HSBC Life (UK) Expands Value Added Benefits

By reading this article, you will understand:

- Which Value Added Benefits are offered by HSBC Life (UK)

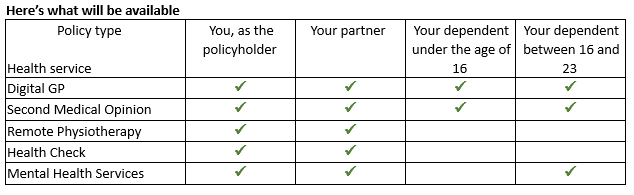

- Which family members are entitled to which benefit

- What the yearly allowances are for each benefit

HSBC Life (UK) Limited is expanding its Value-Added Benefits (VABs) to include policyholders’ partners as part of its ongoing commitment to providing wellbeing and peace of mind for customers. The VABs include mental health services, unlimited 24/7 digital GP, second medical opinions, remote physiotherapy, and an annual health check. They are available to HSBC Life UK’s existing and new protection customers who purchased their cover via intermediary distribution partners including price comparison websites.

Policyholders’ dependents will also have access to digital GP appointments and second medical opinions. In addition, dependents aged 16-23 will be eligible for mental health services.

According to research from our provider, Square Heath, 36% of digital GP appointments are scheduled outside typical working hours. Additionally, 90% of appointments are successfully booked within three working hours. It’s worth noting that children’s health concerns contribute to being the third most common reason for scheduling appointments. This data underscores the efficiency and accessibility offered by our healthcare services.

Richard Waters, Head of Protection Distribution at HSBC Life (UK) Ltd, said: “We understand the importance of staying at the forefront as a leading protection provider. That’s why we are constantly evolving our protection proposition. We believe it is really important that our customers are able to maintain their wellbeing by knowing how to access and use these Value-Added Benefits. As such, we distribute a reminder on the six-month anniversary of customers’ policies, and we include details of the benefits in their annual statements. We want our customers to use these services for prevention rather than cure.”

The table below shows a summary of HSBC Life UK’s Value-Added Benefits:

The table below shows yearly allowances:

Health Service |

Yearly allowance |

Digital GP |

Unlimited |

Second Medical Opinion |

2 |

Remote Physiotherapy |

8 |

Health Check* |

1 |

Mental Health Services |

8 |

Allowances are shared between all family members who have access.

*Health Check allowance is 1 per year and that can be used by either the customer or their partner.

Things to reflect on for CPD:

- How do you identify which VAB’s are going to be of greatest use to your client, during the sales process?

- What questions could you ask your client to identify the VAB’s they will get the greatest use from?

- Should Insurers interact with clients on a regular basis (maybe annual?) to give them a summary of their usage of VAB’s and encourage them to interact with the VAB’s at their disposal?

- For an overview of HSBC Life (UK)’s policies, please visit their Showcase Page