Guardian Critical Illness Showcase Page

Adviser website – https://adviser.guardian1821.co.uk/

General enquiries – 0808 133 1821 Email

Claims – 0808 173 1821

For a personal introduction to Guardian, email [email protected] and one of Guardian’s Account Managers will call you back.

See Guardian’s main showcase page here

Protection Guru has worked with Guardian to create a concise objective analysis of their product range.

Guardian’s critical illness proposition in their own words

Typically, providers define the quality of their critical illness policies by the number of illnesses they cover. At Guardian, we’re focused on offering the best possible cover for the most common illnesses. We’ve done this by simplifying our policy wording, making it easy for advisers and their clients to understand what they’re covered for. And, in most cases, the word of a UK Consultant is all we need for a claim. That means no detailed medical evidence to prove if a critical illness is serious enough. Our crystal-clear policy wording means customers know exactly what they’re covered for – creating certainty and building trust.

On top of that, to make sure all our critical illness policies are future-proofed, we’re offering our existing customers a unique promise. If our critical illness definitions improve, in most cases we’ll apply the improvements to their policies completely free of charge. If they make a claim, we check it against both the definitions they bought and the definitions for new customers. And we pay out if the claim is valid under either. Occasionally, we may introduce changes that we won’t automatically upgrade. If this happens, we’ll offer existing customers the chance to pay to add them.

In this showcase page, Protection Guru share their view on our critical illness proposition and how it compares to the rest of the market.

Comprehensive Cover

Guardian’s critical illness cover provides not only coverage for a wide number of conditions, but extremely comprehensive coverage for the conditions that are most claimed on. These conditions are available on both their stand-alone or combined Critical Illness Protection.

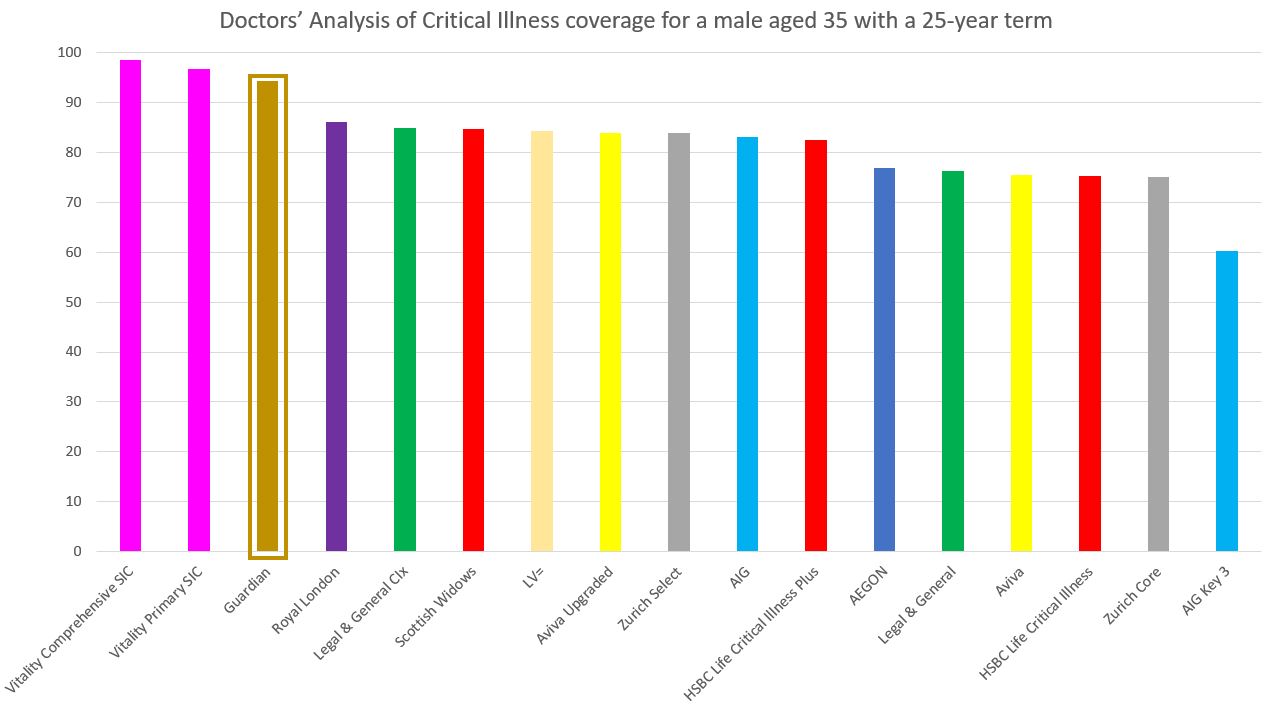

There are many conditions where confirmation of diagnosis alone is sufficient for a client to claim, and the clarity of definitions is a particular strength as our independent panel of doctors explain:

“Having reviewed the critical illness wordings written by Guardian, they have clearly made a significant effort to keep them simple and clear to avoid any unnecessary ambiguity.”

Most claimed on conditions |

Our independent doctors scoring of Guardian’s Definitions (0-100) |

Industry Average |

Cancer |

100 |

100 |

Heart Attack |

100 |

98.5 |

Stroke |

100 |

96.33 |

Multiple Sclerosis |

100 |

97.73 |

Benign Brain Tumour |

75 |

75 |

Cancer is the most common reason for claims under critical illness plans and in this video Julie Hopkins, Director of Underwriting and Claims Strategy, explains how Guardian cover this within their policies.

Cover Upgrade Promise

Guardian’s cover upgrade promise is written into the terms and conditions of the policy and therefore not a discretionary option. It promises that if Guardian upgrade their offering in the future the client’s with a policy already in force will have the opportunity to benefit from any enhancements to the cover. In Guardian’s last update (October 2019), they enhanced a number of their definitions and all clients that had a policy in place before these changes benefit from the enhanced wording free of charge. In some circumstances, Guardian do reserve the right to apply an additional cost, however any such upgrades will always be offered to existing customers who can choose to pay for the upgrade or not.

Ultimately, this means that clients taking a Guardian critical illness plan can be assured that their version of the plan will be, at the very least, as comprehensive as the versions of the plan that Guardian will offer in the future.

Additional conditions

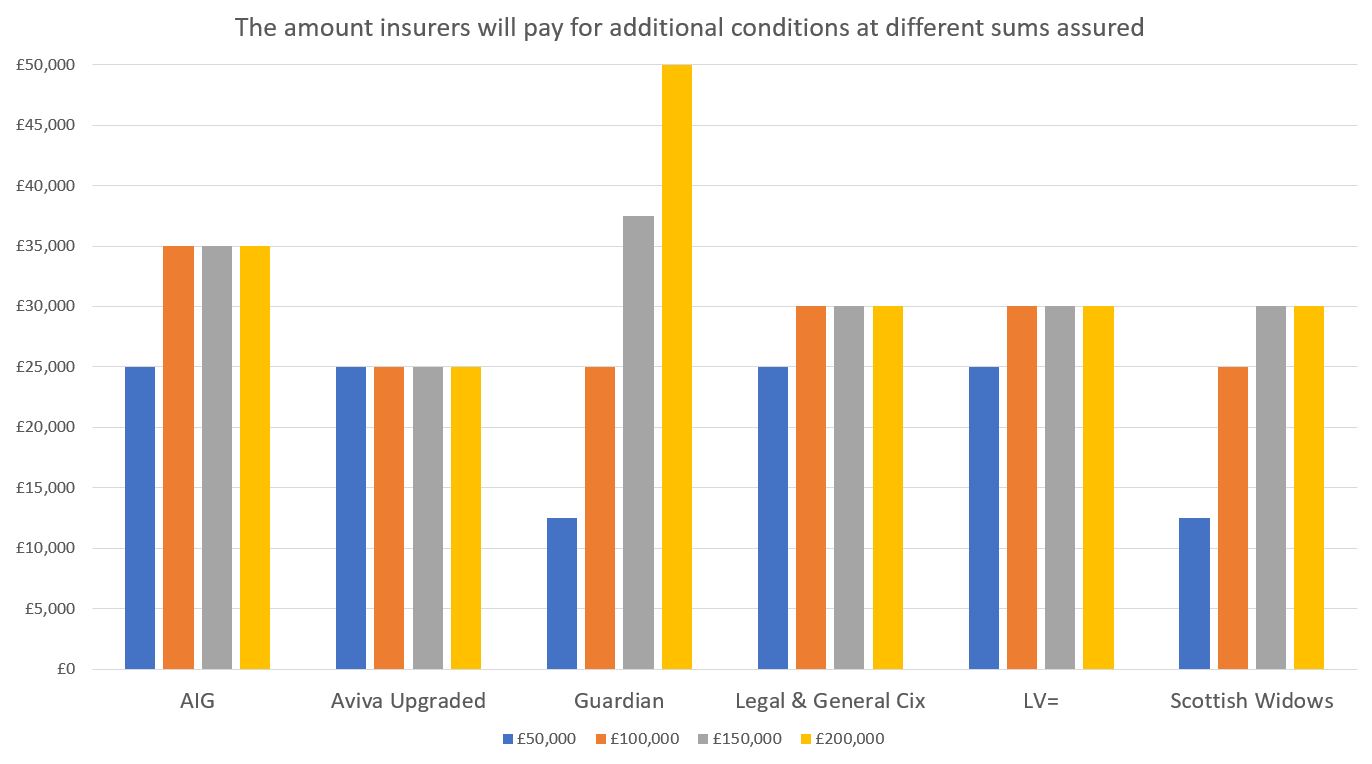

When it comes to additional conditions on critical illness policies there is far more disparity in the actual amount that will be paid across the market than there has ever been. Whilst many plans remain at 25% of the sum assured to a maximum of £25,000, a number of insurers have increased either the percentage or maximum monetary amount they will pay.

Whilst the maximum percentage of the sum assured Guardian will pay is relatively low at the standard 25%, they will actually pay up to £50,000 (The exception being for low risk non-melanoma skin cancer which pays 10% of the sum assured to a maximum of £50,000). This means that at higher sums assured they are likely to pay more than others. The chart below highlights the insurers that will pay more than the standard 25% to £25,000 and the actual amount they will pay at different sums assured.

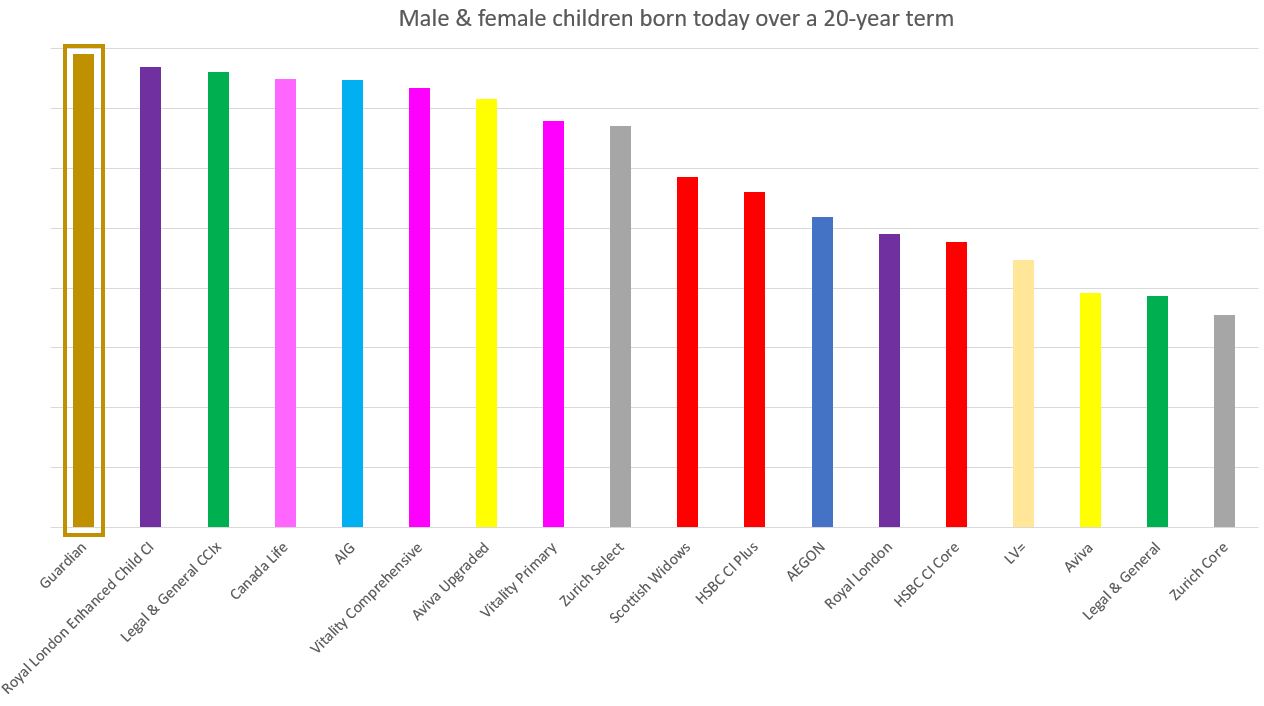

Children’s Critical Illness Protection

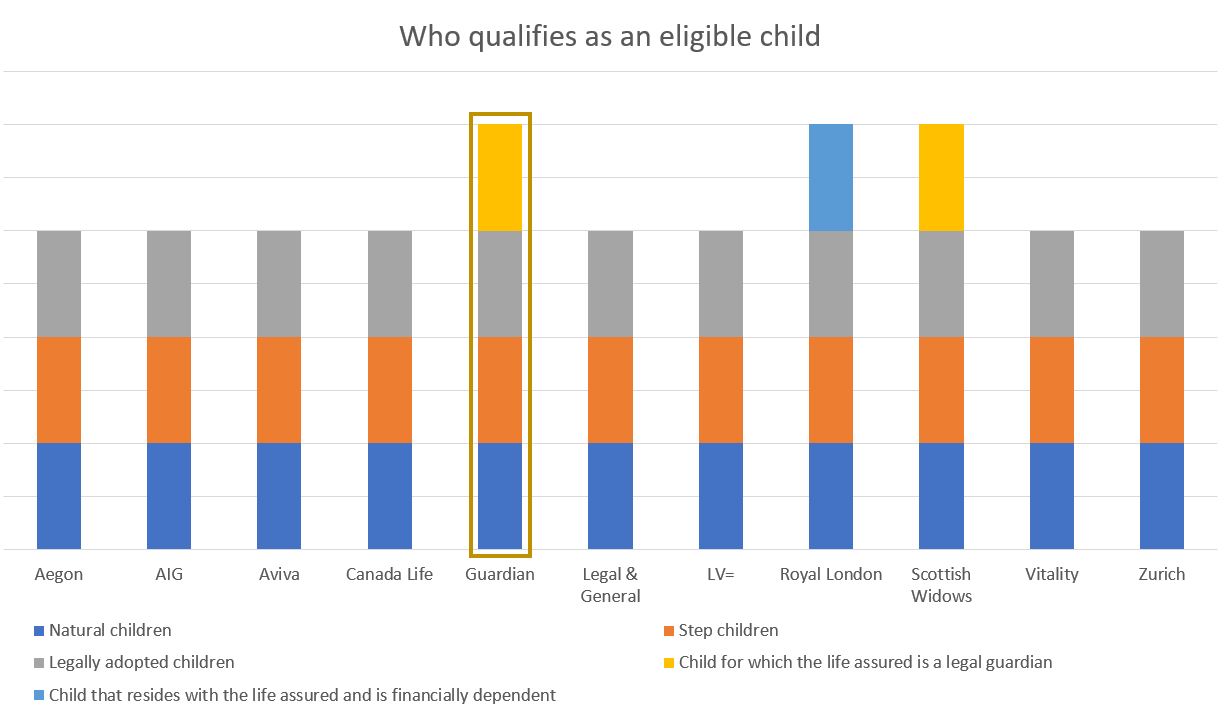

Guardian have made their Children’s CI Protection an optional extra and essentially as a standalone plan in itself, so clients only pay for the cover if they want it. It covers all natural, step or adopted children, and those for whom the parent has parental responsibility or is a legal guardian until their 23rd birthday. Guardian allow the customer to select any amount of cover between £10,000 and £100,000, limited to the parents sum assured and indexed if the parents cover is too. A funeral benefit of £10,000 is also included.

Guardian Anytime

GP 24/7

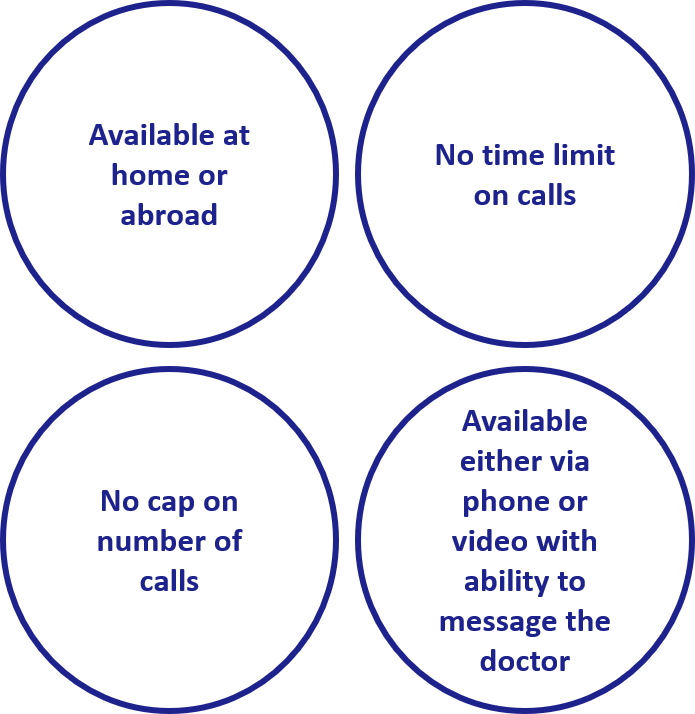

GP 24/7 provides clients and their spouse/civil partner/partner and children with access to GPs. Importantly this service is offered throughout the term of the contract regardless of whether a claim is in place or not.

Also included within GP 24/7 is access to Medi-SMART. This service provides those that have been prescribed or are seeking help with medication with advice on side effects, how different medications may or may not work with each other and alternative medication options from a clinical pharmacist. By providing clients with access to expert medication management, Guardian can help the growing number of patients taking multiple medications due to complex health concerns.

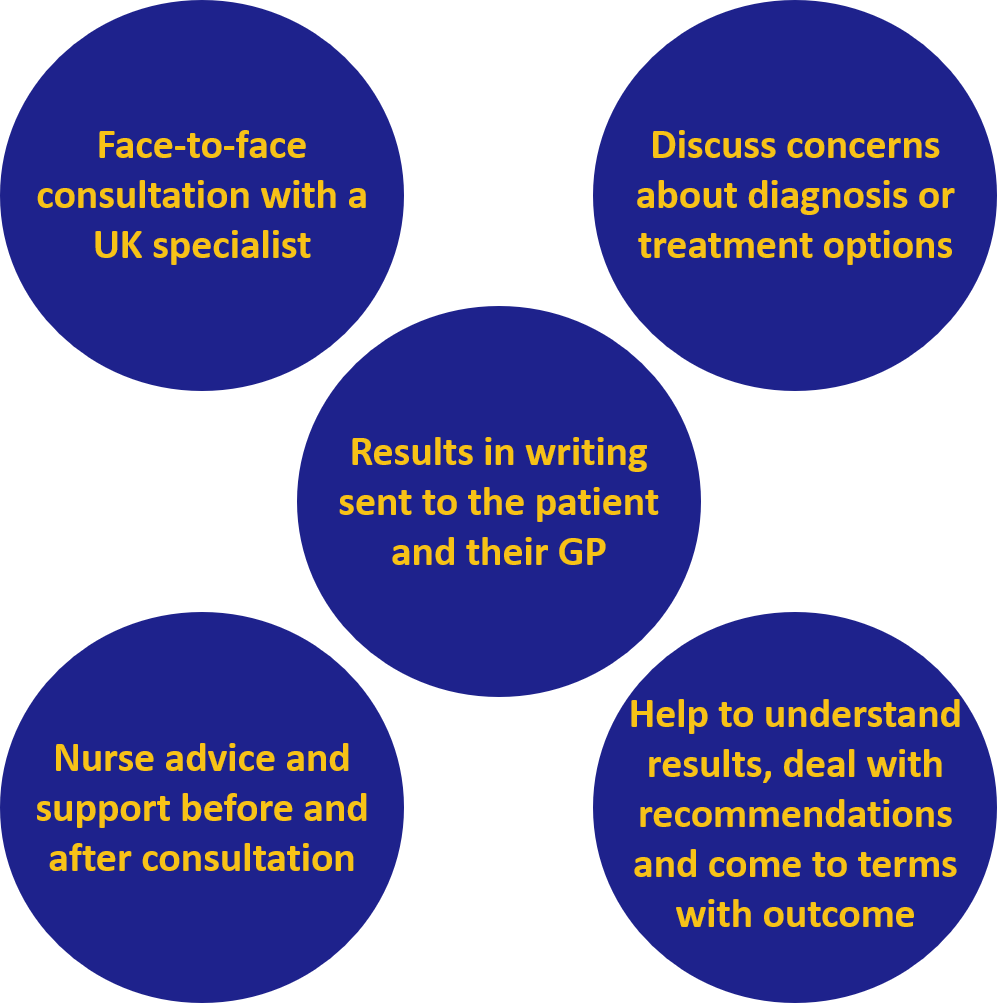

Second Medical Opinion Services

All policyholders can get access to a specialist second medical opinion following diagnosis of a serious illness as well as long-term support from a dedicated nurse adviser.

If the policyholder has Children’s Critical Illness Protection, all eligible children are covered too.

Areas for improvement

- Whilst the breadth of coverage and clarity of wordings is excellent, we feel that Guardian could do more to simplify their critical illness wordings by combining definitions and grouping the conditions covered

- Could consider offering a budget version of the plan like some other insurers where the number of conditions covered and features are reduced to support customers that might not be able to afford the comprehensive offering

- As a new challenger, Guardian do not have a history of claims that other insurers can provide and as such it is difficult for them to produce claims statistics. We would however like to see more claims stories or information on claims that have been paid to date

Protection Guru has worked with Guardian to create a concise objective analysis of their product range. Guardian have had input to the design of this page and contributed to the cost of this construction and maintenance, however Protection Guru have maintained editorial control over the content to ensure objectivity.

Guardian Financial Services Limited is an appointed representative of Scottish Friendly Assurance Society Limited. All products are provided by Scottish Friendly, an insurer with over 150 years’ experience in providing financial products and services.