5 ways protection plans can provide immediate value

With many individuals and households facing rising living costs and a squeeze on their income, there is a risk that valuable protection insurance products are seen by clients as a non-essential cost and therefore they may either forgo the cover entirely or cancel existing products.

Whilst clearly the overall value of any policy is the peace of mind and protection it provides in the event of a claim occurring, this can sometimes seem slightly abstract to people. Clients may ultimately feel that paying a monthly premium for little more than the promise of a pay out, in the event of something happening to them (that they deem unlikely) isn’t worth the cost.

Increasingly though, protection policies provide so much more and can offer clients a range tangible every day benefits that they are more likely to use and that can provide very real value, particularly if they’re facing financial challenges elsewhere.

24/7 Virtual gp services

At the top of the list in the guide are virtual 24/7 GP services. Unsurprisingly this is one of the most commonly selected benefits across our research services and something that many advisers and their clients clearly already see the value of. Arguably something most clients will find a use for and something that purchased privately can be quite costly, so well worth highlighting.

Health MOT

Whilst still only offered by a relatively small number of insurers, health MOTs can be extremely useful. Given the lack of availability of routine health screenings through the NHS (unless offered at a certain age milestone, e.g. 40), this is something that most clients could only do by going private and footing the cost themselves. Health screenings can be an important way of better understanding our health and where necessary making lifestyle changes.

Mental health support

With a greater overall focus on the importance of mental health and wellbeing, one of the biggest challenges for many remains the availability of support services if required. This is a key area where the NHS is often stretched and depending on where someone is in the country, access to services may be limited or they may face long delays. Mental health support is something offered by almost all insurers, in some form.

second medical opinion services

Offered by an increasing number of insurers, second medical opinion services are another benefit that can provide enormous value to clients that have a health concern and wish to seek expert help. Again, whilst the NHS provides invaluable medical support, there is sometimes a limit to what it can do and for clients who are unhappy with a diagnosis, they may wish to use a second opinion service.

Nutritional and wellbeing advice

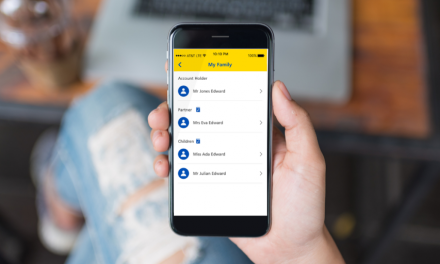

A poor diet and nutrition can often be a major contributing factor in some of the common conditions that result in protection insurance claims. To support clients maintain a healthy lifestyle and hopefully prevent those conditions from arising in the first place, many insurers now include a range of wellbeing benefits and services, available for the client (and in some cases their family) to use at any time. The services can vary, but as our insight highlighted, some insurers give clients access to expert, professional guidance.