Unprecedented evidence that Income Protection pays, the most important message from #IPAW

As it is Income Protection Awareness Week, for the last five days we have dedicated Protection Guru to producing content to help advisers in growing the amount of such plans they can persuade clients to take out. I believe the most important challenge for the income protection community is removing the misconception among consumers that income protection policies don’t pay out.

When in 2018 the Financial Services Consumer Panel investigated the poor take-up of income protection, relative to critical Illness, their consumer research identified that many people simply don’t believe that insurers will keep paying year, after year, after year.

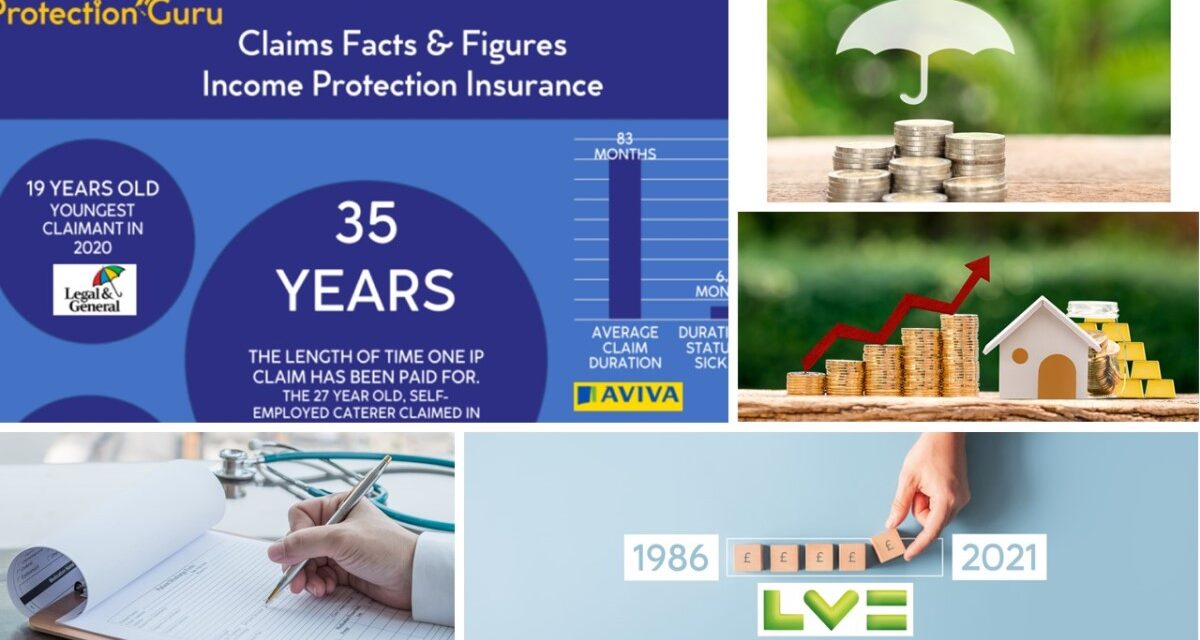

For this reason, Protection Guru has focused our contribution to Income Protection Awareness Week around providing clear and unambiguous evidence that #IncomeProtectionPaysOut. Today we highlighted an outstanding case study of an insurer, LV=, that has been paying an income protection claim for 35 years.

In addition, this morning we also highlighted two further case studies from Holloway and Zürich demonstrating great claims payment persistency and performance.

To further assist advisers, on Thursday we published an infographic designed to use income protection claim stats to overcome client objections. This can be downloaded by advisers from the Protection Guru site and be printed or sent electronically to clients. We are exploring the ability to create white label or co-branded versions of this collateral. If this is of interest, please drop me a line to discuss.

Earlier in the week we also produced a series of studies to help advisers get into the detail of key Income Protection issues. Starting on Monday Rob Harvey looked at three things to understand about deferred periods.

On Tuesday we examined Understanding Benefit Amounts and on Wednesday explored Underwriting Income Protection Plans. Thursday’s study looked at key issues about policy changes and flexibility.

In other Protection news this week, Aviva announced changes to their global treatment and underwriting approach, extensive details of these can be found on Aviva’s showcase page from this link.

Our next Protection Forum meeting will be held on Tuesday 5 October at 11am. The agenda for this session will be:

- What generic pre-underwriting information would make an adviser’s job easier?

- Added Value Services: product gimmick or valuable support services?

- Should all COVID restrictions now be removed and what is holding insurers back?

- Using claims stats to overcome client objections

Any advisers who would like to register for a free ticket to join the session can do so via this link.

Over on Benefits Guru the big news this week was the results of our 2021 Workplace Pensions & Auto Enrolment ratings. There are some outstanding performances analysed in this research and it should be invaluable for anyone operating in the workplace pensions market. Again, advisers can download our workplace pension fact sheets from BenefitsGuru.co.uk.

Also Kat Mitchell delivered the second part of her deep dive into the services and functionality included in member portals. If you missed part one last week you can find it here.

On AdviserSoftware.com it was also a busy week for providing extensive information to help advisers make better decisions about the technology to help them run their businesses more efficiently, more profitably and with even better customer service.

On Monday, Adam Flowers kicked off the week examining Figlo’s financial planning tool. The Dutch software provider has long been a key player in its home market and has been looking to extend its footprint in the UK for many years. Their parent company Advicent was acquired earlier this year by InvestCloud, who have a strong presence in both the US and the UK so Figlo are certainly a company to watch if you want to have a more detailed understanding of what’s going on in the financial planning technology market.

On Tuesday, Adam returned to True Potential, this time focusing on their financial planning, personal financial management and quotation portal offerings. On Wednesday it was time to look at more from Iress, this time their Xtools (Cashflow) and Xtools Engage propositions were considered.

Flagstone’s wealth management system was explored on Thursday

I would also like to highlight my Money Marketing column this week where I explored How I believe Advisers can get lots more value out of the software that they are already paying for.

Last, I’d like to say a very big thank you to Matt Smith, Group Head of Cyber Security at St James’s Place Wealth Management and Tony Challands, Head of IT at Benchmark Capital for the great insights they provided at our Investment Forum meeting on cyber security & secure communications this week. If you were unable to join the event the full transcript will appear online at AdviserSoftware.com shortly.

Our next Investment Forum meeting will take place on Tuesday 19th October at 2pm. We’ll announce the agenda shortly, but any advisers who would like to register for a free ticket to join the session can do so via this link.

It looks like we’re going to have another excellent weekend for weather, so I hope you’ll have a great time whatever you do.