Love Actually – What if the characters were your clients?

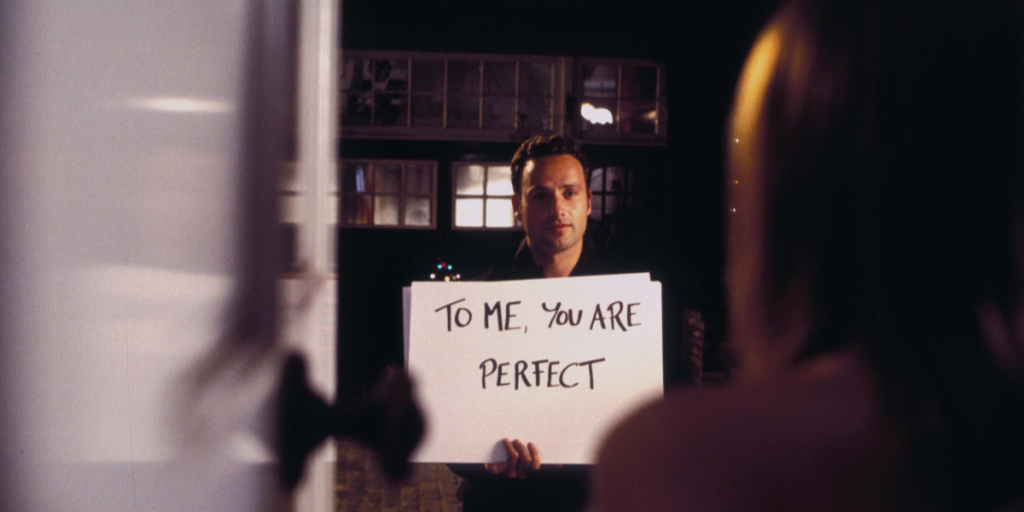

“To me you are perfect”! A great line and whilst I haven’t written it on a cue card with carol music playing in the background, it is one I would dearly love to say about the protection industry. Whilst in reality our industry is far from perfect, we help many, many families each year in dire circumstances. We provide financial resilience to our clients and must adapt and remain relevant to whatever has happened in their life. When watching Love Actually, I was reminded just how quickly a client’s life could change which prompted Protection Guru’s Christmas themed article. How would we advise the nine different story lines if they were our client, and we were meeting them for an annual review?

WARNING: If you haven’t seen Love Actually before (REALLY? Go and watch it!) this article contains spoilers, and you may not understand some references!

Billy Mack and Joe – The ageing rocker and his manager

Taking a song that is one of the longest running number 1’s in UK chart history, adding sleighbells and replacing the word love with Christmas is a stroke of genius. With the single rocketing to Christmas number 1, Billy Mack must have come into a good sum of money and as such I would look to refer him to a wealth colleague to ensure he invests this correctly.

From a protection point of view Billy Mack does not seem to have a family. As such we would encourage him to create a will if he does not have one in which he may choose to select his longtime manager Joe as the beneficiary, especially given their new found love for each other.

As Billy Mack’s manager, much of Joe’s income will be dependent on the career of Billy. This is an interesting scenario as Key person cover might not work with Joe likely to be an employee of Billy and not the other way around. As such we might suggest setting up life & CI (That would be a fun medical!) on a life of another basis. This approach might also provide less financial scrutiny.

Juliet, Peter and Mark – The love triangle

This little love triangle brings far more traditional protection needs. From Mark’s point of view, unfortunately he remains single and without dependents Income Protection would remain his main need. With this in place if injury or illness stopped his fledgling wedding planning and videographer career, he would still have an income.

Juliet and Peter on the other hand have just married (and possibly purchased a home) and as such a full review of their protection cover would be needed. Clearly income protection is top of the list so that bills and the mortgage can be paid if either is unable to work due to ill health. We should also look to cover the mortgage with a life and CI policy. Two single life FIB policies to protect each other against the loss of their partners income in the event of an untimely demise or serious illness should wrap up the full recommendation. Peter, just beware of carol singers!

Jamie and Aurelia – The French affair

Having returned early from a wedding to find his girlfriend in a compromising position with his brother, Jamie is having a tough time. After meeting Aurelia in France the will they, won’t they story begins. As his adviser, this is fantastic news as there is every possibility that wedding bells are the horizon (and as such an advice opportunity). For the time being however, we just need to review his cover, cancel any unneeded cover due to him splitting with his girlfriend and double check that his current plans will cover him if he becomes ill whilst in France (shouldn’t be a problem as it is in the EU but always best to check).

Harry, Karen and Mia – Who’s necklace is it anyway?

Where do we start with this one? As long time clients, Harry and Karen have plenty of cover in place including income protection for Harry, Life & CI for the mortgage and two single family income benefit plans to protect income. Whilst no material change in circumstances have happened (yet), based on events we would check the joint life plan (covering the mortgage) has a separation option, just in case. As all other cover would clearly have been set up on a single life basis, we needn’t worry too much with these. We may also pull Karen aside and highlight that if she needs to talk to anyone her cover includes free counselling sessions.

When speaking to Mia, we are particularly glad that we set up an Accident, Sickness and Unemployment plan (pre-COVID obvs). Depending on how things turn out with Harry and Karen, the unemployment side of the policy could prove useful!

David and Natalie – You saucy minx!

Unfortunately, I am not aware of what No. 10’s benefits package includes (perhaps if anyone knows they can let me know). Based on the other benefits MPs receive, I would guess it is pretty decent and as such if David had a nasty accident when dancing down the stairs, he would be taken care of. This being said we will be sure to book a review meeting the moment his tenure is finished. A big issue however, is that from a money laundering perspective he is the epitome of a politically exposed person and I would assume remains one even if he leaves politics?

Natalie on the other hand may not receive the same level of benefits (or have the same money laundering issues). Income Protection seems the sensible option here and keep a check on how the relationship develops.

Daniel and Sam – Young love!

This one is obviously a tough annual review for many reasons. Having already supported Daniel through claiming on his late wife’s policies, the mortgage is paid off and Daniel has a regular income from the FIB policy to support the upbringing of Sam. Daniel’s family income benefit is still in place as we set policies up on a single life basis and we would suggest that Daniel takes advantage of the bereavement counselling that comes with this for himself (although Claudia Schiffer may also help here ?) and Sam. In any event we are glad our actions have helped Daniel be in a position to buy that drum kit and let Sam chase his dreams… and the girl.

Sarah, Karl and Michael – The work colleague obsession

Sarah is our client here and whilst she has an income protection plan in place, she won’t be able to claim on the carer benefit as it seems that her brother Michael’s illness is long term and started before the policy was taken out. Even with the prospects of a hot office romance with Karl on the horizon there are no real changes to our original income protection recommendation. We may however suggest that a family income benefit policy is put in place with Michael set up as the beneficiary, to provide an income to help cover his care costs in the event of her death as she seems to be his only family.

Colin – The brit abroad

As a young single man with no liabilities, Colin doesn’t have much need for anything with the exception of the income protection plan we set up for him. Having thrown in his job as a caterer and gone travelling to America to use his British accent to woo the ladies the career break option that our IP insurer offered has been particularly useful. Now returned to the UK (American Girls in tow) we will need to contact the insurer to make sure his benefits are reinstated as soon as he starts to earn an income again.

John and Judy – The sex scene stand-ins

As stories go, meeting your partner for the first time, whilst naked and simulating a sex scene is pretty impressive. Maybe just not one you would tell your grandkids? As professional stand-ins for films you might imagine that both John and Judy’s income may be quite sporadic. As such having a non-financially underwritten income protection plan could be quite beneficial we would just need to be wary of any long periods of unemployment that actors will often face. Needless to say as their adviser there is real potential for future protection reviews so we will be sure to keep tabs on future developments.

Putting in place a protection plan epitomises a show of love. It demonstrates that if the worst happens, you still want to take care of your loved ones. In the case of life assurance it can be a financial cuddle from the grave. As the film shows, if you look for it, I have a sneaky feeling Love, Actually is all around. Lets hope that this Christmas and in 2023 more people provide the gift of financial resilience (just read that back and wow! that was corny! I’m keeping it though, it’s Christmas).

Merry Christmas Everyone from the whole Protection Guru Team