Protection Guru has worked with LV= to create a concise objective analysis of their product range.

LV= in their own words

“Many are unprepared for the life changing nature of a serious illness and the impacts this could have on their finances, emotional wellbeing, overall lifestyle and importantly, their family.

We offer a range of Life and Critical options designed to meet your client’s different needs and lifestyles. Whether your client is budget conscious or after added peace of mind, we provide an option to protect your client in those life-changing events. You can select our Life and Critical Illness cover which provides flexibility for your client to add our Enhanced children’s cover at outset or later (as long as five years remain on the policy before it ends), as well as removing the child’s cover at any time. Or our Life and Enhanced Critical Illness cover, which includes children’s cover as standard, but also has the option to add our Enhanced children’s cover. See more details below.”

Life and Critical Illness Cover

A more affordable option that will cover the most common conditions and more.

- 41 conditions covered in total (if Total Permanent Disability is added).

- Enhanced accident benefit covering 9 conditions.

- Children’s critical illness cover is not included on the policy; your client can opt to add Enhanced Children’s Cover at an added cost

- Access to valuable support through LV= Doctor Services and LV= Member Benefits.

- Option to add Total Permanent Disability condition for an additional cost.

- Take out Waiver of Premium to run alongside your client’s cover.

Life and Enhanced Critical Illness Cover

A more comprehensive cover for your client and their family.

- 87* conditions covered in total (if Total Permanent Disability is added).

- Enhanced payments for 17 conditions.

- Wider coverage for less advanced cancers.

- £1,000 cost of cancer diagnosis payment.

- Children’s Cover or the option to take out Enhanced Children’s Cover for an added cost*

- Access to valuable support through LV= Doctor Services and LV= Member Benefits.

- Option to add Total Permanent Disability condition for an additional cost.

- Take out Waiver of Premium to run alongside your client’s cover.

*20 of these conditions are grouped under 1 additional payment definition – ‘Less advanced cancers’.

Optional enhanced children's cover

Your client can choose to add Enhanced Children’s Cover to their Critical Illness policy for an additional premium. This provides comprehensive cover for your client’s children from birth until their 23rd birthday, giving your client’s peace of mind.

Enhanced Children’s Cover can be added and removed at any time, however once it is removed it cannot be re-added to the policy. Your client must remember to remove it once their child reaches the cap of their 23rd birthday, or they could be paying for cover they can’t benefit from.

Why you should recommend critical illness

Many clients will expect some form of financial detriment but the full impact of suffering from a severe illness are often unexpected. Many clients will also not grasp the emotional impact that suffering from a critical illness will have on them and their family

On average, how worse off are people after being diagnosed with cancer?

How many parents have to take time out of work to take care of a sick child?

Options for many different client profiles

Roll your mouse over or touch an image to find out more

More affordable cover

LV= Life and Critical Illness cover provides essential cover at a more affordable cost. It covers the most claimed for conditions (and more), with 41 conditions covered in total.

Cover for extra peace of mind

Enhanced claim payments

(Automatically included with Life and Enhanced Critical Illness cover only)

We cover your client’s children from birth to their 23rd birthday for 85* conditions, with no survival period requirement and child funeral payments included, one per child.

(Optional for both levels of cover)

Covers children from birth to their 23rd birthday for 95* conditions including 10 child-specific illnesses, cover for 6 pregnancy complications and our Junior Option, which gives the child the option to take our their own critical illness policy with no medical underwriting, if taken out within six months of their 23rd birthday.

Child funeral payments

If an eligible child dies within the term of the plan, LV= will pay £5,000 per child to help with funeral costs. This is included in both the standard and enhanced children’s cover options.

*20 of these conditions are grouped under 1 additional payment definition – ‘Less advanced cancers’

Enhanced claim payments

LV= recognise in these scenarios that your clients are more likely to be impacted long-term or live with these conditions for the rest of their life. The enhanced payments described below are paid on top of the main sum-assured. The added money can provide added peace of mind and can be used towards costs like home adaptions, care costs or for their family’s future.

Life & Critical Illness Cover

LV= will pay an additional enhanced claim payment of 50% of the sum-assured (up to a maximum of £200,000), if it’s the direct result of any of the following:

Enhanced Accident Benefit

Applies to 9 conditions:

- Blindness – permanent and irreversible

- Brain injury due to trauma, anoxia or hypoxia – resulting in permanent symptoms

- Coma – with associated permanent symptoms

- Deafness – permanent and irreversible

- Loss of hand or foot – permanent physical severance

- Loss of speech – permanent and irreversible

- Paralysis of limb – total and irreversible

- Surgical removal of an eyeball

- Third degree burns – covering 20% of the body’s surface area or affecting 20% of the area of the face or head

Life & Enhanced Critical Illness Cover

LV= will pay an additional enhanced claim payment of twice the sum-assured (up to a maximum of £200,000) for the following conditions/scenarios:

Enhanced Accident Benefit

Applies to 10 conditions:

- Blindness – permanent and irreversible

- Brain injury due to trauma, anoxia or hypoxia – resulting in permanent symptoms

- Coma – with associated permanent symptoms

- Deafness – permanent and irreversible

- Loss of hand or foot – permanent physical severance

- Loss of independent existence – unable to look after yourself ever again

- Loss of speech – permanent and irreversible

- Paralysis of limb – total and irreversible

- Surgical removal of an eyeball

- Third degree burns – covering 20% of the body’s surface area or affecting 20% of the area of the face or head

4 Neurological conditions

If the client is diagnosed before the age of 55 with any of the following:

- Alzheimer’s disease or other dementia – resulting in permanent symptoms

- Motor neurone disease and specified diseases of the motor neurones – resulting in permanent symptoms

- Parkinson’s disease – resulting in permanent symptoms

- Parkinson Plus Syndromes – resulting in permanent symptoms

3 Major organ conditions

If the client has any of the following major organ conditions:

- Liver failure

- Major organ transplant – from another donor

- Severe lung disease

Flexible Cover for families

No one wants to ever imagine a life-changing illness or injury happening to a child. Sadly, it does happen. In these moments, knowing there is cover in place can lessen the worry on a parent who is in this incredibly difficult situation.

Children’s critical illness cover works in the same way as the main benefit, paying a lump sum on the diagnosis of one of the listed conditions covered.

- Life & Enhanced Critical Illness Cover

- Life & Critical Illness Cover

- Optional Enhanced Children's Cover

Standard Children’s Cover is included at no extra cost, with the option to upgrade to Enhanced Children’s Cover at an additional cost.

- Covering children from birth to their 23rd birthday with no requirement to be in full time education.

- 85* conditions covered.

- Enhanced claim payments of up to £50,000 covering accidents and major organ conditions.

- No survival period requirement (unique to LV=).

- Child funeral payment of £5,000

Children’s cover is not included on the policy; your client can opt to add Enhanced Children’s Cover for an additional cost.

Enhanced Children’s Cover can be added to either critical illness policy and could be ideal for clients planning or growing their family.

- Covers 95* conditions including 10 child specific conditions

- £5,000 payment covering 6 pregnancy complications

- Claim payments are up to £35,000 (or £70,000 if both parents have this cover)

- Child funeral payment covering from the 24th week of pregnancy for stillbirths (excluding elective termination) up until their 23rd birthday during the term of the policy

*20 of these conditions are grouped under 1 additional payment definition – ‘Less advanced cancers’.

With all LV=’s Children’s Cover options, children won’t be covered if your client was aware of an increased risk of the condition or they were suffering from symptoms of the condition before the policy started. They also won’t be covered if the condition was a result of self-inflicted injury, the taking of drugs, alcohol or solvent abuse, or if there was unreasonable failure to follow medical advice.

Supporting clients from day 1

True to our philosophy, our Critical Illness cover goes beyond the pure financial. We include emotional and practical support from day one through LV= Doctor Services, LV= member benefits and signposting to Maggie’s, the home of cancer care. We’re here for advisers, clients and members every day, and in the moments that matter most.

LV= Doctor Services

As lives get busier, it can be difficult to keep on top of one’s health. When your client takes out a protection policy with LV=, your client and their spouse or partner* gets immediate access to LV= Doctor Services. This gives them fast and convenient use of six expert medical services in one easy to use app or by phone call:

Roll your mouse over or touch to read more

Remote GP 24/7

Prescription services

Second Opinion

Remote Physiotherapy

Remote Psychological Support

Discounted Health MOTs

LV= Member Care Line

The LV= Member Care Line ensures your client and their family have access to valuable day-to-day support 24/7 and free of charge:

- Health advice from qualified doctors and nurses

- Lifestyle support for general health and wellbeing

- Counselling from qualified counsellors for in the moment support

- 16-23 mental health helpline providing dedicated support for young adults

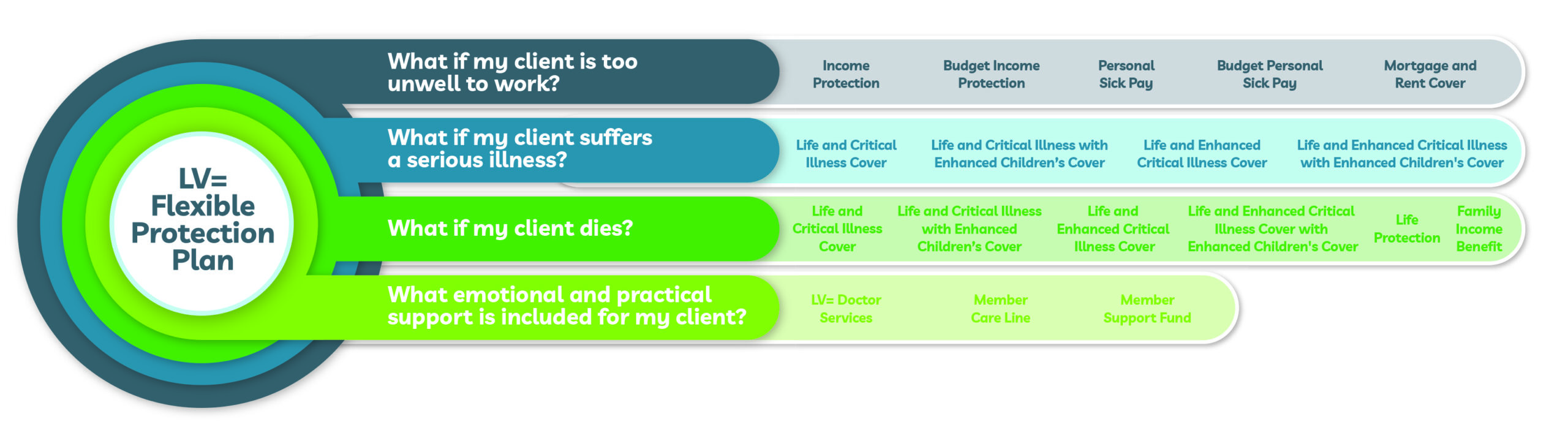

LV= Flexible Protection Plan

These services fit within the LV= Flexible Protection Plan providing clients with cover for a wide range of scenarios, including protecting income and supporting the policyholder and their family through illness, death and everyday life.

Supporting advisers

Tools to support your client conversations

- Risk Reality Calculator provides a personalised report showing the likelihood of income shocks, serious illness and death, so you can talk your client through the real risks they face, creating the need for a menu of protection. (Click here)

- LV= Life and Critical Illness conditions tool simplifying the conditions covered so you can be confident what matters most to customers and their families is protected. (Click here)

Helping get policies on risk

- Pre-underwriting tool allowing you to check pre-existing conditions so you can immediately see if they’ll impact your client’s policy terms. This 24/7 online tool can help you manage your client’s expectations from the start, and can aid your recommendations. (Click here)

- Fastway, LV=’s quote and apply tool provides an online application journey allowing you to submit an application for any of LV=’s products in the Flexible Protection Plan. (Click here)

- LV= Protection Hub to help you track the status of your applications submitted through Fastway. (Click here)

2020 Critical Illness Claims Statistics

LV= paid 92% of all critical illness claims in 2020

Adult Critical Illness |

Children’s Critical Illness |

|

Total value of claims paid |

£28.3m |

£282,500 |

Youngest age of claimant |

26 years old |

Newborn |

Top cause of claims |

Cancer (60%) |

Cancer (38%) |

Second biggest cause of claims |

Heart Attack (10%) |

Benign Brain Tumour (15%) |

Third biggest cause of claims |

Stroke (8%) |

Terminal Illness (15%) |

The main claim statistics tell part of the story, however there are many other benefits within critical illness plans that clients can claim on. Whilst some of these may provide a financial benefit, others provide something more personal by supporting the client either physically or mentally at their time of need.

Event |

Claims paid |

Enhanced claims for diagnosis of neurological conditions at a young age |

In total, LV= have paid £240,000 in addition to the main sum assured since this feature was added |

Enhanced claims for accidents |

In total, LV= have paid over £300,000 in addition to the sum main assured since this feature was added |

Number of calls made to Member Care Line in 2020 |

1,391 |

Number of Green Heart Experiences delivered in 2020 |

28 |

LV=’s Green Heart initiative provides gestures of support when it’s needed the most but expected the least. This includes hampers, vouchers, children’s gifts and financial support to cover hospital parking, flowers and more. Their claim team embrace Green Heart Support and make it part of their everyday, recognising when they can step in and make someone’s day just a little brighter.

Areas for improvement

- Currently do not offer an family income benefit with critical illness

- Children’s funeral cover is lower than some other insurers who provide a £10,000 lump sum

- Only covers natural, step or legally adopted children whereas some other insurers have extended this to cover children that are financially dependent or where the life assured is a legal guardian

Protection Guru has worked with LV= to create a concise objective analysis of their product range. LV= have had input to the design of this page and contributed to the cost of this construction maintenance, however Protection Guru have maintained editorial control over the content to ensure objectivity.