How much will Income Protection plans pay if you become unemployed?

With the rise of the gig economy and flexible working the status quo of staying in the same 9 to 5 job for most or all of one’s career is becoming a thing of the past. A side effect of this is that there will be greater uncertainty for consumers over the benefits payable on their Income Protection plans. As Income Protection policies are generally underwritten at claim, advisers should consider what benefits their clients could be eligible for should their working status change before a claim.

In a previous insight we explored how some Income Protection plans offer a guaranteed minimum benefit, providing a safeguard should the insured person’s income fall before a claim. However, many providers require that the insured person must be working a minimum number of hours to be eligible for the benefit.

This week we will be exploring how providers assess the benefit payable if, when making a claim, the insured person is unemployed or working less than the minimum hours required to be eligible for the minimum benefit guarantee.

To avoid overcomplicating the matter, the following analysis does not consider the standard deductions that would apply to any benefits paid (e.g. if the insured person received benefits from other related insurance policies).

Working Less than the Hours Required

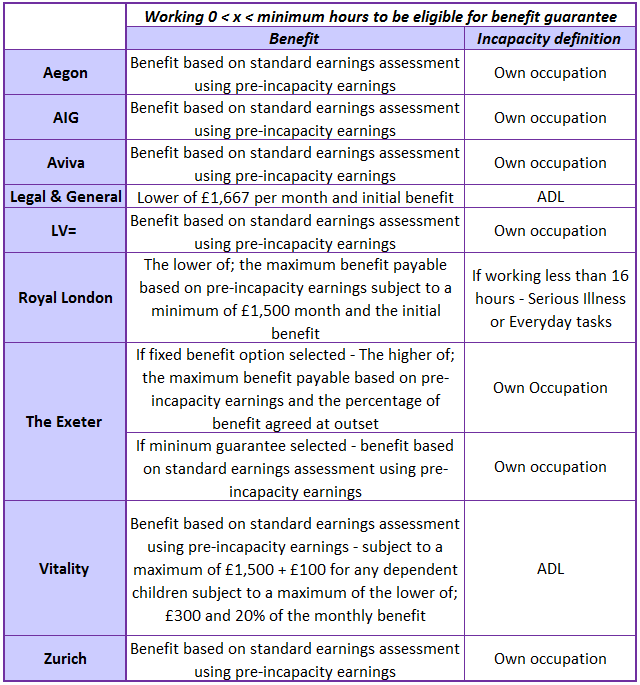

In this situation most providers will calculate the maximum benefit payable based on their standard earnings assessment* using the insured person’s pre-incapacity earnings. The definition of incapacity used by these providers to assess the validity of a claim will be the one defined when the plan was set up. Vitality are an exception to this as they use their activities of daily living definition. They will also increase the benefit if the insured person has dependent children.

Some providers, however, take a different approach to calculating the benefit payable.

Legal & General will pay the lesser of; the initial benefit amount and £1,667 per month, but only if the insured person meets their activities of daily living definition of incapacity.

For clients who hold a plan with The Exeter and have selected the fixed benefit option there is no minimum required hours to be eligible for the benefit guaranteed under the option (so long as the insured person has not become unemployed at any point before claim).

Equally, Royal London will provide their minimum benefit guarantee regardless of the number of hours the insured person is working. However, if the insured person is unemployed or working less than 16 hours a week they will need to meet Royal London’s serious illness or everyday tasks definition of incapacity for the benefit to be paid.

The maximum benefit term providers will assign to these benefits will generally equal the remaining term of the plan.

The table below summarises the different approaches taken by providers to paying benefits if the insured person is working but is not eligible for the minimum benefit guarantee at claim. The table below assumes no deductions are applicable and the definition of incapacity applied to the plan is own occupation.

Unemployed

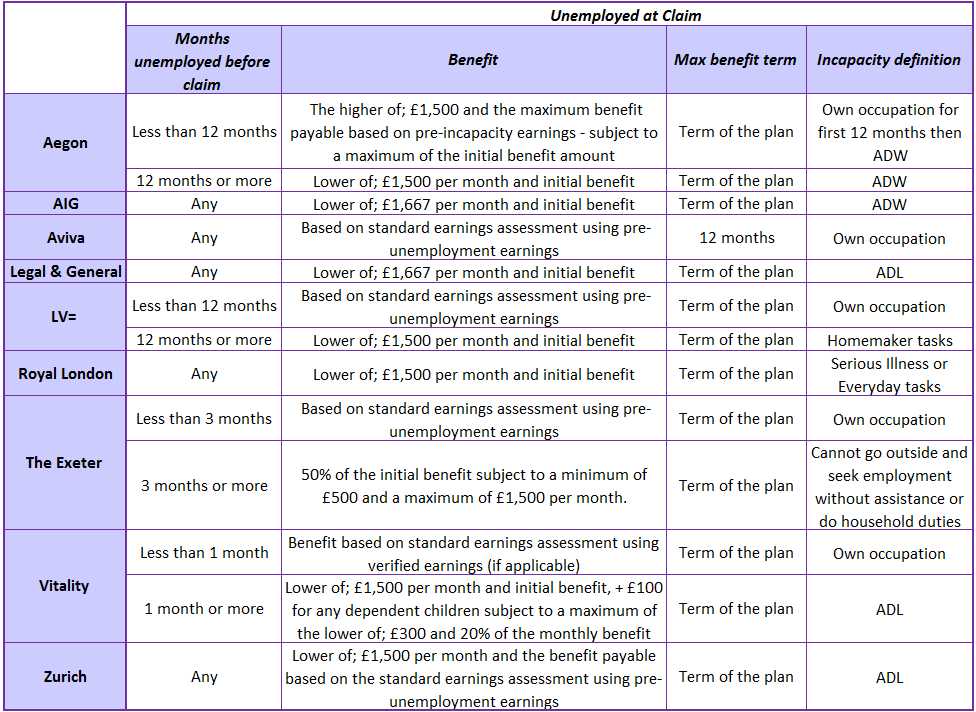

If the insured person is unemployed at claim, the benefit payable may differ depending on how long they have been unemployed for. This is case for the plans offered by; Aegon, Aviva, LV=, The Exeter and Vitality.

Advisers should be aware that if the nature of the insured person’s work often results periods of unemployment (e.g. contractors) then some providers may still assess the individual as employed. In addition, some providers offer maternity, paternity and adoption leave cover which offers a different benefit if the insured person is unemployed due to taking relevant leave.

The table below summarises the different approaches taken by providers to paying benefits if the insured person is unemployed at claim. Again, this assumes no deductions are applicable and the definition of incapacity applied to the plan is own occupation.

Where a client has been unemployed for a short period (often less than one month) some insurers may use discretion and provide benefits based on the clients employed income.

In summary, if a client is unemployed or working minimal hours at claim the benefits payable can vary significantly between providers. It is therefore important for advisers to understand a client’s future career plans, such as whether they are likely to take a career break, and to regularly review their cover to ensure that the product is and remains suitable.

LV= seem particularly strong for clients who are unemployed for up to 12 months by offering benefits based on their pre-unemployment earnings. The Exeter’s fixed benefit option offers far more guarantees of income if a client works minimal hours.

*standard earnings assessment = benefit calculation giving the lower of; the initial benefit and the maximum benefit amount available based on the insured person’s earnings over a given period.

0 Comments