda’s Wednesday insight examined Health checks support benefits – how providers compare. Our second insight that day covered the third instalment from our May Protection Forum meeting, asking What has the pandemic taught us about protection sales?

Thursday’s insight saw Amanda inquire What mental health support do protection providers offer?

Month in, month out Protection Guru Forums are providing some great feedback from advisers on their first-hand experiences giving protection advice so to end the week Rob Harvey put together a summary of What advisers are talking about on Protection Forum – 6 things you should read. This provides both a transcript and audio summary of recent meetings. Hopefully this will be useful for other advisers who have not joined the sessions to understand what goes on. I also think it will be invaluable for anyone working in an insurer or reinsurer in marketing products or distribution to understand what’s really important to advisers engaging directly with customers. This is certainly a few hours audio that would be a good investment to listen to.

On Benefits Guru Jason Green took a look at Default Investment Options(part one) and here is part two .

Both our protection and investment forums will be taking a break over the summer. The next

Protection Forum will be on Tuesday 7th September at 11AM. Investment Forum will return on Tuesday 21st September at 2pm.

Details of the agendas for each meeting will be released in the coming weeks but feel free to get in touch if there are specific subjects you think we should address.

Have an amazing time over what will be the most important weekend for British football in 55 years.

I hope the hangovers we will almost all have on Monday morning will be as a result of joy not sorrow on Sunday.