Revolutionising The Adviser Market: How Consumer Duty Spurs Quality-Focused Protection Recommendations

Research published by Guardian today validates that the adviser community sees Consumer Duty as a huge opportunity, while at the same time driving substantial changes in the advice market.

Over 40% of advisers said they expect to make more protection recommendations because of Consumer Duty. This is a great result, making sure more individuals have the protection in place to not only protect their future but that of their families.

More interestingly 84% of advisers agreed that with Consumer Duty’s emphasis on fair value product analysis services will become a more important part of the selection process, and 81% said that Consumer Duty will result in more advisers focusing on quality over price when selling protection. This represents a fundamental change in the way advisers give advice and new, more sophisticated, tools will be essential if the time taken to give advice is not to be far longer.

While it is great news that advisers see Consumer Duty as a great opportunity, personally I’m concerned at the level of additional work that will be necessary in the advice process, unless advisers have access to highly sophisticated tools that can produce value quality and price assessments in a single process. This is why over the last 18 months we have been building out Protection Guru Pro as the most comprehensive protection research product for advisers.

So why does Protection Guru Pro represent such a compelling proposition for advisers?

Here are 10 reasons why it’s simply the best protection research system available to advisers today:

- Simply more product coverage.

- Value, price & quality in a single assessment.

- 85% of consumers want better protection products, not the cheapest.

- Produces comprehensive analysis in less than two minutes.

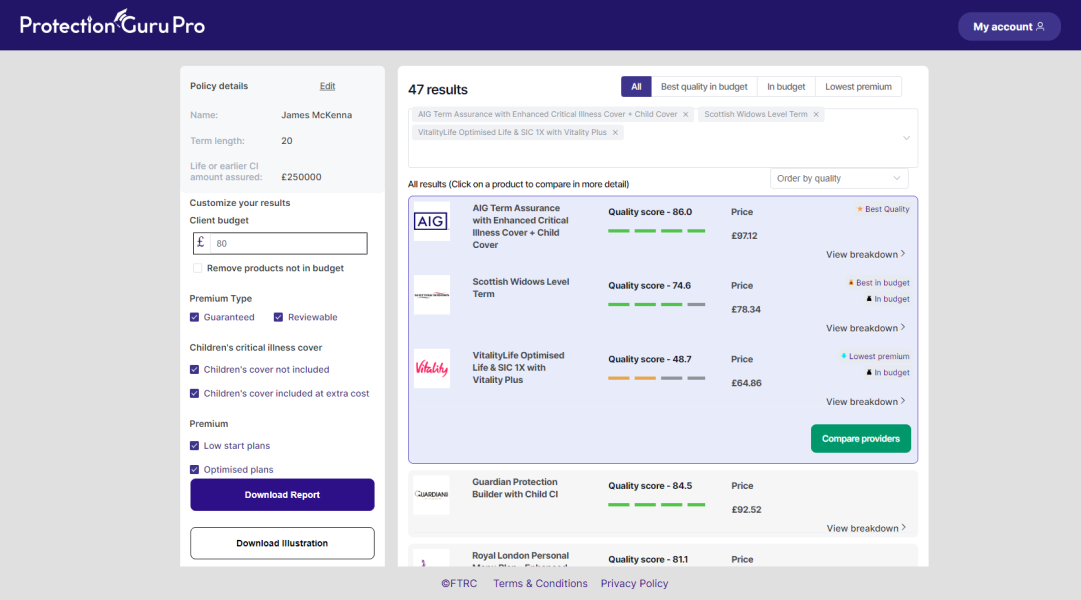

- Designed to accommodate a client’s budget.

- Filters out plans that are not like-for-like, e.g. Low Start, Variable Premiums.

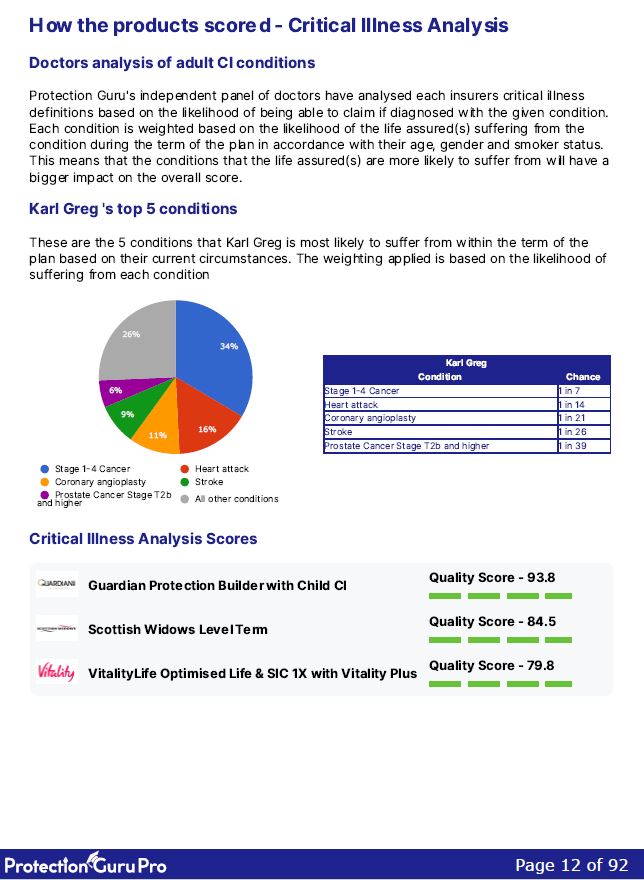

- Uniquely, critical illness conditions are analysed by medical professionals.

- Increasing a single plan by £2 per month can cover the license fee.

- Comprehensive output report, showing the full audit trail of the advice.

- Coming soon – underwritten premiums, so plans can go on cover the same day.

Allow me to expand on the above in more detail. Firstly, no other solution provides such comprehensive coverage of price and quality analysis across life protection, mortgage protection, income protection, critical illness, family income benefit, and business protection.

In addition, our research process leads with quality first, so that you could show clients the plans that will provide the most comprehensive cover. Data provided to us by advisers who use our system identifies that 85% of consumers, when given the choice of the cheapest policy or a better plan, opt for the better contract. This is hardly surprising, if you’re buying protection to provide for the people you love the most surely you want a better plan, not the cheapest one.

If you present protection options to clients starting with a price list, they naturally settle on the lowest figure as a benchmark in their mind. It is, then a challenge for the adviser to upsell to a better contract.

Conversely, if you start with the best quality, you can then move down the price list to find the best mix of quality and values to support this process. Protection Guru Pro allows you to set a client budget, then identifies the best quality plan within the client’s financial means – an ideal way to demonstrate best value.

Additionally, our service enables advisers to filter out plans that might not be direct comparisons, such as low start contracts, those without guaranteed premiums and short-term income protection, so you can always be sure to be comparing like-for-like rather than have a table of very different plants which you have to sift through.

Regular users of our system should be able to generate their comprehensive research within literally two or three minutes.

All of this information can be generated in two forms of output report, either short report giving a brief summary of the process to the client or the comprehensive report which gives a complete audit trail of the process, including every contract excluded.

Uniquely ours is the only protection product research service where the critical illness definitions are assessed by an independent panel of medical practitioners. Critical illness wordings are especially complex and the difference between a wording that uses “and” or “or” to define the circumstances where a plan will pay out can be substantial.

Year in, year out, there are major changes to medical practice, with new treatments and testing transforming the way many serious or critical illnesses are addressed. Late last year, the Association of British Insurers produced a new recommended minimum definition for heart attack cover, but regrettably, the ABI committee which produced this new wording didn’t realise the definition actually excluded a heart attack. This was identified by our clinicians, and indeed the ABI have now subsequently revised the wording.

If the ABI, with all the resources they have from insurers and reinsurers can’t identify such issues what chance does any individual adviser or other industry specialist have of staying up to speed with the latest medical developments? Would you want to risk making a recommendation regarding critical illness based on an assessment by anyone without medical training and current experience providing medical care? This feature, we believe, puts us head and shoulders above all other critical illness comparison services.

Again, research with our existing users tells us that, on average, clients pay an additional £6 per month premium when choosing a better plan rather than the cheapest through the Protection Guru Pro research process, although on average industry commission rates an adviser only needs increase a single contract by £2 per month to cover the £40 per user monthly cost of the software.

Next month, we will release a further version of Protection Guru Pro which will include an integration with UnderwriteMe’s Protection Platform enabling advisers to not only produced the best analysis of value by incorporating price and quality, but also then to proceed to underwriting online submission and the ability to put the cover in place the same day when needed.

If you would like seven-day free trial of Protection Guru Pro please click here to contact Jo Legg via LinkedIn.