Guardian Showcase Page

Adviser website – https://adviser.guardian1821.co.uk/

General enquiries – 0808 133 1821 Email

Claims – 0808 173 1821

For a personal introduction to Guardian, email [email protected] and one of Guardian’s Account Managers will call you back.

Protection Guru has worked with Guardian to create a concise objective analysis of their product range.

Guardian is renowned as having a feature-packed and comprehensive product. As such, it will be no surprise that they were one of the few companies that achieved a gold for all of their products in our ratings.

Guardian in their own words

We have a single ambition: for every family to have protection that they truly believe in. We aim to do this by constantly challenging industry norms. And, in line with our brand promise of Life. Made Better, we’ll constantly strive for ‘better’.

We’ve deliberately departed from some of the conventional norms in protection product design.

Comprehensive critical illness cover

Guardian’s critical illness cover provides extremely comprehensive coverage for the most claimed on conditions. These conditions are available on both their stand-alone or combined Critical Illness Protection.

In most cases, the word of a UK consultant is all that is needed for a client to claim, and the clarity of definitions is a particular strength as our independent panel of doctors explain:

“Having reviewed the critical illness wordings written by Guardian, they have clearly made a significant effort to keep them simple and clear to avoid any unnecessary ambiguity.”

Most claimed on conditions |

Our independent doctors scoring of Guardian’s definitions (0-100) |

Industry Average |

Stage 1 to 4 Cancer |

100 |

100 |

Heart Attack |

100 |

98.5 |

Stroke |

100 |

96.33 |

Multiple Sclerosis |

100 |

97.73 |

Benign Brain Tumour |

75 |

75 |

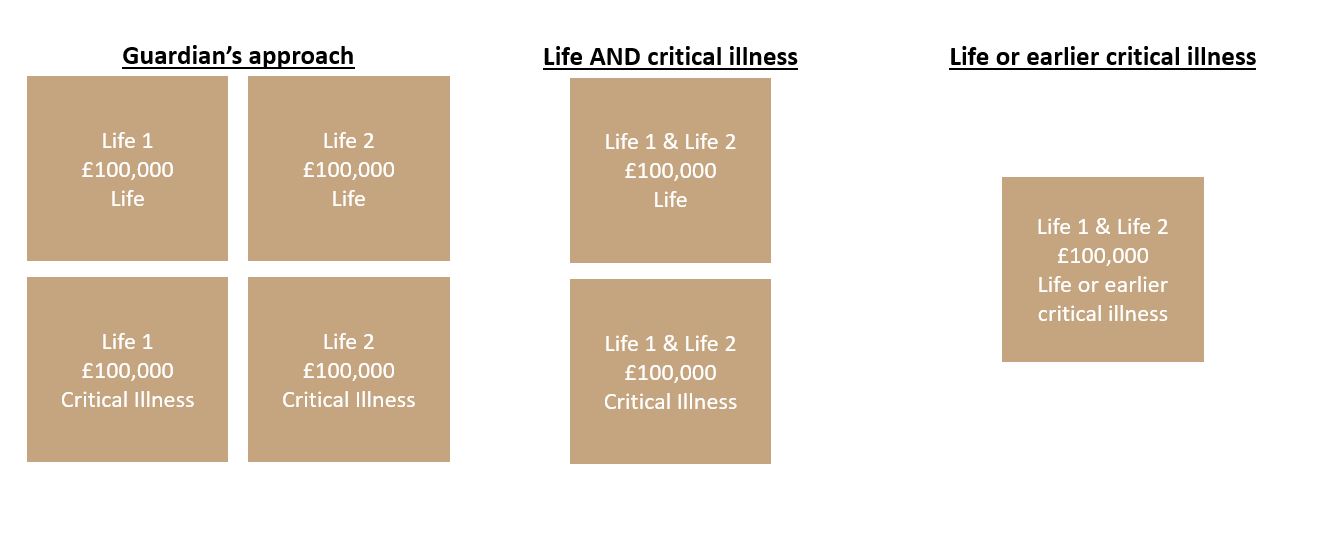

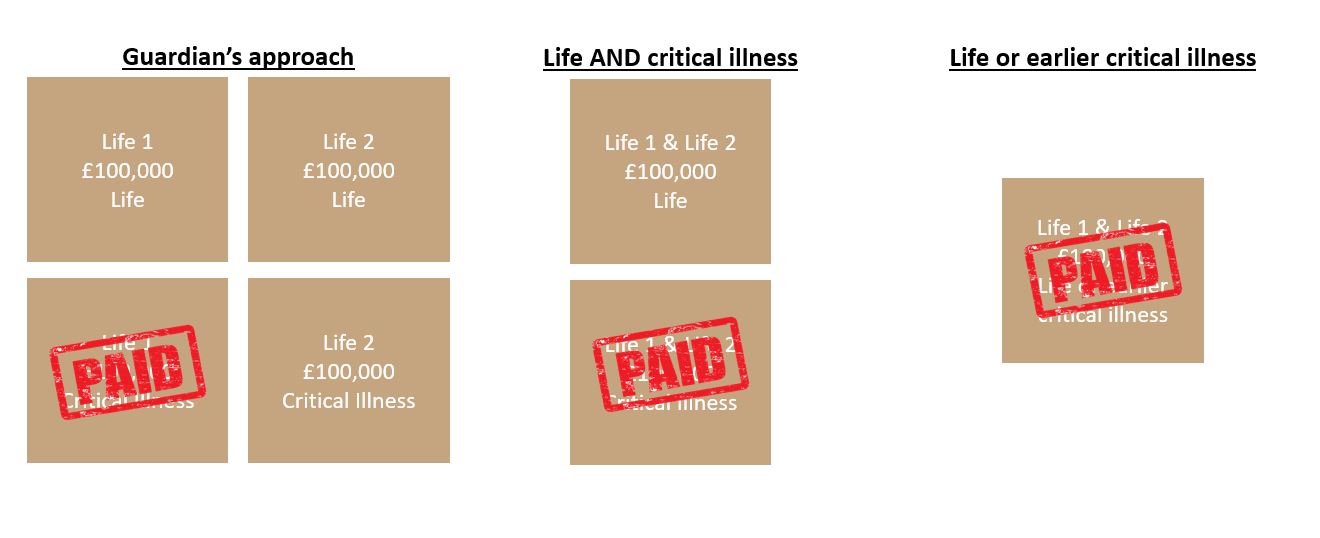

If a life assured suffers from a critical illness that meets the criteria of a plan, Guardian will pay out under their critical illness benefit. They will maintain their life cover and the other life assured’s life cover and critical illness also remain in force.

With the joint life and critical illness approach a claim can be made on the critical illness element, however the second life would no longer have critical illness cover and their life cover would remain in place.

If a joint life or earlier critical illness plan was in place then the policy would pay out and no cover would remain in place.

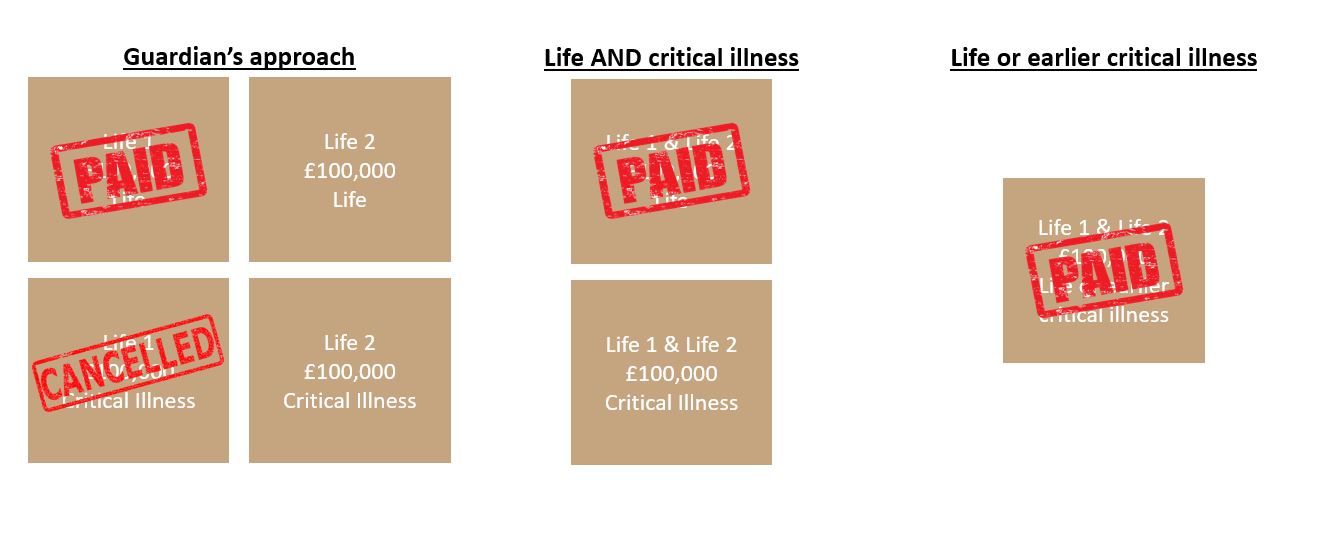

In the event of a life assured dying, the Guardian approach would pay a claim under the life assureds life cover and their critical illness would cease. The second life assured, however would keep both their life and critical illness cover.

If joint life and critical illness was in place then the life cover would pay out and the critical illness would remain in place at the same premium meaning the surviving life assured is still paying for their deceased partner.

Again under the life or earlier critical illness the policy would pay out and all cover would cease.

Cover upgrade promise

Guardian contractually offer all existing customers free cover upgrades. In some cases, they may introduce changes that won’t automatically upgrade. If this happens, they’ll offer existing customers the chance to pay to add them. This means that client’s with a policy in force will have the opportunity to benefit from enhancements to the cover.

To date, all cover enhancements were offered for free. Ultimately, this means that clients taking a Guardian critical illness plan can be assured that their version of the plan will be at least as comprehensive as future versions of the plan.

TERMINAL ILLNESS

Guardian’s Life Protection not only pays out if a client is expected to survive for less than 12 months but uniquely, they also guarantee to pay out if a policyholder is diagnosed with incurable stage 4 cancer, regardless of their life expectancy. They do the same if the policyholder is diagnosed with motor neurone disease, Creutzfeldt-Jakob disease or Parkinson-plus syndromes

Our independent panel of doctors describe these conditions and the prognosis below:

Stage 4 cancer

“Stage 4 cancer, often referred to as metastatic cancer, implies that the cancer has spread to at least one other body organ from the place that it started. This is the most advanced stage of cancer. Generally speaking, it is unlikely that a stage 4 cancer can be cured or enter into remission.

Most treatments are not aimed at cure, but at improving survival and quality of life. The survival rates for different types of cancers vary significantly. For example, if pancreatic cancer is diagnosed at stage 4, the median survival is only between 2 and 6 months. This contrasts significantly to prostate cancer, with 5-year survival rates for those diagnosed at stage 4, reported at 49% in the UK.”

Motor Neurone Disease

“Motor neurone disease (MND) is regarded as a devastating neurological condition, which usually follows a relentlessly progressive deterioration in the muscles of the limbs, spine and those involved with swallowing and breathing. This often results in death through lung failure and pneumonia from aspirating food and liquid from swallow issues. The disease can still be highly variable in terms of symptoms and time course. The most common form of MND, has a median survival of 3-5 years from diagnosis, although it is reported that 10% can survive up to 10 years.”

Parkinson-Plus Syndromes

“Parkinson-plus syndromes is another neurological disorder which does not respond to treatment and has a poor prognosis. They are often associated with early onset dementia, significant disability and confinement to bed or wheelchair is typically necessary late in the disease.”

Creutzfeldt-Jakob Disease (CJD)

“CJD is a rare, degenerative brain disease with no curative treatment and results in rapid progression of dementia, leading suffers to be unable to care for themselves within a short period. In the early stages, along with memory and behavioural issues, there are coordination and eyesight problems. Eventually, people lose the ability to move and speak and then enter into a coma. About 70% of individuals die within one year of diagnosis.”

Guardian Anytime

GP 24/7

GP 24/7 provides clients and their spouse/civil partner/partner and children with access to GPs. Importantly this service is offered throughout the term of the contract regardless of whether a claim is in place or not.

- Available at home or abroad

- No time limit on calls

- No cap on the number of calls

- Available either via phone or video with the ability to message the doctor

- Medication support

Second Medical Opinion Services

All policyholders can get access to a specialist second medical opinion following diagnosis of a serious illness as well as long-term support from a dedicated nurse adviser.

If the policyholder has Children’s Critical Illness Protection, all eligible children are covered too.

- Face to face consultation with a UK specialist

- Discuss concerns about diagnosis or treatment options

- Results in writing sent to the patient and their GP

- Nurse advice and support before and after the consultation

- Help to understand results, deal with the recommendations and come to terms with the outcome

Guardian’s latest videos

Areas for improvement

- Currently do not offer a Business Protection proposition

- Do not offer as wide a range of preventative services which can help clients lead healthier lifestyles pre claim

- As a new entrant not encumbered by legacy systems or a legacy book of business, Guardian have the opportunity to develop their proposition into new areas with more innovative features and we would like to see more done here

Protection Guru has worked with Guardian to create a concise objective analysis of their product range. Guardian have had input to the design of this page and contributed to the cost of this construction maintenance, however Protection Guru have maintained editorial control over the content to ensure objectivity.

Guardian Financial Services Limited is an appointed representative of Scottish Friendly Assurance Society Limited. All products are provided by Scottish Friendly, an insurer with over 150 years’ experience in providing financial products and services.