Aegon improve underwriting limits

Over the course of the last year it is fair to say that the majority of Aegon’s focus has been on being easier to do business with. A host of online changes and improved functionality throughout the year have made it far easier to transact with the insurer. Today, Aegon are aiming to remove more barriers, by revamping their non-medical underwriting limits. In this article we take a look at what exactly has changed and what this means for advisers and their clients.

The changes introduced this morning not only increase the sum assured at which the insurer will automatically request medical evidence but also removes the requirement for a doctors screening (MER) for all but the highest sum assured cases. Both life and critical illness limits have been reviewed as part of the exercise, however income protection remains unchanged.

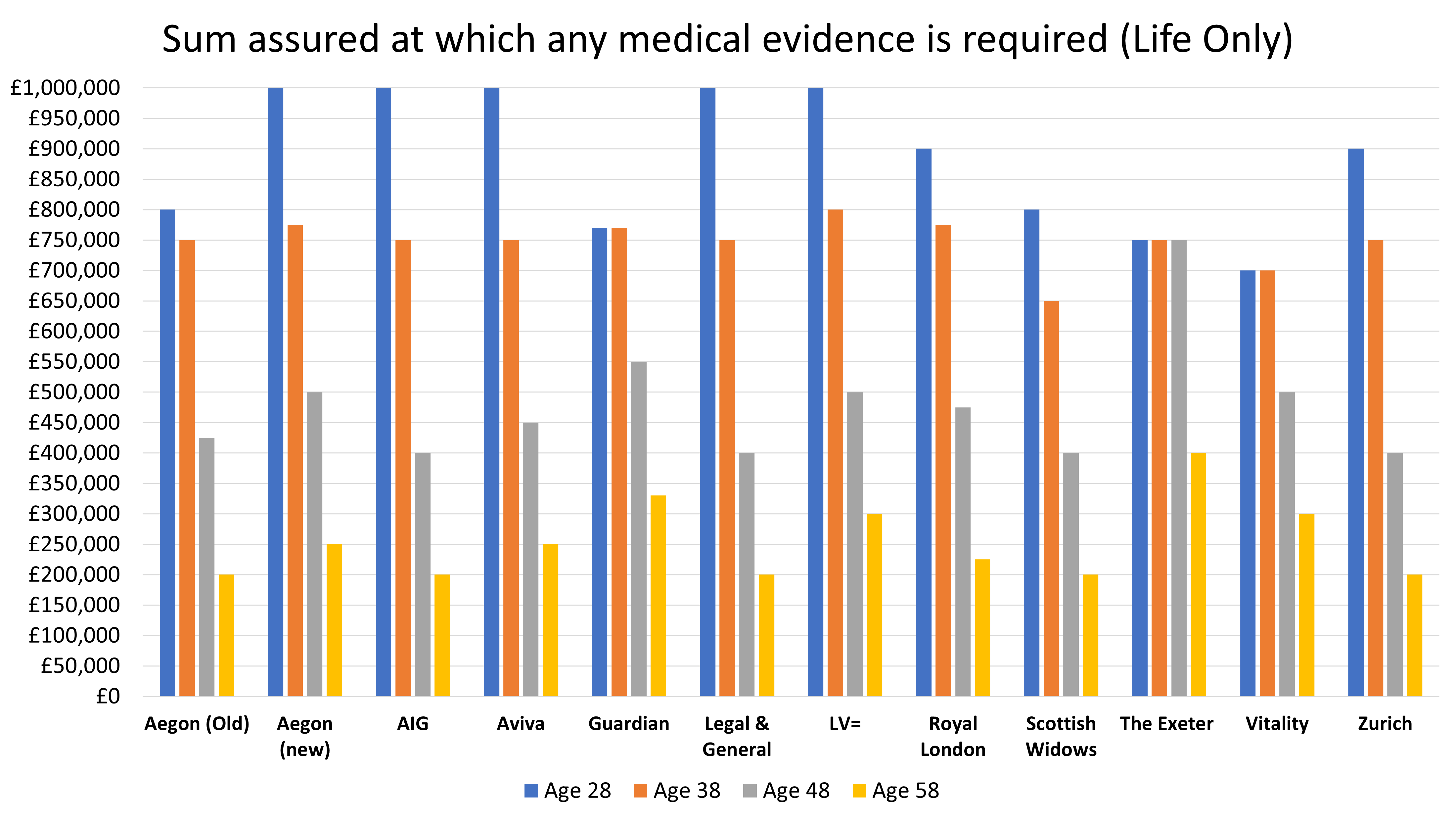

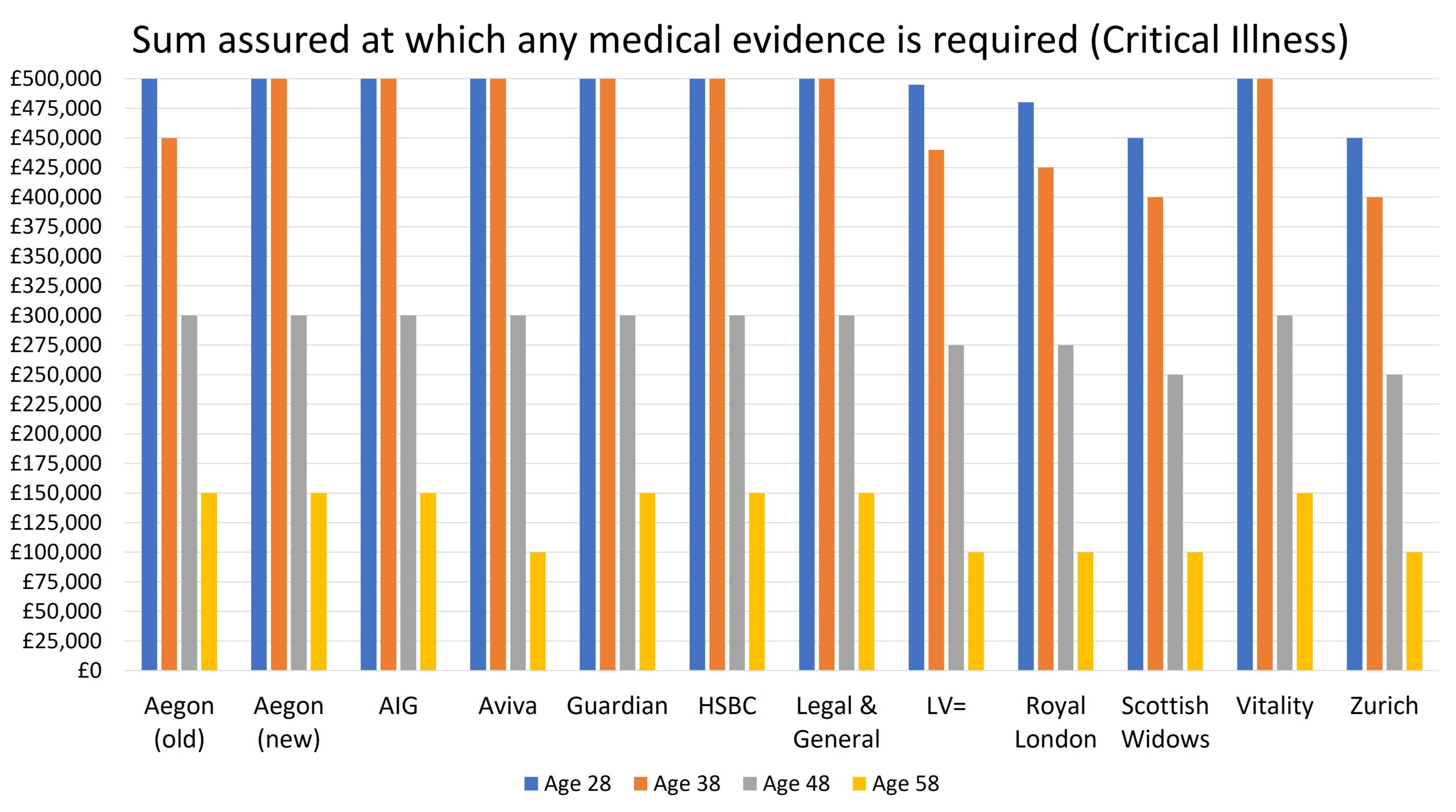

THRESHOLD FOR ANY MEDICAL EVIDENCE

When compared to other insurers, Aegon have until now set relatively low thresholds for requesting any medical evidence, particularly at younger ages and on life only cases. Pleasingly, Aegon now align with the best in the market in this category.

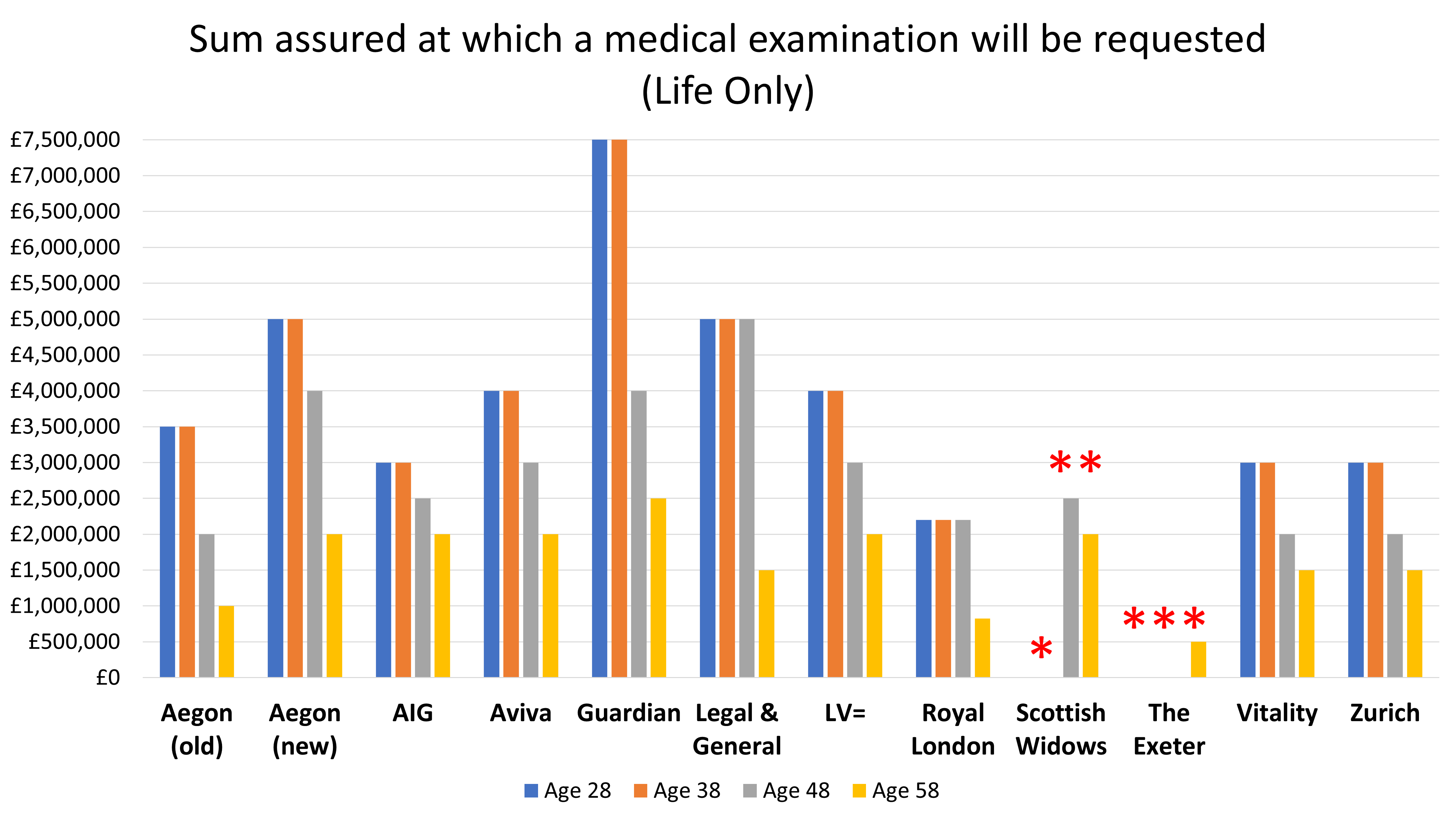

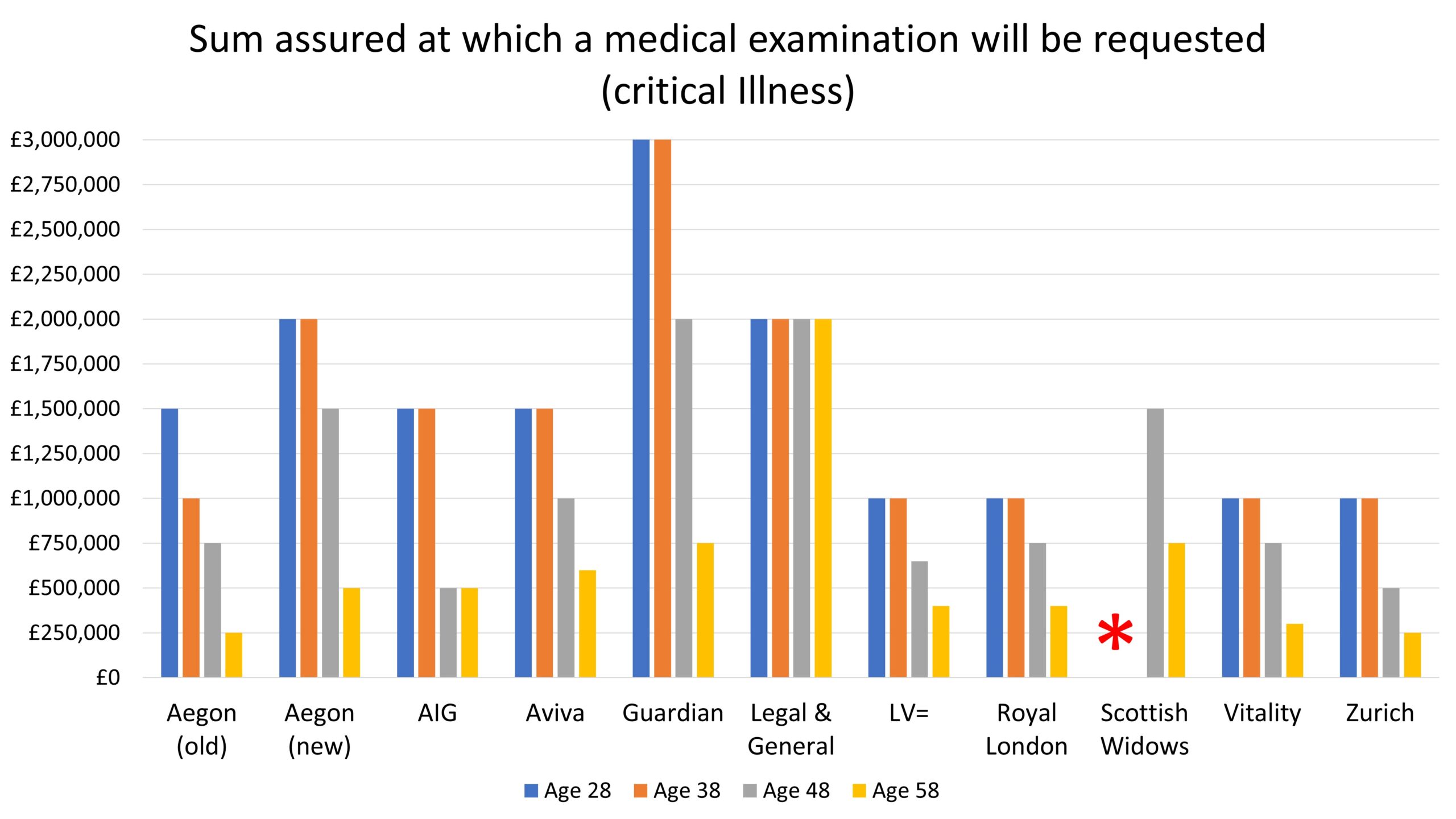

The graph below highlights the sum assured at which any medical evidence would be requested based on 28, 38, 48 and 58-year-old applicants (these will generally be the middle ages of insurer age bands and so are more reflective). This is based on age attained.

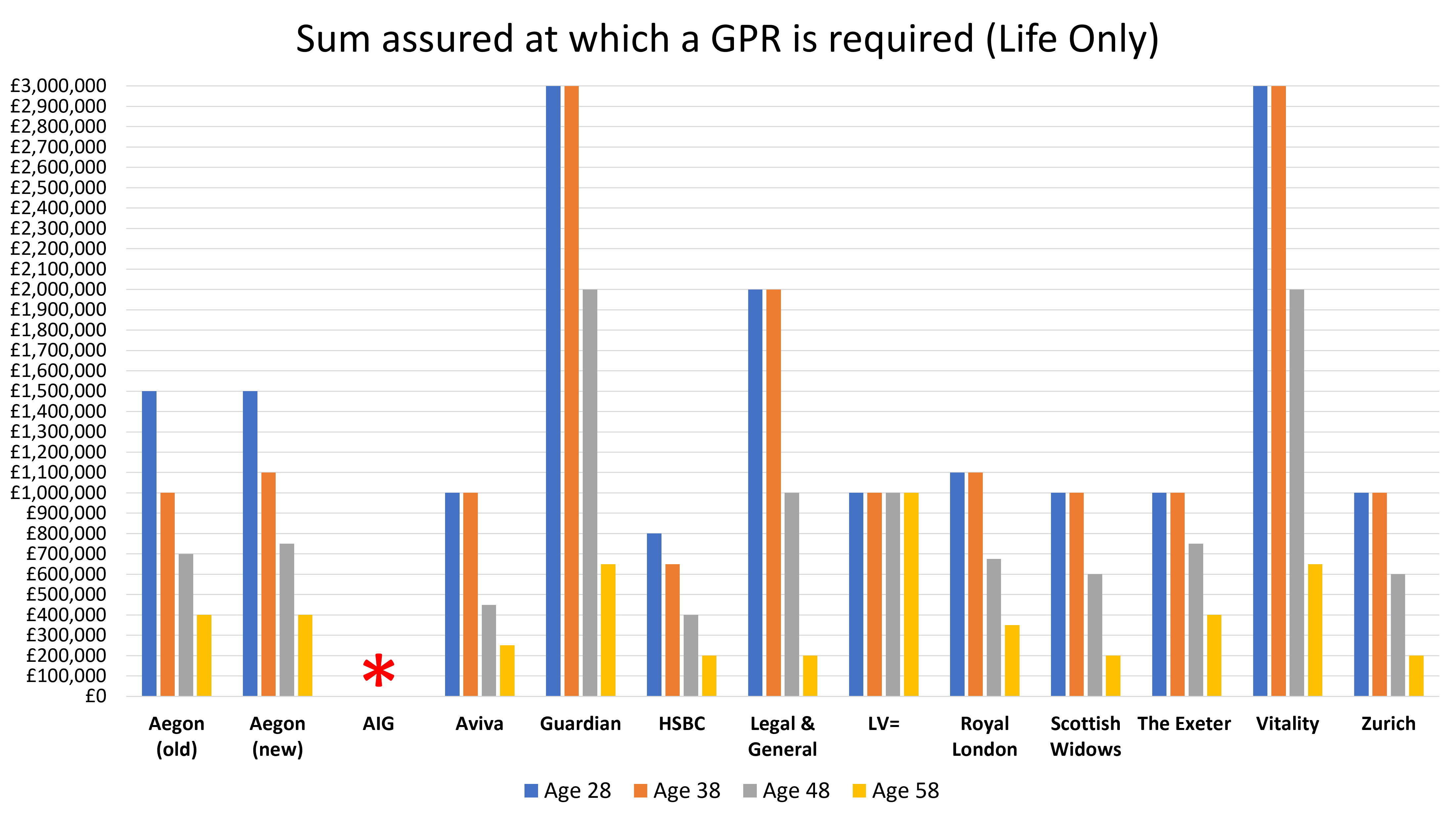

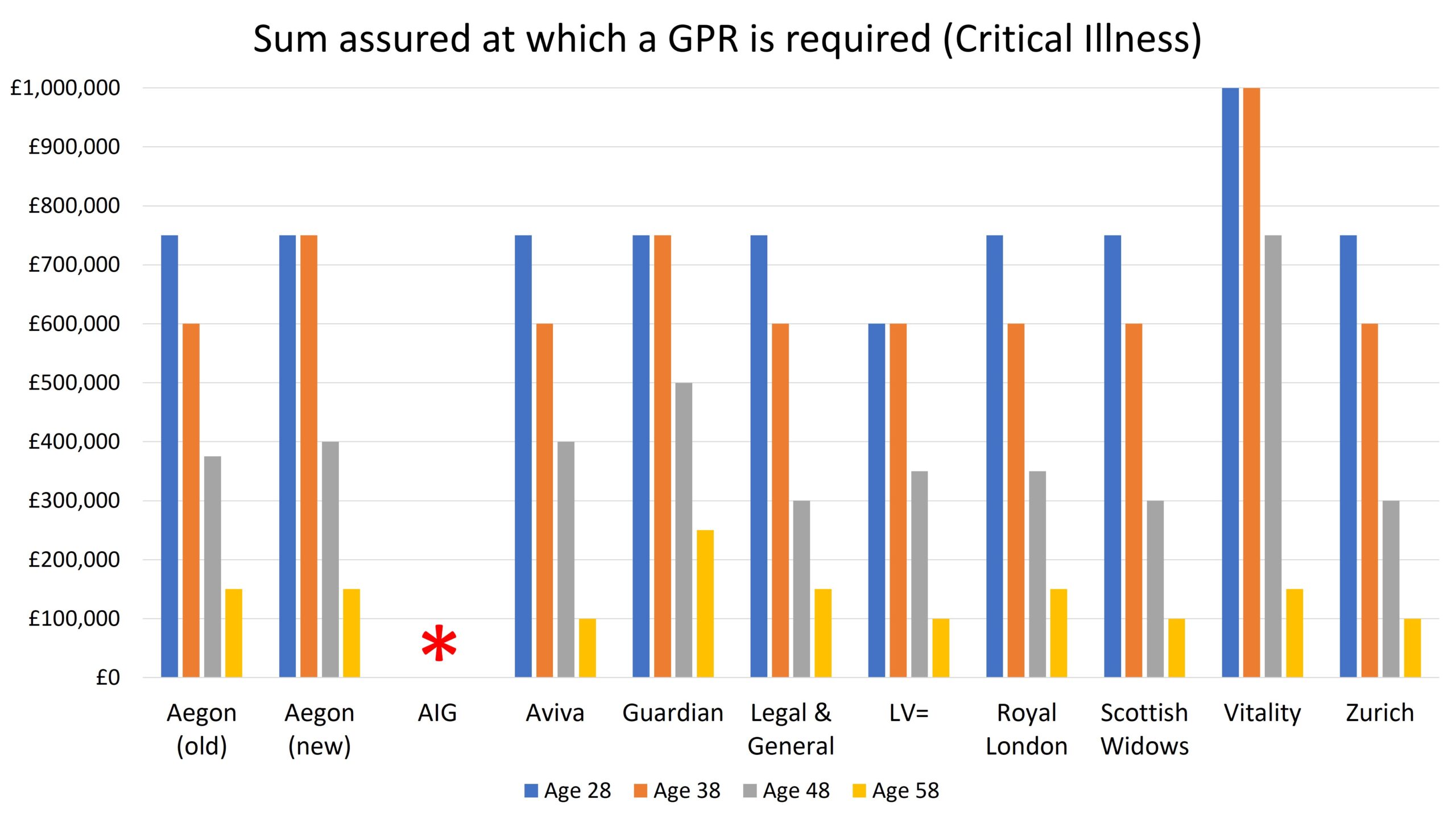

THRESHOLD FOR GP REPORT

The use of electronic reports (e-GPRs) is on the increase and are clearly much easier, but in a large number of cases GPs continue to take a manual approach, meaning the return of a GPR can take weeks and in some cases months, depending on the workload of the surgery and priority given to these reports. A GP surgery can be more difficult for the adviser to chase as well and therefore the timescale of returning these is largely out of their hands. In the last year we have seen insurers increase considerably the limits at which GPRs are requested, which means medical disclosures notwithstanding, this evidence should only be required for the very highest sums-assured or older clients.

Although not a massive change, Aegon have increased the sum assured at which they will request a GPR between 30 and 50 as can be seen below:

*AIG do not automatically request a GPR regardless of the sum assured.

THRESHOLD FOR DOCTORS MEDICAL EXAMINATION

Doctors medical examinations are a more extensive health check and are generally only requested for very high sums assured or for much older clients. Should a Medical Exam be required, the time and location is more likely to be dependent on the doctor and as such will be more restrictive.

This is perhaps the biggest change that Aegon have announced today by vastly increasing the sums assured at which a doctors exam would automatically be required. This is hugely positive as doctors are under increasing pressure and perhaps often difficult to arrange consultations with.

*Scottish Widows do not automatically require a medical examination as an underwriting requirement.

**For clients over the age of 45 Scottish Widows require an exercise ECG, based on the sums assured highlighted in the graph. An exercise ECG will need to be conducted in a clinic.

***The Exeter will not automatically request a doctors medical for clients under the age of 51

It is always great to see an insurer working hard to make advisers and their clients’ lives easier. The requirement for medical underwriting is a big contributor to cases not being put in force and increasing non-medical underwriting limits should reduce this risk at the very least for those with higher sums assured. Reducing the requirement for doctors’ involvement is also a huge positive and these changes bring Aegon’s limits in line with the highest across the market.