How Protection Guru are supporting adviser with their Consumer Duty requirements

Today, July 31st, 2023, the highly anticipated Consumer Duty has come into force, this has implications for advisers and the wider protection industry. Let’s recap what this means:

- Assessment of Value: Financial advisers are now required to conduct a thorough evaluation of protection products under Consumer Duty. This assessment goes beyond just considering price and involves analysing the benefits and features of the products relative to their costs. The aim is to ensure that clients receive protection solutions that genuinely cater to their individual needs.

- Consumer-Centric Approach: The primary focus of Consumer Duty is to prioritise consumers’ best interests. Advisers must recommend protection products that are well-suited to their clients’ specific requirements, considering their unique circumstances and preferences.

- Transparency and Accountability: Advisers are expected to be transparent and provide clear information to their clients. They must explain the basis of their recommendations in detail, demonstrating how the chosen products align with the clients’ needs, and offer them the most suitable options available.

- Compliance Requirements: Consumer Duty imposes additional compliance obligations on financial advisers and insurance providers. This ensures that consumers are treated fairly, and that the industry operates with a high level of accountability and integrity.

- Impact on Product Offerings: It will have an impact on the design and marketing of protection products. Providers will be encouraged to prioritise offering products that genuinely deliver value to customers, meeting their specific needs effectively.

As the protection industry adapts to these changes, PGPro is here to assist financial advisers meet their obligations.

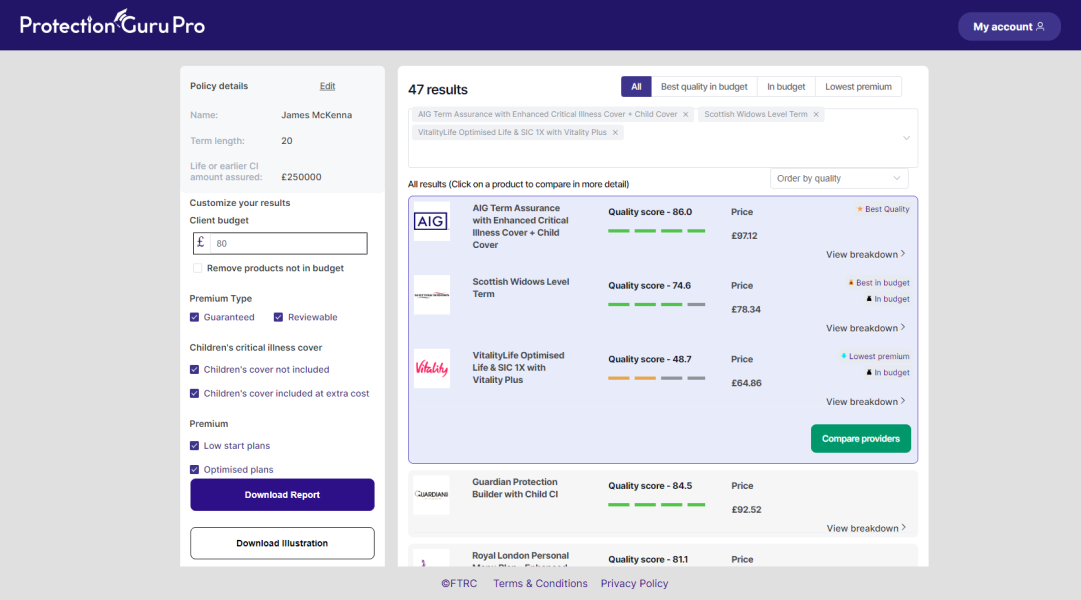

- Comprehensive Analysis: PGPro offers an exhaustive analysis of protection product features across a wide range of benefit types. With a panel of doctors’ analysis of critical illness wordings, advisers gain detailed insights into the products they recommend.

- Personalised Recommendations: Understanding the uniqueness of each client, PGPro tailors its analysis to identify the most relevant features based on individual scenarios. This enables advisers to provide personalised and more suitable protection recommendations.

- Efficiency and Speed: PGPro streamlines the process by enabling advisers to start with the best possible recommendation taking into account price and quality.. Within minutes, advisers can present suitable options to their clients, saving time and improving efficiency.

- Compliance Support: PGPro generates a range of reports with detailed information, justifying the recommendations made. These reports aid advisers in meeting compliance requirements and ensuring transparency in their recommendations.

In conclusion, Consumer Duty brings significant changes to the protection industry, emphasising value assessment and consumer-centric approaches. PGPro is a valuable tool that support advisers by providing in-depth analysis, personalized recommendations, efficiency, and compliance assistance to navigate these changes effectively.

To learn more about the benefits of PGPro, the Protection Guru team will be hosting a demonstration on Wednesday morning at 9.30 am. For those interested in joining the session, please contact [email protected]. You can also visit: ProtectionGuruPro for further information and sign up for a 7 day free trial.