Claims Statistics and stories-Everything you need to know

In reading this and the linked articles you will understand:

- The stories behind the claims statistics

- How insurers compare in what support they offer to claimants

- How you can use claims information in conversation with clients

Claiming on a protection insurance policy is something any of us hope a client never has to do, but is the ultimate reason that advisers recommend the cover in the first place. When a claim does arise it is the true test of the quality of the advice, product recommendation and the insurer themselves. Advisers may turn to past claims experience when recommending a particular insurer’s product to their client, whilst claims data and stories can be a helpful tool in demonstrating the importance and value of protection insurance to consumers. There is still unfortunately a lack of trust amongst some consumers when it comes to insurers paying claims, however the drive for ever greater transparency and the publication of detailed claims data can help to improve this. Increasingly insurers are providing not only the main headline statistics, but information on claims relating to additional benefits and support services. There have been efforts to also publish more claims stories and case studies, which can be especially hard-hitting. In this ‘everything you need to know’ we bring together some of our recent insight articles on the subject of claims.

PROJECT TEDDY – HOW AVIVA HAVE BEEN SUPPORTING THE CHILDREN OF CLIENTS

Having to claim on a critical illness policy must be hard at any time. If the claim is due to a condition that your child is suffering then one can only imagine the anguish the parent is going through. If your child is in pain, just being able to see them smile, if only for a little while, would make a massive difference. Whilst the money received from a critical illness policy in such circumstances will always be gratefully received it is often the little and unexpected touches that make a real difference. Aviva’s Project Teddy initiative was designed for this exact reason and in this article we looked at how this has given a short but welcome distraction to many families over the last year.

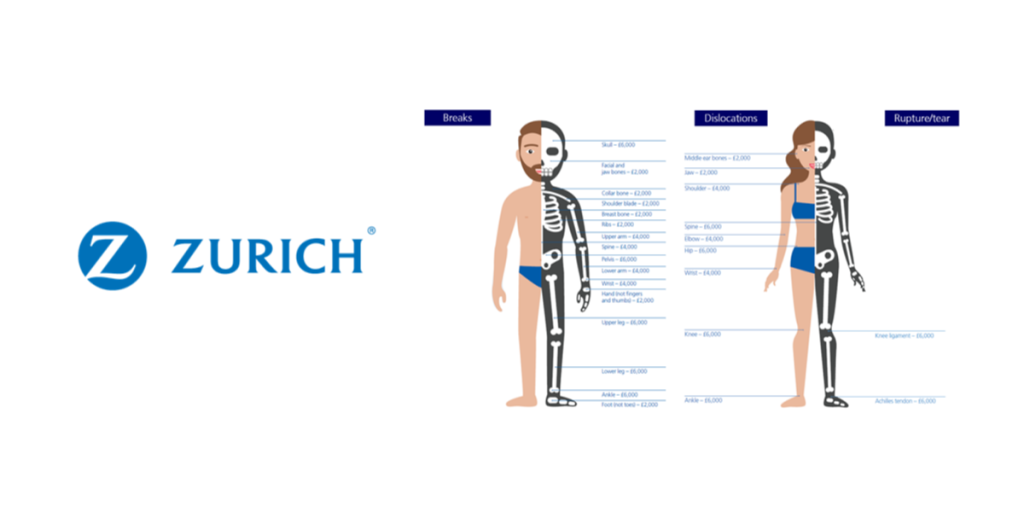

ZURICH’S CLAIMS STATS HIGHLIGHT FRACTURE COVER IS NOT JUST FOR ACTIVE CLIENTS

A broken bone or ligament tear can have severe implications on our ability to carry out day to day tasks. It is also something that is not unfamiliar as it is not uncommon to pass someone on the street in a cast (when we could pass people on the street) or see someone stretchered off a sporting pitch with a brace on TV. With many sporting injuries (and particularly football) being high profile it is perhaps understandable that many advisers would focus more on younger, more active clients when discussing fracture cover. Zurich’s record number of fracture claims in 2020 however, highlights that perhaps we should be widening these discussions to those that are not as active. In this article we explored in more detail what fracture cover claims Zurich paid and events that led to those claims.

SUPPORT DURING CLAIMS – HOW PROVIDERS COMPARE

There is a lot at stake when a client needs to make a claim. That ‘what if’ scenario that their adviser was talking about when they were sold the policy has become a reality. They are unable to work and they need the policy to do its job.

It means insurers need to step up and fulfil what was promised – professionally, efficiently and smoothly, so as not to cause the client any additional distress or aggravation. Not only does an insurer’s reputation rest on getting the claims experience right, the client’s faith in protection is on the line every time they make a claim. Their experience, for good or bad, will also reflect on the client’s relationship with the adviser that instigated their protection journey. This insight looked at how providers support clients through the claims process to ensure their experience is a good one.

THE STORIES BEHIND INCOME PROTECTION CLAIMS

Income Protection provides far more than just financial support to those that are unable to work due to injury or ill health. Within this page we have brought together a selection of videos that explore the impact that having income protection has had on a number of clients and some of the families supported by the 7 Families initiative.

THE STORIES BEHIND CRITICAL ILLNESS CLAIMS

It is well publicised that consumers have a misconception that the protection industry does not pay claims. All insurers now publish their claims paid stats that highlight claims paid are often well in excess of 90% and this data is freely available for advisers to pass on to their clients. Whilst this can help build consumer confidence it only tells part of the story and nothing quite highlights the importance of protection like a real-life example of a client benefiting from their protection plan. Many insurers now release case studies on their websites which tell the stories of claimants, how their scenario has affected them and their family and how having protection has benefitted them. We have brought together a collection of case studies from across the market telling such stories.