Hospitalisation and rehabilitation support benefits- 5 things you should read

Whilst any protection insurance policy is ultimately intended to pay the claimant an amount of money if they die, are diagnosed with a major illness or are incapable of working due to sickness, increasingly insurers do so much more than this. At the early stages of an illness or injury the client may find themselves in hospital, undergoing immediate care or treatment. Whilst later on, when they’re hopefully on the mend, they may need support with recovery and rehabilitation. At both stages, before and after an illness or injury many insurers now provide additional financial and specialist support, to help clients at this difficult time. In this ‘5 things you should read’, we bring you a roundup of insights on hospitalisation and rehab support benefits.

HOW INCOME PROTECTION PROVIDERS HELP WITH A HOSPITAL STAY

Whilst Income Protection plans are designed to subsidise a loss of income due to illness or injury, the deferred period often means that the immediate costs of workplace absence need to be met by the client. Should they end up in hospital however, some insurers can step in and provide financial help during the defer period, on top of the usual income protection benefit. In this insight we looked at what financial help insurers can provide if a client is admitted to hospital.

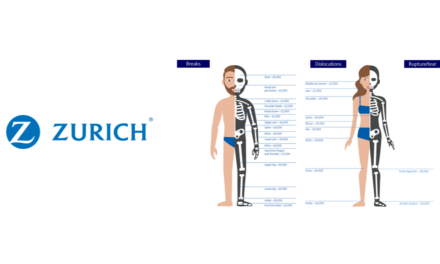

WHICH CRITICAL ILLNESS POLICIES COME TOP IF CLIENTS HAVE A SERIOUS ACCIDENT?

A serious accident can have a massive impact on a client’s life where they face a long stay in hospital or being permanently disabled due to the injuries they have sustained. This can have huge financial implications in the short and longer term, not only for the client but also their families. So, if insurers can step in and provide a bit extra, this can make clients’ lives a little bit easier. In this insight we looked at what financial aid critical illness insurers provide following a serious accident.

WHICH CRITICAL ILLNESS PLANS SUPPORT PARENTS WHEN THEIR CHILD IS HOSPITALISED?

For any parent, witnessing their child suffering in hospital must rank highly among the more stressful times in their entire life. Feelings of helplessness, fear and anxiety will be soaring. The need to focus on the child’s support and care is paramount, leaving little headspace for worrying about financial matters, yet the costs – both direct and indirect – can mount up. In this insight we looked at which insurers offer an additional feature of child hospitalisation benefit on their policies.

REHAB SUPPORT ON INCOME PROTECTION PLANS – HOW PROVIDERS COMPARE

The financial support that income protection provides will be a lifeline for many people who become unable to work through illness or injury. However, no policy will replace all of a client’s income, so it’s in their interests to recover as quickly as possible – although not rushing their recovery before they are ready – to bring their income back up to its usual level. In this insight we looked at which insurers offer rehabilitation services to help clients return to work and how each proposition distinguishes itself from the competition.

HELPING CLIENTS RECOVER AFTER A CRITICAL ILLNESS – HOW INSURERS COMPARE

Medical advancement has improved the survival rates for many critical illnesses, so it is becoming increasingly important to consider quality of life after a serious illness. The road to recovery however may see people experiencing a range of physical problems including weakness and loss of energy. Their mental health may also be affected by what they have been through, resulting in anxiety, depression or post-traumatic stress. In this insight we looked at the support insurers are providing to help clients with their physical rehabilitation following a critical illness.