AIG Critical Illness Showcase Page

Protection Consultants: <[email protected]> <0345 600 6829>

Pre-Sales Underwriting: <0345 600 6812>

Customer Services Team: <[email protected]> <0345 600 6820>

AIG in their own words

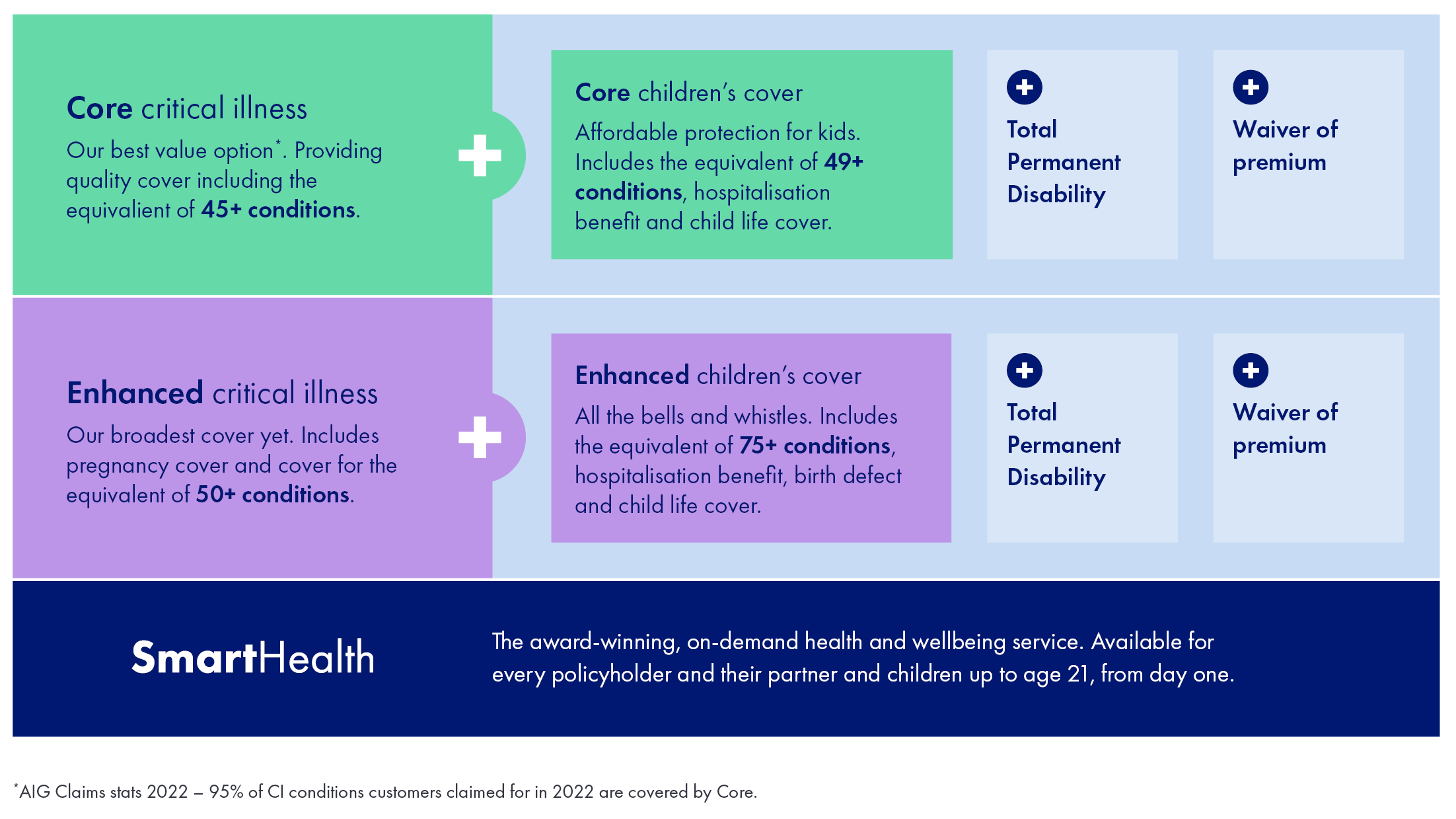

We’re about customers, not just a long list of conditions. That’s why our insurance is flexible, so you can personalise protection for your client, their family and their budget. For the main cover, we offer two options to suit your clients’ needs: Core critical illness cover and Enhanced critical illness cover.

Your clients kids’ health is their top priority. We know that. And our children’s cover is no different. It focusses on the conditions that children are most likely to suffer from, and covers any child up until the age of 22. It’s important for parents to protect their kids, whatever their budget. So, as with the main cover, there are Core and Enhanced levels (depending on the main cover chosen), which both include hospitalisation benefit and child life cover.

The product has the grouped conditions you’ll be familiar with – simple to explain and easy to understand, but we’ve also consolidated over 20 conditions into four impact-based groupings. By focusing on specific surgeries or the impact on daily life, not the name of a condition, it makes for fairer customer outcomes. If the impact is the same, customers will be covered – whatever the name of the condition.

The ability to tailor cover to clients’ needs

AIG’s approach to critical illness enables advisers to tailor cover to suit each client’s needs. For those with budget constraints, core critical illness cover provides a lower cost option. For those wanting comprehensive cover, enhanced critical illness cover can be added to provide our broadest cover ever, with all the bells and whistles.

Smart Health is provided to AIG Life Limited customers by Teladoc Health. We want to let you know that these services are non-contractual, which means they don’t form part of the insurance contract with us. If our partnership with Teladoc Health ends, these services could be changed or withdrawn in the future.

COVERING THE IMPACT, NOT THE CAUSE

The whole idea behind grouped conditions is to make critical illness cover simple. Whilst providing cover for a wide range of conditions is clearly beneficial, having the largest number of definitions does not reflect the broadest coverage. So, AIG have included grouped conditions you’ll be familiar with – easy to explain and even easier for your client to understand what they’re covered for. By focusing on specific surgeries or the impact on daily life, not the name of a condition, your client is more likely to be covered – whatever the name of the illness.

DEGENERATIVE NEUROLOGICAL DISORDERS

Covering the impacts commonly seen in conditions such as Alzheimer’s disease, dementia, CJD, motor neurone disease, Parkinson’s disease, Parkinson’s plus any other neurological condition that meets our criteria.

REDUCED HEART FUNCTION

Covering the impacts commonly seen in conditions such as cardiomyopathy, pulmonary hypertension plus any other cardiac condition that meets our criteria.

SURGERY TO THE HEART, AORTA OR PULMONARY ARTERY

Covering surgeries such as aorta graft surgery, cardiac arrest, cardiomyopathy, coronary artery bypass grafts, heart surgery, heart valve replacement or repair, pulmonary artery replacement, plus any other condition that results in the specified surgeries.

SURGERY VIA THE SKULL

Covering the common surgeries used to treat cerebral or spinal arteriovenous malformation or aneurysms, pituitary gland tumours, brain abscess, drug resistant epilepsy, plus any other condition that results in the specified surgery.

WHAT OUR DOCTORS SAY :

AIG’s approach to grouped definitions has a number of advantages to consumers. Firstly, this avoids unnecessary overlap of conditions and is a refreshing move away from the “condition race” whereby insurers claim to cover ever increasing numbers of illnesses, despite many being covered in other wordings and providing no additional benefit. This is generally misleading and results in complex policies and confusion amongst advisers and policy holders.

Secondly, it allows the coverage to be broader as it is not focusing on a specific disease. AIG have managed to maintain coverage of all previous conditions covered in today’s market, but would also allow claims for other diseases. The risk with providing specific disease wordings is that rarer conditions, despite causing a similar burden of disease and impact to life, may end up “slipping through the net” and not result in a payment. AIG’s new grouped wordings, provide an additional safety net and appears a fairer approach to providing cover.”

FUTURE PROOFING COVER

AIG have also worked extremely hard to add in as much future proofing to their new critical illness wordings as possible. In doing so they have allowed for future advancements, breakthroughs in treatment and potentially new diseases as our doctors explain.

WHAT OUR DOCTORS SAY :

By providing cover related to the impact of a disease, instead of at diagnosis, this provides future proofing of the policy. Advancements and breakthroughs in treatment and management are occurring frequently in modern medicine. This has the potential to quickly change the face of what is considered a critical illness. It is easy to appreciate this when you consider the vast changes in mortality and morbidity of many illnesses even in the last 20 years. These safeguards are important to keep this type of insurance viable, as it is not sustainable to make frequent large payments for an illness that has little burden on an individual. An example, in AIG’s policy is the addition of “expected to progress throughout the life of the person”, in the degenerative neurological disorders. There are already some encouraging treatment advancements in certain genetic neuromuscular disorders, through the use of gene replacement therapy. This could potentially provide a cure or prevent this becoming a progressive illness in years to come.

Children’s cover designed for children

AIG have made it easy for parents or parents to be to add child cover. They offer both core children’s cover and enhanced children’s cover, with both including hospitalisation benefit and cover for any child, up until the age of 22. The child cover option available depends on the adult level chosen.

Core children’s cover

The core children’s cover is split into four types of benefit:

Group 1 conditions – £25,000 or 50% of the sum assured, whichever is lower, will be paid out

Group 2 conditions – £25,000 or 25% of the sum assured, whichever is lower, will be paid out

Child life cover – £5,000 will be paid out

Hospitalisation benefit – £100 per night from the seventh consecutive night, up to a maximum of 30 nights

AIG will pay one claim under each Group per child, at which point the children’s critical illness cover ends for that child.

Enhanced children’s cover

The enhanced children’s cover is split into five types of benefit:

Group 1 conditions – £50,000 or 50% of the sum assured, whichever is lower, will be paid out

Group 2 conditions – £25,000 or 25% of the sum assured, whichever is lower, will be paid out

Child life cover – £10,000 will be paid out

Birth defect cover – £5,000 will be paid out

Hospitalisation benefit – £100 per night from the seventh consecutive night, up to a maximum of 30 nights

AIG will pay one claim under each Group per child, at which point the children’s critical illness cover ends for that child.

Birth defects coverage

Whilst providing excellent coverage for the traditional “congenital” conditions such as cerebral palsy, Down’s Syndrome and muscular dystrophy, AIG also cover four birth defects. These provide cover for conditions that although not life threatening, will often require surgery to correct and as such will be a tough period for both the child and parents.

Our doctors explain the conditions in more detail below:

CLEFTS

Cleft palate and cleft lip, which is a gap or split in the upper roof of the mouth or lip, present at birth. It affects 150 per 100,000 births in the UK currently. This requires surgery, usually in the first year of life, with difficulties in feeding, hearing, speech and dental problems leading up to this point. The infant usually needs a long term care plan and can cause immense disruption and distress in this early period of life. AIG cover both cleft lip and cleft palate where there is surgery to repair the defect.

CONGENITAL TALIPES

A baby is born with their ankles pointing downwards and the feet pointing inwards. If this is not corrected, the soles of the foot will not be able to be placed flat on the ground when they start to walk, causing mobility issues. This is a common problem and affects 1 in 1000 babies born in the UK. It is treated with the Ponseti Method, which is a combination of manipulation and casting, that is changed on a regular basis to bring the feet back into alignment. AIG will cover all cases where the Ponseti Method is used. This will cover the vast majority of cases, as research has shown that this gives better results than surgery and is the preferred first line treatment method.

DEVELOPMENTAL DYSPLASIA OF THE HIP

DDH is a condition where the hip joint does not form properly and the ball part of the thigh bone does not fit correctly into the socket of the pelvis. 1-2 in 1,000 babies have DDH that requires treatment and it is more common in females. AIG, will cover this condition if surgery is performed. The first line treatment is a fabric splint that holds the hips in a stable position, known as a Pavlik Harness, and it needs to be worn constantly for several months. Only if this is ineffective, or if this was discovered after 6 months of age, would surgery be needed. Surgery has been reported as around 25 per 100,000 in females and 5 per 100,000 in males in the first year of life. Incidence rates drop drastically after this and is rarely performed after 4 years of age.

Most claimed for conditions

Adult Critical Illness |

Children’s Critical Illness |

Cancer – 65% |

Diabetes Mellitus Type 1 – 27% |

Heart Attack – 12% |

Cancer – 22% |

Stroke 6% |

Children’s death benefit – 11% |

Multiple Sclerosis – 2% |

Cerebral Palsy – 11% |

Parkinson’s Disease – 2% |

Down’s Syndrome – 11% |