The top 10 most read articles by advisers IN 2021

In the second of our two part series rounding up the most read articles by advisers, today we go from 10 down to 1. The top 10 articles has a good spread of regulation, underwriting, claims and awards and gven that we remain in a pandemic, it may not be a massive surprise as to what was the most read article. As per yesterday’s run down of 20 to 11 most read articles, we have split out all non adviser page views to focus solely on what posts advisers are viewing.

NO.10

HOW CAN BUSINESSES PROVIDE AN INCOME PROTECTION BENEFIT TO A DIRECTOR OR SINGLE EMPLOYEE

The UK is overwhelming a nation of small businesses, with SMEs accounting for over 99% of the business population. The number of SME businesses has steadily been rising over the last few decades, alongside a dramatic rise in the number of people in self-employment, particularly sole-owner/employee ltd companies. Many businesses and business owners are still under-protected and there remains a significant business protection gap. Whilst products such as Key Person and Shareholder Protection Insurance are an important means of providing a financial safety net for the company itself, cover for the owner or key employees can be overlooked. For many small businesses Group Income Protection may not be affordable or even viable (if there are too few employees), so an alternative solution is needed. In this insight we look into Executive Income Protection and how it differs from standard income protection plans.

NO.9

ARE TWO SINGLE LIFE PLANS BETTER THAN A JOINT LIFE PLAN?

During my time both as an actual adviser and then supervising and managing a team of advisers, a frequently asked question was whether two single life policy’s are better than a joint life policy. Sometimes that question can come from clients, often unfamiliar with the cost differences and technical aspects of different life plans, or from advisers themselves trying to establish the best solution for their client, whilst ensuring the advice remains correct and compliant. Ultimately the answer will usually be that it depends on the clients’ situation and each client is different, so assumptions shouldn’t be made until the their circumstances and needs have been fully established.

NO.8

HOW WILL THE NEW CONSUMER DUTY IMPACT ADVISERS?

This is the first post in a series bringing you the great conversations from our July Protection Forum. In this section, Johnny Timpson and Robert Sinclair from AMI explained the new FCA Consumer Duty, how it came about, and how it will affect the protection community.

NO.7

PROTECTION GURU AWARDS

THE INSURER AWARDS

A run down of the nine different awards that were presented to insurers at our inaugeral Protection Guru Awards on 22nd October. These awards were voted for by our adviser readers on Protection Guru and celebrated a range on insurers.

no.6

PROTECTION GURU AWARDS

THE ADVISER FIRM AWARDS

A run down of the six different awards that were presented to adviser firms at our inaugeral Protection Guru Awards on 22nd October. These awards celebrated a range of different types of advice businesses from newly formed firms, networks, support groups, mortgage advisers, wealth advisers and the overall protection advice firm of the year.

no. 5

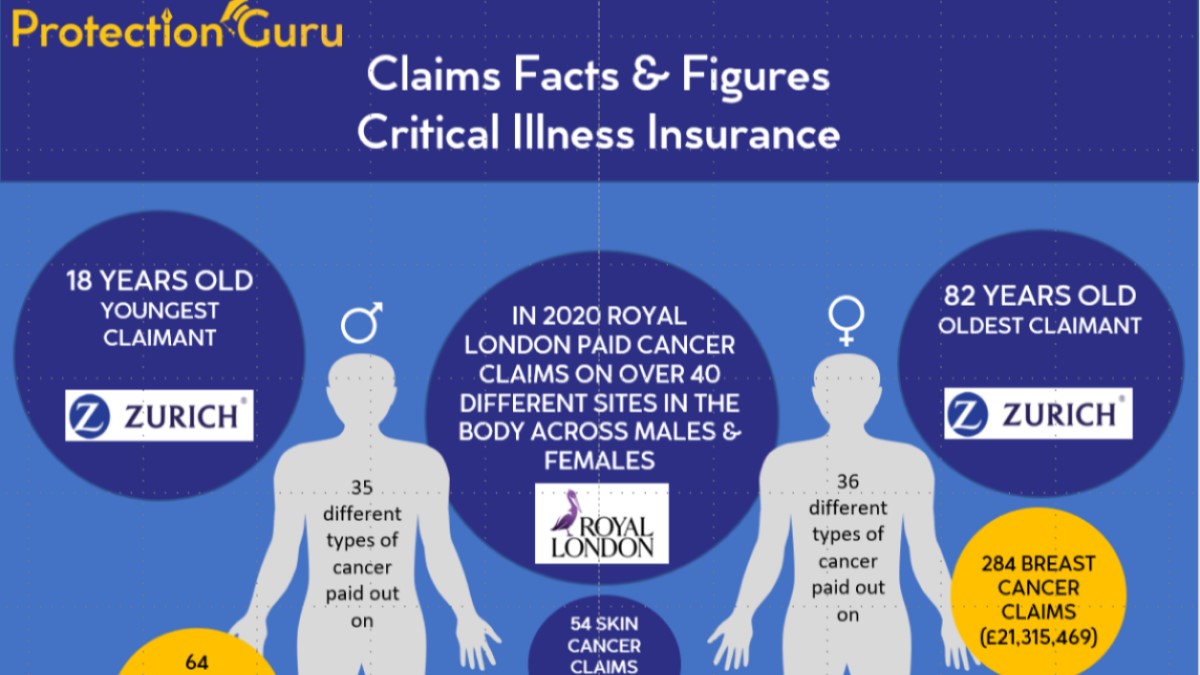

CRITICAL ILLNESS CLAIM INFOGRAPHIC

This was the second of our ‘facts & figures’ infographics, following the income protection sheet, this time focusing on Critical Illness Insurance. Once again, we’ve pulled together some of the most powerful claim stats from across the industry, in order to provide advisers with a simple one page resource that can help overcome many client objections. Follow the link below to view and download our new CI claim infographic.

no.4

PROTECTION GURU AWARDS

THE INDIVIDUAL ADVISER AWARDS

A run down of the five different awards that were presented to individual advisers at our inaugeral Protection Guru Awards on 22nd October. These awards celebrated those who peromoted powerful claims messages, had a big presence on social media, provided outstanding support to advisers and those newer to the industry or role.

NO.3

INCOME PROTECTION CLAIM INFOGRAPHIC

We pulled together some of the most impressive income protection claim stats from across the industry, in order to provide advisers with a simple one page resource that can help overcome many client objections. Follow the link below to view and download our Income Protection claim infographic.

no.2

WHICH INSURERS OFFER FRACTURE COVER AND HOW DO THEY COMPARE?

Many insurers now offer a range of additional benefits and support services alongside their core cover, designed to provide clients with either additional help or a further financial safety net if required. One such benefit offered by a few insurers is fracture cover. In this insight we look at fracture cover in more detail and how those insurers who offer it compare.

NO.1

LIFE INSURANCE NON-MEDICAL UNDERWRITING LIMITS – HOW INSURERS COMPARE

Understanding an insurers’ requirements to assess a protection application before submitting the case can make a big difference in ensuring the process is as smooth as possible. Obtaining medical evidence, either because the client has medical disclosures, or because underwriting limits have been exceeded can delay the application process. It’s helpful therefore to know what evidence is needed and when, to prepare the client and manage expectations.