How does British Friendly’s new fracture cover compare?

For a long time, I have felt that fracture cover and income protection fit perfectly together. Unless extremely severe, a broken bone isn’t going to lead someone never being able to work again, but it will lead to short term incapacity and likely financial loss. Providing a small lump sum to help cover that short term loss until the deferred period elapses makes sense. Clearly the market agrees as fracture cover has grown in popularity. As its popularity has grown, more insurers have added it to their proposition and today British Friendly join that group. But how does their new Fracture cover compare to others in the market.

Does it cost anything?

Across the market there are seven other insurers that offer Fracture Cover within their income protection propositions. For some (namely Aegon, LV= and Royal London) the costs of the fracture cover are absorbed into the normal premiums. The others (Aviva, Cirencester Friendly, Legal & General and Zurich) offer Fracture cover as an add on at an additional cost.

British Friendly joins the latter group by offering their cover as an add on to both their Breathing Space and Protect products at an additional cost of £4 per month.

Insurer |

Cost of Fracture cover |

Aegon |

N/A |

Aviva |

£4.00 per month |

British Friendly |

£4.00 per month |

Cirencester Friendly |

£6.00 per month* |

Legal & General |

£5.90 per month |

LV= |

N/A |

Royal London |

N/A |

Zurich |

£6.90 per month |

*Cirencester Friendly charge £6.00 for a combination of fracture and hospitalisation benefit, as part of their My Extra Benefits package.

What fractures are covered?

Like all insurers that offer fracture cover, British Friendly will pay differing amounts depending on the bone that is broken. The more debilitating a break of a particular bone is likely to be, the more they are likely to pay.

Fracture |

Aegon |

Aviva |

British Friendly |

Cirencester Friendly |

Legal & General |

LV= |

Royal London |

Zurich |

Skull (open fracture) |

£2,200 |

£6,000 |

£6,000 |

£1,500 |

£7,500 |

£2,200 |

£4,000 |

£6,000 |

Skull (closed fracture) |

£1,250 |

£4,000 |

£4,000 |

£1,500 |

£7,500 |

£1,250 |

£2,500 |

£6,000 |

Cheekbone |

£1,000 |

£1,500 |

£1,500 |

£1,500 |

£2,000 |

£1,000 |

£1,500 |

£2,000 |

Jaw |

£1,000 |

£3,000 |

£3,000 |

£1,500 |

£2,000 |

£1,000 |

£2,000 |

£2,000 |

Collar Bone |

£650 |

£1,500 |

£1,500 |

£1,500 |

£2,000 |

£650 |

£1,000 |

£2,000 |

Shoulder blade |

£1,000 |

£2,000 |

£2,000 |

£1,500 |

£2,000 |

£1,000 |

£1,500 |

£2,000 |

Sternum |

£1,000 |

£2,000 |

£2,000 |

£1,500 |

£2,000 |

£1,000 |

£1,500 |

£2,000 |

Arm |

£1,250 |

£3,500 |

£3,500 |

£1,500 |

£4,000 |

£1,250 |

£2,500 |

£4,000 |

Ribs |

£650 |

£1,500 |

£1,500 |

£1,500 |

£2,000 |

£650 |

£1,000 |

£2,000 |

Vetabra |

£1,000 |

£2,500 |

£2,500 |

£1,500 |

£4,000 |

£1,000 |

£2,000 |

£4,000 |

Wrist |

£1,000 |

£2,000 |

£2,000 |

£1,500 |

£4,000 |

£1,000 |

£1,500 |

£4,000 |

Hand |

£1,000 |

£1,500 |

£1,500 |

£1,500 |

£2,000 |

£1,000 |

£1,500 |

£2,000 |

Pelvis |

£1,250 |

£2,500 |

£2,500 |

£1,500 |

£6,000 |

£1,250 |

£2,000 |

£6,000 |

Upper leg |

£2,200 |

£6,000 |

£6,000 |

£1,500 |

£6,000 |

£2,200 |

£4,000 |

£6,000 |

Knee |

£2,200 |

£6,000 |

£6,000 |

£1,500 |

£6,000 |

£2,200 |

£4,000 |

£6,000 |

Lower leg |

£1,250 |

£4,000 |

£4,000 |

£1,500 |

£6,000 |

£1,250 |

£2,500 |

£6,000 |

Ankle |

£1,250 |

£2,500 |

£2,500 |

£1,500 |

£6,000 |

£1,250 |

£2,000 |

£6,000 |

Foot |

£1,000 |

£2,000 |

£2,000 |

£1,500 |

£2,000 |

£1,000 |

£1,500 |

£2,000 |

As you would expect, those that do not charge extra for Fracture Cover pay out less than those that charge. Whilst British Friendly are not paying out as much as both Legal & General and Zurich on many of the fractures, they are directly comparable to Aviva’s cover both in terms of the bones covered and amount paid.

Both Legal & General and Zurich also provide cover for dislocations, ligament tears and tendon ruptures which is reflected in the higher cost.

What isn’t covered?

As a largely non-underwritten benefit, it is perhaps not surprising that insurers will place a few exclusions on when the cover will pay out. Gone are the days where an adviser can stand at the gates of their local rugby club and hand out fracture cover forms.

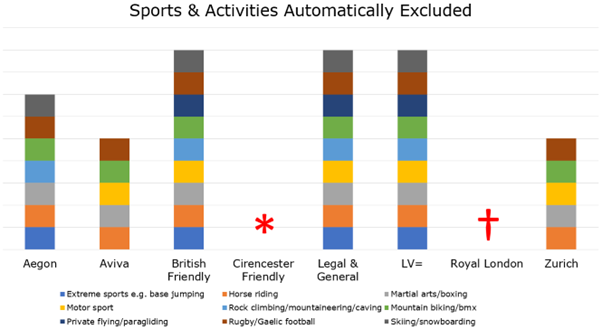

*Cirencester Friendly apply no automatic exclusions for any sports or hobbies. They may decline offering fracture cover if the client has had recent past fractures.

† Royal London do not automatically apply exclusions. Activities will only be excluded if they are also excluded on the main IP application.

Whilst the activities included in the graph above is not an exhaustive list, we can see that Cirencester and Royal London are the most generous when it comes to exclusions for certain activities.

As well as exclusions for sports and activities, there are a number of other exclusions, such as for self-inflicted injuries and cosmetic surgery. Aviva will also decline fracture cover for clients living with osteoarthritis, whilst Legal & General would decline claims for those living with osteoporosis or pseudarthrosis. British Friendly state that they would not pay a claim if the “fracture is due to osteoporosis or a medical procedure.

How many times can a client claim?

Where an accident happens and the client suffers multiple fractures at the same time, the amount paid will be equal to the highest value fracture with only one amount being paid. British Friendly will pay one fracture cover claim per annum. Other insurers vary on their approach to multiple claims in a policy year as can be seen below:

Insurer |

Number of claims permitted per annum |

Aegon |

No numerical limit to number of claims, but total that can be claimed in a year cannot exceed £2,200 |

Aviva |

1 claim per year |

British Friendly |

1 claim per year |

Cirencester Friendly |

1 claim per year |

Legal & General |

No numerical limit to number of claims, but total that can be claimed in a year cannot exceed £7,500 |

LV= |

1 claim per year |

Royal London |

2 claims per year |

Zurich |

No numerical limit to number of claims, but total that can be claimed in a year cannot exceed £6,000 |

Conclusion

On the grand scale of all the injuries and illnesses a person may suffer, a broken bone (whilst painful) may seem relatively low on the longer term severity scale. It will, however have a huge impact on most people’s ability to work in the short term. A broken leg, for example is likely to affect anyone that is required to be on their feet for any period of time, just as much as a broken wrist will impact a person that needs to use their hands.

The addition of Fracture cover to British Friendly’s proposition is most welcome. It may not be the most comprehensive or highest paying Fracture cover out there but combined with the wider Income Protection propositions, the mutual benefits and BF Care, British Friendly have a compelling proposition that can compete with anyone in the market today.