lv=’s phenomenal 35 year Claim and 2 other ip stories you should read

In our fifth and final series of dedicated income protection insights to mark IP Awareness Week from the IPTF, we bring you three powerful stories on claims. These truly highlight the value and importance of income protection and hopefully help to dispel any myths that client’s may have that “it won’t happen to me”, “I don’t need income protection” or “it never pays out”.

For those who missed it yesterday, we also published the first of our claims infographics, on income protection. We’ve pulled together some of the stand-out stats and figures from across the industry, to help advisers overcome client objections. Click here to view and download the infographic.

LV=’S 35 YEAR INCOME PROTECTION CLAIM… THAT IS STILL BEING PAID

When speaking to clients about protecting their income there are many objections that might be thrown at you. “I’m too young”, “I’m healthy”, “if I’m ill I won’t be off for a long time” might be some of the more common, especially in younger clients. Whilst statistically, a younger person is less likely to need a long period off work, it does happen and the story of one claim from LV= highlights exactly why younger clients should be prioritising Income Protection.

HOW HOLLOWAY FRIENDLY HELPED A CLIENT ACHIEVE THE BEST POSSIBLE OUTCOME

One of the benefits of working as closely with insurers as we do is that, during claims stats season, we are often provided with far more information than insurers generally expose through their claims literature. Earlier in the year, when discussing 2020 claims statistics with Holloway Friendly we came across an astounding story that not only highlights why income protection is so important, but also the fantastic ongoing support that they provide to their clients that many do not see or appreciate.

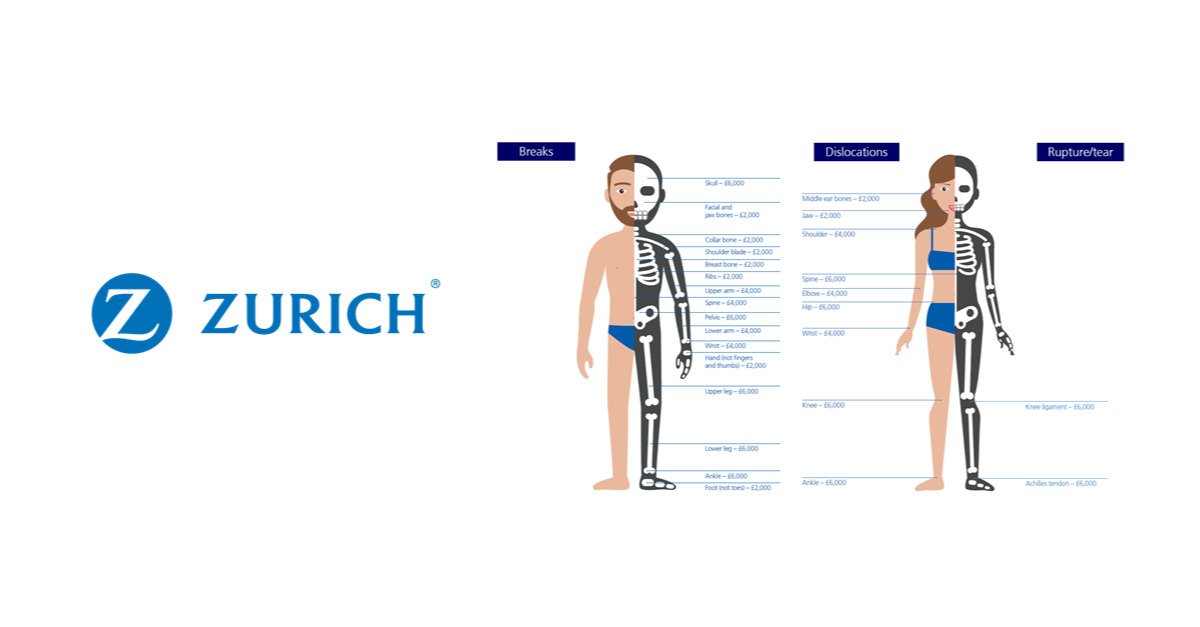

ZURICH’S CLAIMS STATS HIGHLIGHT FRACTURE COVER IS NOT JUST FOR ACTIVE CLIENTS

Additional cover and support benefits are an increasingly integral component of protection plans, alongside the core cover. A number of insurers offer fracture cover, intended to provide additional financial protection for clients should they suffer a broken bone or other injuries. Zurich’s record number of fracture claims in 2020 highlight the value of this benefit and why it’s worth considering for all clients, not just the physically active. In this article we explored in more detail what fracture cover claims Zurich paid and events that led to those claims.