What were the big product developments in the second half of 2020? Everything you need to know

It is fair to say that by the second half of 2020, insurers had got over the initial shock of the pandemic and started to return to business as normal (whatever that was). Whilst there was and still is a lot of focus on getting cases underwritten in difficult circumstances, we also saw a number of product developments enter the market. In the second of our two part look back at 2020 we pull together our reviews of what we believe were the biggest (non-COVID-19 related) product updates in the second half of 2020.

Please note the graphs and charts within these articles are based on the market position at the time of the particular launch and may not reflect the current market position.

LV= introduce enhanced children’s critical illness cover

In the second of their critical illness upgrades in 2020, LV= introduced their Enhanced Children’s Cover on 20th July to complement the changes made earlier in the year. Offered as an optional add on, Enhanced Children’s Cover included an additional ten child-specific conditions plus an additional payment for six pregnancy related complications. Along with an increase in the amount that would be paid for claims on full payment conditions, this update helped make LV= a serious player for children’s cover.

Aviva join the simplification race

On 14th August, Aviva made a move to simplify their critical illness wordings by amalgamating a number of conditions together into single definitions. These changes were very positive, however did not improve coverage a great deal but we particularly liked the way they categorised conditions into the parts of the body they affect and how they visualised this through a body image.

Vitality’s long awaited simplification

For as long as I can remember advisers have told me that the Vitality proposition needs to be simplified and on 16th September this finally happened. Whilst no changes were made to the serious illness definitions and severity payments rates, there were big changes to the way the optimisers are applied and simpler options when selecting cover. This was a massive step forward for Vitality, however there is still much more they could do.

Legal & General expand their income protection offering

On the 29th September, Legal & General introduced two new income protection plans to their proposition. Their Low Cost Income Protection plan was focused on making Income Protection slightly more affordable at outset by providing initial discounts to the premium with increases applied each year. To keep the premiums low, certain features were removed, however broadly the new plan mirrored their existing IPB plan. In addition to this Legal & General entered the Executive Income Protection market, a fantastic move as this market is woefully underserved.

To see what is and isn’t included in the Low Cost Income Protection plan click here

AIG make bold and huge steps forward for critical illness

In undoubtedly the biggest shake up for the critical illness market in 2020, AIG introduced a bold new approach and took simplification to another level. Along with the usual amalgamation of conditions, they introduced four new definitions which combined would cover in excess of 20 of the usual critical illnesses available from other plans. What was particularly impressive was the fact that no diagnosis is required and the definitions are based on impact. There were also significant enhancements in children’s cover where AIG introduced new conditions not covered anywhere else in the market that actually do have relatively high prevalence.

Royal London help ensure that the proceeds of a claim go to the right people

We all know that not enough policies are written into trust and the potential consequences at point of claim. There are however many reasons for this from it being too complicated, difficult to change once implemented and difficult to get agreement and where signatures are required from those involved. Throughout 2020 Royal London have made some significant changes to the way their trusts work and ease of implementation, however on 11th November they also introduced their new nomination of beneficiary function that enables clients to elect who the proceeds of a claim will go to without the need for a trust (simple cases only).

To see what types of client a nomination of beneficiary will work for click here

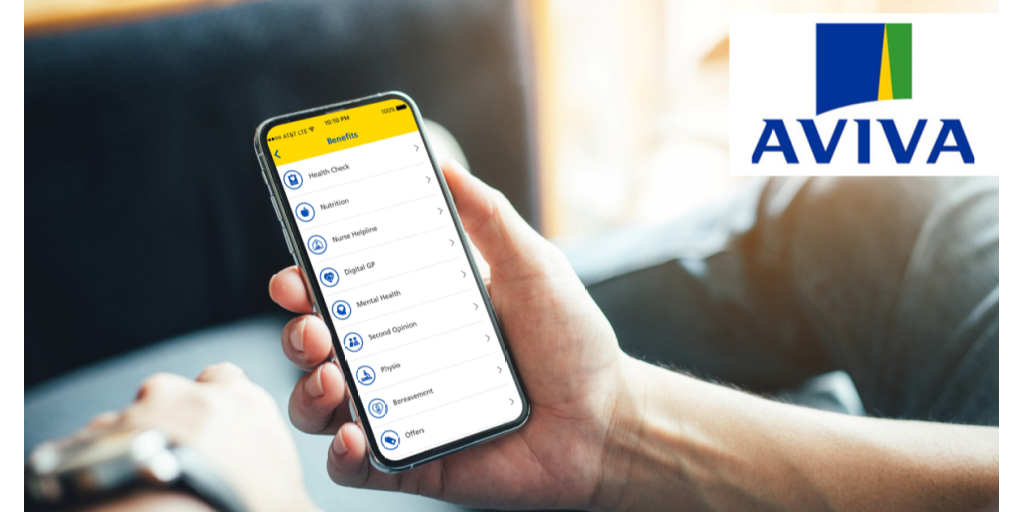

Aviva shake up the added value benefit market

All through 2020, the added value benefit propositions provided by insurers have really come into their own and provided valuable services to clients who might have struggled to obtain them otherwise. Following the launch of DigiCare+ to their group risk plans on 30th September, Aviva launched DigiCare+ to their individual clients on 8th December. We were hugely impressed with the proposition as it brought a wide range of both preventative and curative services from different service providers together within a single app, whilst also providing the ability for clients to be referred across services. Crowned with a new approach to health checks using blood samples, this really was a huge development.