Zurich Income Protection Showcase Page

Zurich Intermediary Website

Main showcase

Critical Illness showcase

Children’s Critical Illness showcase

Protection Guru has worked with Zurich to create a concise objective analysis of their Income Protection products.

CORE FEATURES

PHYSICAL REHAB

MENTAL REHAB

LINKED CLAIMS

CAREER BREAK

EXTRA BENEFITS

Zurich in their own words

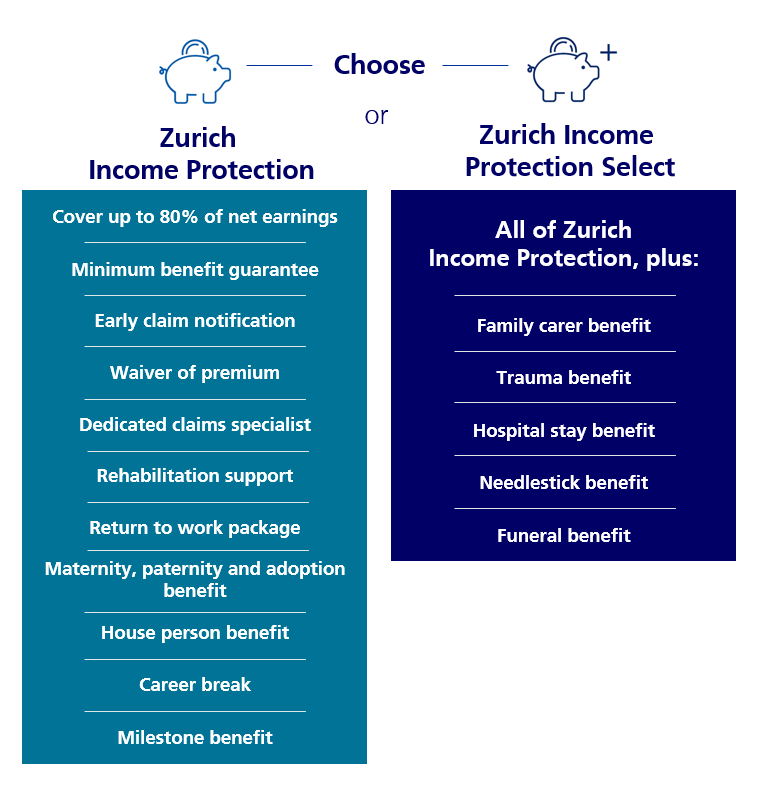

Zurich Income Protection will provide your clients with a monthly income when they’re too ill or injured to work. Zurich offer two comprehensive levels of cover, Core and Select, enabling you to tailor cover to the needs of each client. During the term, cover can be increased or decreased, deferred periods can be altered, clients can change between limited and full payment term (or vice versa) and Multi-Fracture Cover can be added at outset and removed at any time. Alongside a wide range of benefits, Zurich offer rehabilitation services provided by a team of professional nurses, mental health specialists and physios to help your clients get better.

FEATURES FOR DIFFERENT DEMOGRAPHICS OF CLIENT

When recommending income protection, it is important that the needs of each individual client are recognised. Whether the client has budget constraints, wants to start or increase their family or have a specific sick pay scheme their income protection plan needs to be able to adapt.

full term or short term

Although a full term benefit payment period is always preferable, this may not be affordable for all clients. As well as a full term benefit option, Zurich also provide a 2-year benefit payment period to help advisers protect those with less disposible income.

maternity, paternity & adoption.

For clients that are on maternity, paternity or adoption leave, if they become ill during that time Zurich will base their benefit payments on the clients net earnings in the 12 months prior to taking leave.

Net income

Zurich base the maximum allowable benefit on NET earnings, which is beneficial for those on low to mid incomes and easier for clients to understand. Zurich will cover up to 80% of a client’s net income, up to a maximum benefit of £20,000 per month.

flexible defer periods

Being able to match a client’s sick pay scheme is vital to ensure that there is no period where they are out of pocket. Zurich offer a wide range of single and dual deferred period options that can be easily change if the client changes employer.

Waiver of Premium

Zurich will stop collecting premiums 13 weeks from the date of incapacity or at the end of the deferred period, whichever is earlier. If the client agrees to the steps recommended by the Zurich claims specialist, Zurich will waive premiums from point of claim notification.

Doctors and surgeons

Doctors and surgeons that work for the NHS have a tiered sick pay scheme. To help ensure that such clients are covered from the moment their income reduces, Zurich provide sick pay matching plus an increased minimum benefit guarantee of £3,000 per month.

SUPPORT TO HELP YOUR CLIENTS RETURN AND STAY IN WORK

PHYSICAL REHABILITATION

Zurich have a team of rehabilitation nurses and physiotherapists who will work with the client’s doctors to arrange treatment. If Zurich do not have the specific specialism required to support the client’s condition, then they may pay for private treatment.

Key benefits:

- Bespoke physical rehabilitation available at point of claim

- Provides occupational therapy, physiotherapy, complimentary therapies and talking therapies

- No limit to the use of these services

MENTAL REHABILITATION

Zurich also have a team of mental health specialists that can work with the client where their mental health is suffering. Again where a client requires a specific treatment not available within the Zurich team, they may source and pay for this privately.

Key benefits

- Bespoke mental health rehabilitation available at point of claim (Mental health support also available at any point during the term of the plan via Zurich Support Services)

- Can be accessed face to face, via telephone, email and online

- Full costs of the service are covered

PROPORTIONATE BENEFITS

When returning to work on a limited capacity, it is likely that a client will not be earning the level of income they received before their incapacity. To ensure that the client is not financially impacted in such a scenario, Zurich will continue to pay a reduced income in line with the difference between the pre and post incapacity earnings.

Key benefits

- Will be paid if income is reduced due to a limited return to work, starting a different lower paid occupation or a phased return to work

- The effect of inflation on income from date of initial incapacity to the return to work is taken into account when calculating the proportionate benefit

- Proportionate benefits will be paid for up to 24 months if the client returns to the same occupation but on reduced hours. If the client returns to a different occupation there is no limit on the length of time proportionate benefits will be paid for

linked claims

For some clients who return to work, whatever it was that forced them out of work in the first place could return or flare up again, resulting in them having to take another period of time out of work and once again claim on their policy. Insurers refer to this scenario as a linked claim and in the case of Zurich, they’ll waive the deferred period for any linked claim that occurs within 12 months of the previous claim ending.

Key benefits

- Clients will not have to wait for their deferred period to end, if they return to work and are then forced to claim again because of a re-occurrence of the same condition that resulted in the previous claim.

- Zurich’s 12 month period in which the deferred period will be waived for a linked claim is more generous than some insurers, who will only waive the defer period for linked claims occurring within 6 months of the previous claim ending.

career break option

With more people no longer following a linear career path, there are times when a client may need to pause their cover because they’re taking a break from work, perhaps to re-train or travel. Zurich’s career break option gives clients the flexibility to temporarily reduce their cover and pay as little as the £5 p/m minimum premium, without having to cancel their policy.

How does it work?

Clients taking a break from work or who need to temporarily reduce their cover for some other reason, can reduce their monthly benefit to as little as £250 p/m (subject to a £5 p/m minimum premium). When the career break ends, their cover and premiums will automatically revert back to the previous levels, with no new underwriting questions.

How long for?

Clients can reduce their cover for up to 52 weeks, once during the term of their policy. If the client returns to work before the end of the 52 week period, they can end the career break at any time if they need to.

extra payments TO PROVIDE ADDED SUPPORT WHEN SOMETHING BAD HAPPENS

At the heart of any income protection plan is the monthly benefit it will provide if a client is ill or injured and unable to work. There are many situations however where this may still not be enough. Zurich provide a range of features within the Select Income Protection plan, to provide additional financial support should the worst happen.

All of the benefits listed below are paid in addition to the monthly benefit

Carer Benefit

Zurich will pay a benefit of the lower of the monthly benefit or £1,500 per month for up to 12 months, where a spouse, civil partner or child of the life assured is unable to perform at least three activities of daily living for at least three months.

Hospitalisation benefit

Where a client is hospitalised as a result of illness or injury for 7 consecutive nights or more, Zurich will pay £100 per night, for up to 90 nights during the policy deferred period. This can provide valuable financial support before the full benefit payments kick in.

trauma benefit

For a number of serious life changing illnesses or injuries – blindness, deafness, loss of hand or foot, loss of speech, paralysis of limb or loss of ability to live independently due to mental failure – Zurich will make an extra payment of the lesser of 6x monthly benefit or £50,000.

death benefit

If the life assured dies within the term of the plan, regardless of whether a claim is in progress or not, Zurich will pay the lesser of six times the monthly benefit or £10,000, to help their family with any immediate costs relating to the death.

Needlestick benefit

If the client is accidentally infected with HIV, Hepatitis B or Hepatitis C (and meets their strict criteria) whilst performing their normal duties of employment (such as a doctor or nurse), Zurich will pay the lower of six times the monthly benefit or £50,000.

Areas for improvement

- Using NET income when calculating the maximum benefit means that Zurich will provide a lower maximum sum assured for high income earners (income in excess of £100,000 p.a.) compared to others

- Could extend their doctors and surgeons benefits to other NHS staff

- Do not provide a terminal illness benefit

Protection Guru has worked with Zurich to create a concise objective analysis of their product range. Zurich have had input to the design of this page and contributed to the cost of the construction and maintenance, however Protection Guru have maintained editorial control over the content to ensure objectivity.