Insurer Claims processes – 6 things you should read

Claiming on a protection insurance policy is something any of us hope a client never has to do, but is the ultimate reason that advisers recommend the cover in the first place. When a claim does arise it is the true test of the quality of the advice, product recommendation and the insurer themselves. Increasingly advisers are involving themselves more in supporting their clients through the claim process and we’ve seen some fantastic case studies shared by advisers, where they’ve been able to help their client at that difficult time. In this ‘6 things you should read’, we’ve pulled together our content on insurers claim processes, to help advisers better understand how insurers manage claims and how they can support their client through the process.

CLAIMS HANDLERS

The support provided to claimants during and after their claim is assessed can be as important as the money they receive. This support can be different depending on the reason for the claim. We take a look at when ongoing support is provided and what is offered.

CLAIMS NOTIFICATION

Depending on the nature and reason for a claim, the person notifying the insurer of a potential claim may not be the life assured. Here we interrogate who can notify an insurer of a claim and what the insurer does to keep the adviser informed that the claim is in place.

CLAIM DOCUMENTATION

It is quite understandable for insurers to request some form of evidence that the claimable event has taken place. Making this easy for the claimant to provide, will help reduce the burden and stress placed on the client and here we look at what evidence might be requested and how it can be provided.

CLAIM TRACKING

The last thing a claimant wants is to have to worry about what is happening with the protection policy claim. Keeping both the claimant and the adviser abreast of what is happening is vital and here we look at how insurers do this.

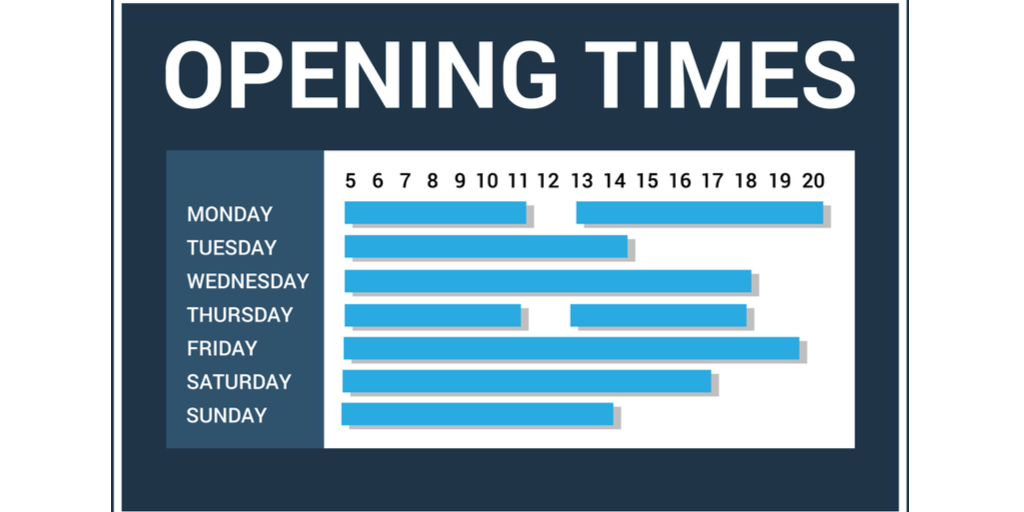

CLAIMS CALL CENTRE OPENING TIMES

Where a claimant is informing an insurer of a claim over the telephone, they may not always be able to do this from 9 to 5 on a Monday through to a Friday. As such the longer the opening times of claims call centres the better. Below we look at the opening times for insurer claims call centres.

ONGOING SUPPORT

The support provided to claimants during and after their claim is assessed can be as important as the money they receive. This support can be different depending on the reason for the claim. We take a look at when ongoing support is provided and what is offered.