Guardian Life Protection showcase Page

Adviser website – https://adviser.guardian1821.co.uk/

General enquiries – 0808 133 1821 Email

Claims – 0808 173 1821

For a personal introduction to Guardian, email [email protected] and one of Guardian’s Account Managers will call you back.

See Guardian’s main showcase page here

Protection Guru has worked with Guardian to create a concise objective analysis of their product range.

Guardian’s life protection proposition in their own words

Because every one of your clients is different (with different protection needs), we’ve made our Life Protection different too. It comes with a range of benefits designed to make the perfect foundation to every policy.

When we were designing our proposition our challenge to typical protection policy design didn’t stop at our critical illness cover. We looked at all situations customers with life cover could find themselves in throughout the term of their policy and looked to see if we could do ‘better’.

Firstly, and what makes our Life Protection really stand-out is our approach to terminal illness. Read the full details below. This market-leading approach to terminal illness means we pay out on diagnosis of certain terminal conditions, rather than imposing the typical 12-months-to-live prognosis of other providers.

What’s also unique to Guardian is that you can add our optional Children’s Critical illness Protection to an adult’s Life Protection policy. So, for those parents who can’t get or can’t afford their own cover, they can still protect their children.

Thank you to Protection Guru for our showcase page focusing on our Life Protection in more detail. This provides an independent view, and should help you understand the features that make our Life Protection different.

Terminal Illness

Guardian’s terminal illness wording is market leading. Like all others, they will pay the full sum assured if the client is diagnosed with a condition that has resulted in a prognosis of less than 12 months to live. It is now standard across the industry for such terminal illness claims to be paid at any point during the policy regardless of whether the 12 months’ life expectancy extends beyond the end of the policy.

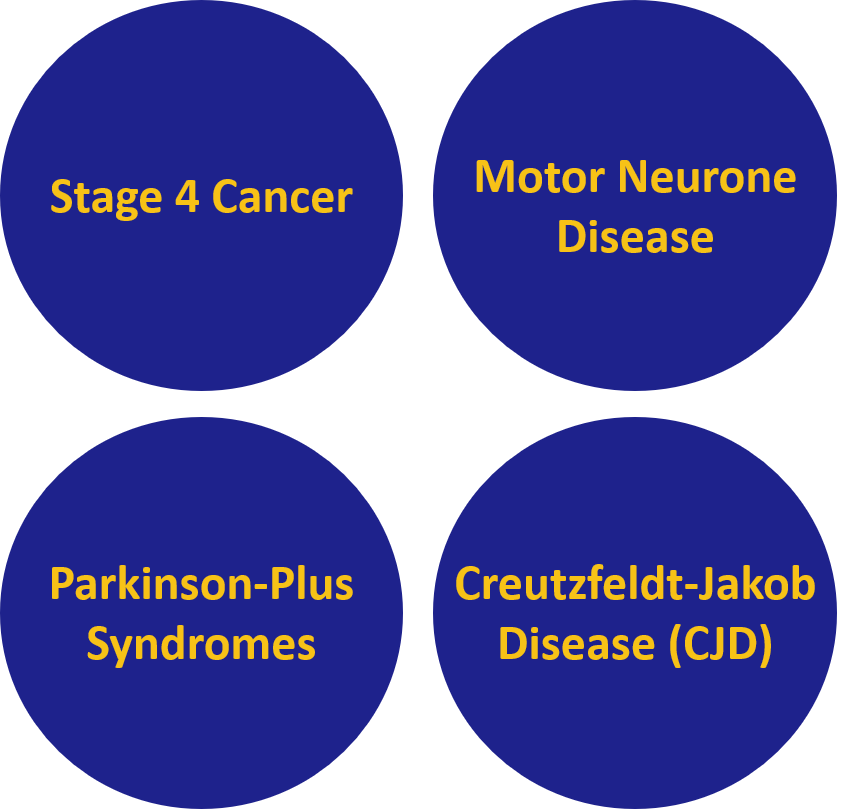

In addition to this however, Guardian will also pay a claim if the client is diagnosed with one of four conditions that are likely to have no cure and tend to progress at a steady rate towards death. Our independent panel of doctors describe these conditions and the prognosis below:

“Motor neurone disease (MND) is regarded as a devastating neurological condition, which usually follows a relentlessly progressive deterioration in the muscles of the limbs, spine and those involved with swallowing and breathing. This often results in death through lung failure and pneumonia from aspirating food and liquid from swallow issues. The disease can still be highly variable in terms of symptoms and time course. The most common form of MND, has a median survival of 3-5 years from diagnosis, although it is reported that 10% can survive up to 10 years.

“Parkinson-plus syndromes is another neurological disorder which does not respond to treatment and has a poor prognosis. They are often associated with early onset dementia, significant disability and confinement to bed or wheelchair is typically necessary late in the disease.

“CJD is a rare, degenerative brain disease with no curative treatment and results in rapid progression of dementia, leading suffers to be unable to care for themselves within a short period. In the early stages, along with memory and behavioural issues, there are coordination and eyesight problems. Eventually, people lose the ability to move and speak and then enter into a coma. About 70% of individuals die within one year of diagnosis.”

Mortgage Guarantee

Where cover is being taken out to protect a mortgage, Guardian do not require the adviser/client to select a specific interest rate at which the plan will decrease by. Where other plans require this they will guarantee to repay the mortgage as long as interest rates do not increase above the rate selected and as such selecting a lower interest rate will result in cheaper premiums.

With Guardian, if cover is taken out to protect a mortgage, the sum assured of the plan will decrease in line with the capital amount outstanding on a repayment mortgage paying interest at 5% per annum. The mortgage guarantee will automatically be included. This guarantees to pay out the value of the mortgage outstanding at the time of the claim regardless of whether this is higher than the sum assured at that point, as long as the amount and term is the same as when the policy started and it is not in arrears at the time of claim. If the mortgage is increased and the client exercises the mortgage increase guaranteed insurability to increase the cover in line with this then the mortgage guarantee will still be in place.

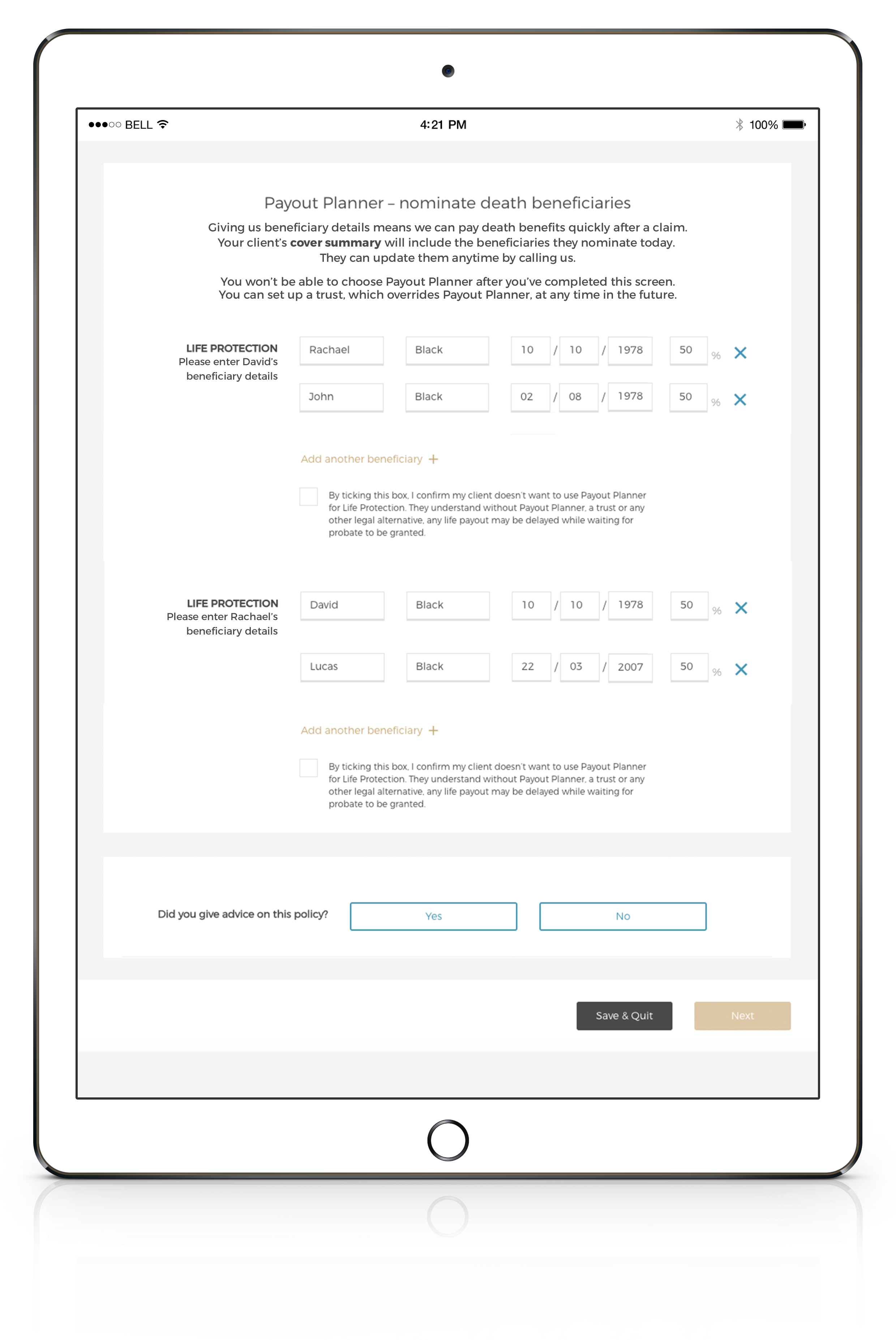

Payout Planner

Payout Planner is Guardian’s quick and simple alternative to trusts, designed to avoid probate for people with less complicated estates. It is set up during the application process by simply providing the names and dates of birth of the beneficiaries and the percentage split of the proceeds they are to receive (these can be changed at any time), and if there is a claim, Guardian will pay the beneficiaries directly.

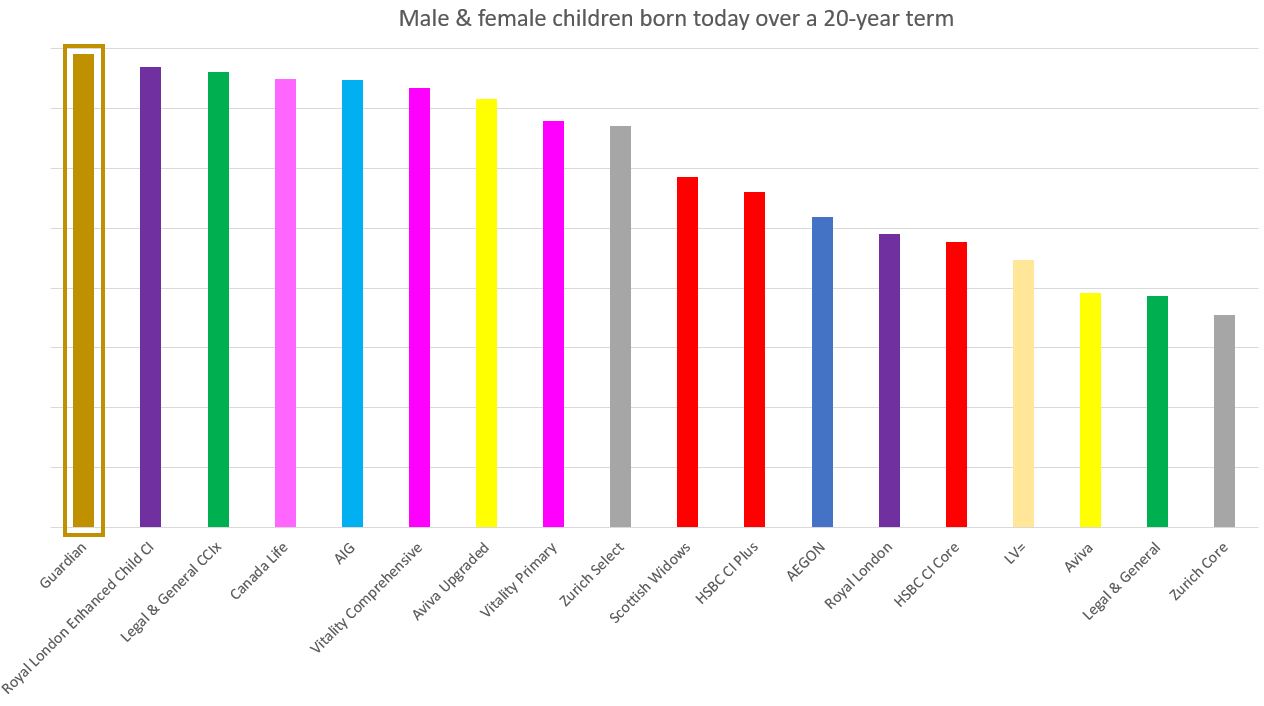

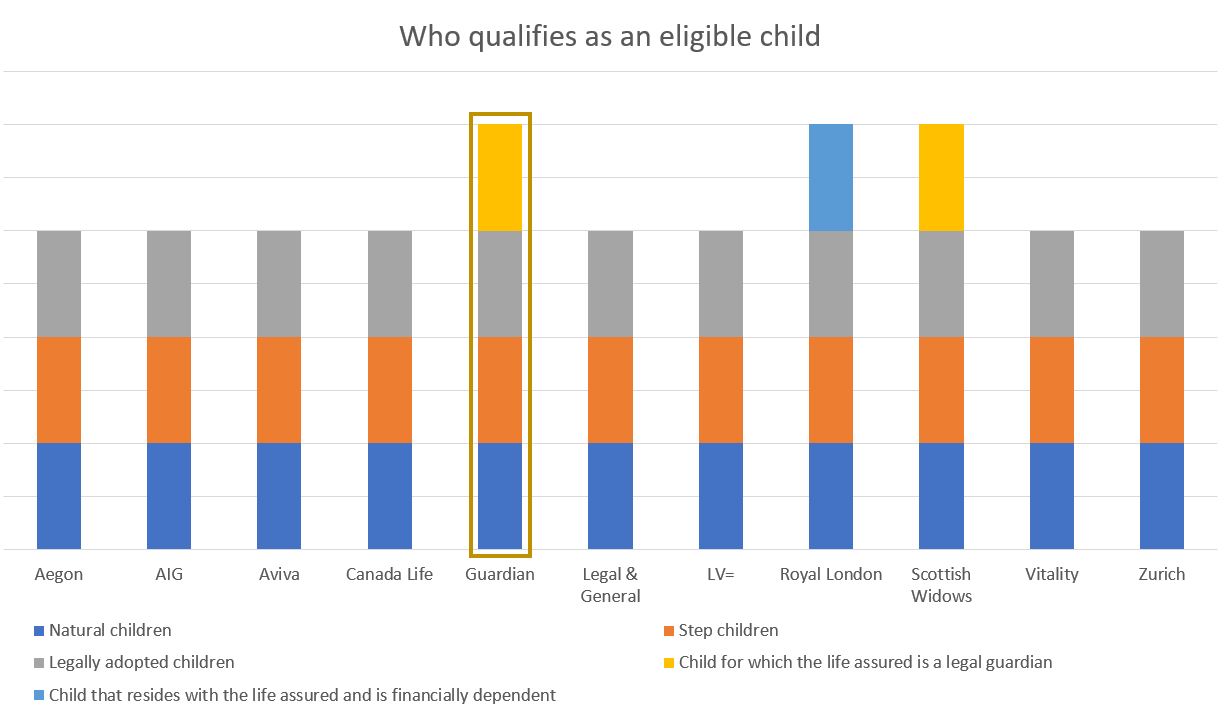

Optional children’s critical illness protection

As Guardian offer children’s critical illness cover essentially as a standalone policy, clients taking out life cover have the ability to add children’s critical illness without critical illness cover for themselves. This could be particularly useful for clients that do not want critical illness cover themselves, might not be able to afford their own cover or have cover through work and want to ensure that some cover is in place for their children.

Children’s cover can be added or removed at any time and as such advisers are able to tailor the protection offering to the clients’ current and future situation and ensure that they are not paying for something that they can no longer claim for. Clients can choose the amount of children’s critical illness cover from £10,000 to £100,000 up to the amount of the parents sum assured.

Areas for improvement

- We would like to see Guardian extend who they offer guaranteed insurability options to further so that more people that have been rated can use these. Currently this is offered to all clients with a rating of +100% or less.

- As a new challenger, Guardian do not have a history of claims that other insurers can provide and as such it is difficult for them to produce claims statistics. We would however like to see more claims stories or information on claims that have been paid to date

Protection Guru has worked with Guardian to create a concise objective analysis of their product range. Guardian have had input to the design of this page and contributed to the cost of this construction maintenance, however Protection Guru have maintained editorial control over the content to ensure objectivity.

Guardian Financial Services Limited is an appointed representative of Scottish Friendly Assurance Society Limited. All products are provided by Scottish Friendly, an insurer with over 150 years’ experience in providing financial products and services.