2022 income protection ratings – everything you need to know

Our Protection Product Ratings provide advisers with a valuable resource to research and check the quality of each insurers protection proposition, as well as a range of underlying features and benefits. The features and benefits that make up the overall score are based on those most commonly selected by advisers on our research tools over the last 12 months. For this reason, our ratings are a reflection of what is important to advisers and their clients. They’re not static either and throughout the year we update the scores and medals if and when insurers make improvements to their products.

For our income protection product ratings we’ve done things a little different this year and included two categories – one for clients with a stable income and one for clients with variable earnings. The addition of a new category focusing on clients with variable earnings reflects the growing importance of non-traditional income protection plans or features, designed for the self-employed, those on zero hours contracts, or highly variable earnings. Many more people are no longer following a traditional career path, with a stable PAYE salary that steadily grows each year, so it’s crucial income protection plans are able to cater for the full variety of client needs.

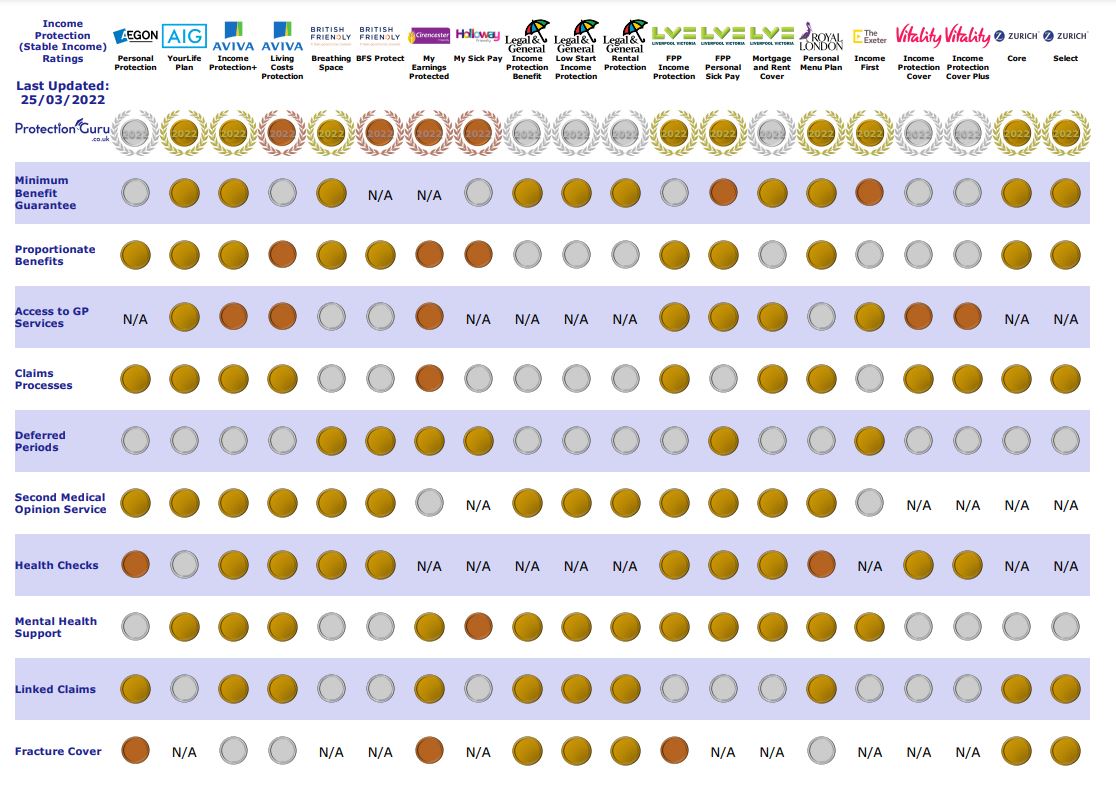

Income protection (stable earnings)

Our income protection ratings (stable earnings) is our traditional income protection category and focuses on the core features and benefits advisers deem most relevant for IP clients, whose income is unlikely to fluctuate significantly from one year to the next. For this category we’ve included a number of standard core features such as minimum benefit guarantees, proportionate benefits and claims processes. Reflecting the growing importance of every day support services, we’ve also included things like virtual GP services, second medical opinions and mental health support.

income protection (variable earnings)

For our income protection ratings for clients with variable earnings, such as the self-employed or those on zero hours contracts, we’ve weighted the overall score more heavily in favour of guaranteed benefits. The stand out policies here are those where a monthly benefit is provided with no link to the clients income, or insurers offer the ability to complete upfront financial underwriting and fix the benefit from outset. Other underlying features include guaranteed insurability options, proportionate benefits and linked claims.