The power of social media and claims case studies

This week I was exceptionally moved by the very brave testimonial recorded and posted on LinkedIn by a client of Emma Astley from Cover my Bubble. Her client talked through her experience of losing a child and how Emma was able to support her through that journey at a very difficult time resulting in a successful claim.

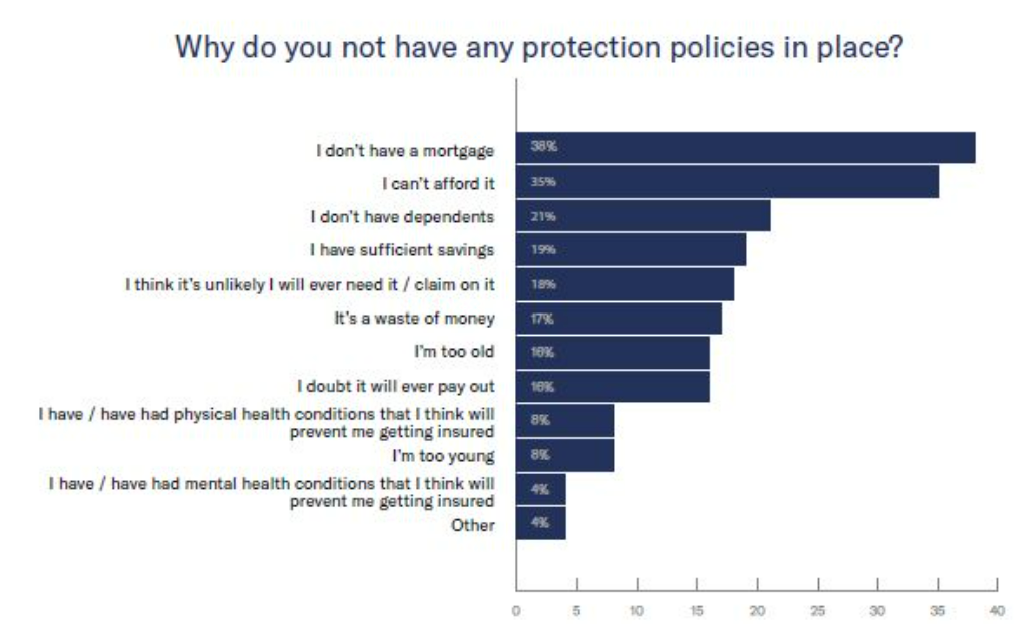

Our view at Protection Guru is that Advisers should encourage their clients to do this much more. Ask their clients for testimonials, for videos of their experiences. This will ultimately build the trust for other consumers. The recent survey from AMI confirmed that consumer trust and confidence is low on why they do not have protection policies in place and certainty of a claim being paid on. Additionally, 52% of consumers said they didn’t trust insurer claims stats, so there is still a great deal to do build the trust evidently.

We all know that personal experiences are the most powerful form of relatability, and we urge Advises to encourage their clients to share their experiences.

Source: AMI viewpoint survey 2022

We are growing the team!

In other news, we are very pleased to announce that we are growing the team at Adviser Software under FTRC. We are recruiting a Research Consultant. Do you know of an experienced Pararplanner or Adviser Firm Operations Manager who is looking for a new career opportunity?

Please click on the following link for further information. The role has huge potential and to put this into context both Poppy Achilles our current Chief Operating Officer, and Jason Green our Chief Commercial Officer, joined the business as former paraplanners.

Please click the link below to find out more information:

Empowering Advice Through Technology conference – January 26th 2023 – Black Friday offer!

Technology is important to your business. But its hard to know where to start, or what questions to ask.

The Empowering Advice Through Technology conference will help you understand the issues you need to consider when choosing technology and help you get started on sourcing and implementing the best technology for your needs.

The Empowering Advice Through Technology event is structured to help firms understand the issues they need to consider when choosing technology and help them:

- Validate if they have the right technology in their businesses

- Understand how emerging technology can enhance the experience they give customers

- Commence a plan to source and implement technology that best meets their needs

Don’t miss out on our final EATT2023 ticket discounts of the year. Use code BLACK15 at the checkout to save 15% on standard price adviser tickets or standard price provider, software vendor and industry consultant tickets. Click on the following link to find out more Join Our Empowering Advice Through Technology Conference – Adviser Software

On ProtectionGuru we started the week looking at the Guaranteed Increase Options Insurers Offer On Life and Criticall Illness Cover. Life is never static, so life events can change a client’s personal circumstance, which in turn alters their protection needs. Guaranteed Insurability Options (GIOS) enable the sum assured to be increased without underwriting if certain events happen. This is a positive for clients, as without them clients could potentially face the hassle of going through the underwriting process again and any change in health may negatively impact them. In this article we look at which life and critical-illness providers offer GIOs, how much cover can increase by and eligibility criteria.

On Tuesday, we revisited our November Forum that explored if Income Protection is Consumer Duty ready. Consumer duty should arguably go some way to improving the importance placed on all protection insurance and in a drive to deliver better consumer outcomes, it will no longer be enough to simply ignore income protection. However, are we confident the product in it’s current state is actually fit for purpose in meeting the expectations and long-term needs of consumers. For our November forum we discussed this, with particular focus on exploring ‘do income protection products need to change to better align with consumer duty requirements?’

Many of you will be aware of the term Movember and when it occurs however, are you aware that Movember is also the name of the leading charity changing the face of men’s health. Movember has funded more than 1,250 men’s health projects around the world with the aim of transforming the way health services reach and support men. One of their main cause areas is mental health and suicide prevention. On Wednesday, Adam Higgs set out how Protection Plans can help clients manage their mental wellbeing.

Having a child who is seriously ill or disabled often limits parents’ ability to work, which has financial consequences. In the current economic climate where costs are rising some parents may turn to state benefits for financial support. On Thursday, Amanda Newman Smith gave us an insight into the State Benefits that are available for sick or disabled children.

We ended the week on Protection Guru highlighting everything you need to know about relevant life cover.

Have a great week everyone.