How Royal London Excelled in our Ratings

In the second of our series of articles highlighting the insurers that excelled in our 2021 ratings, today we take a look at why Royal London achieved nine gold overall gold medals across the ten benefit types we benchmarked. As regular readers will be aware, our ratings are designed to highlight product excellence and comprehensiveness based on the features that advisers select the most when comparing plans across our various benchmarking tools.

Royal London’s excellent performance in this years ratings continues their excellent run in our ratings having performed admirably over the last few years.

One of the aspects of the Royal London proposition that we particularly like at Protection Guru is the range of options they offer in order to meet different needs. This is particularly apparent with regard to their critical illness offering where they offer standard or enhanced children’s cover as well as an option to not include children’s cover at all.

Critical Illness

Royal London’s critical illness coverage is broad with good coverage of the more common critical illness conditions. In particular, Royal London have excellent coverage for male clients mainly due to the fact that their low grade prostate cancer definition does not require the client to have had treatment.

Royal London’s standard children’s cover provides decent coverage for the core critical illness conditions. Their Enhanced Childs CI plan also provides excellent coverage for conditions that are more common in children such as Type 1 diabetes, Intensive care, cerebral palsy as well as broad coverage for pregnancy related and congenital conditions.

Income Protection

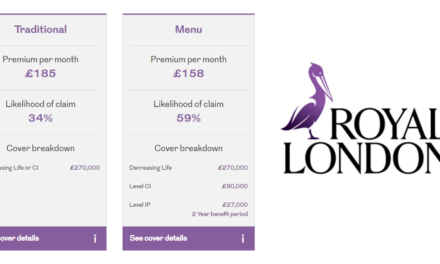

Royal London’s income protection proposition also provides advisers with a wide range of choices to met their client’s budgetary needs. For the more cost conscious they offer a choice of one, two or five year limited benefit payment period options, which still provided full term benefits where a client can afford it.

We particularly like Royal London’s approach to their minimum benefit guarantee. Unlike other insurers, who require the client to be working at least 16 hours at the time of incapacity to qualify, Royal London will not remove the guarantee but instead switch from an own occupation definition to their serious illness definitions if the client is working less than 16 hours a week.

In addition to these features, Royal London also provide proportionate benefits that are unaffected if the client’s income increases by less than the rate of inflation, good rehabilitation support in partnership with RedArc and funeral cover of 12 times the monthly premium.

Mortgage Protection

When protecting a mortgage, Royal London are the only other insurer apart from Guardian who offer a mortgage guarantee. This guarantees to repay the value of the mortgage at point of claim as long as the amount and term is the same as when the policy started and it isn’t in arrears at the time of claim regardless of the rate of interest.

Free cover of up to £1,000,000 is also provided for up to 90 days, providing clients with a little bit more breathing space to align the policy start date with the completion date and not be left exposed when the liability starts after exchange of contracts.

Business Protection

When it comes to business protection, Royal London’s Underwrite Later facility which allows policies to be put in force based on an underwriters assessment of the information provided within the application is market leading. Cover can be kept in place for up to six months whilst the necessary medical evidence is obtained and as a result business can be protected almost immediately.

Royal London also provide their business protection customers with access to business legal advice providing support in areas such as HR, health & safety commercial disputes and tax issues. In addition to this the business protection team at Royal London have a detailed understanding of trust law, corporate law, accountancy practices among other areas.

Where can Royal London improve?

When Helping Hand was launched it offered market leading support to clients and this continues to offer a range of vital services. In recent times however, the market has started to provide more early detection and preventative services such as access to virtual GPs and health checks and this is an area where Royal London could look to broaden their proposition.

With regard to critical illness, Royal London currently only pay 25% of the sum assured up to £25,000 for their additional payment conditions. This is an area where the market, and particularly the comprehensive end of the market where Royal London would see themselves, has moved on with some insurers paying considerably more.

Overall

Overall, Royal London have had another stellar year in our product ratings. The fully comprehensive iterations of their plans received nine overall golds and a total of 61 gold medals for the underlying categories out of the 100 areas we benchmarked across all benefits.