Website

Contact details

Protection Guru has worked with Vitality to create a concise objective analysis of their product range.

SERIOUS ILLNESS

INCOME PROTECTION

PREMIUM OPTIONS

CLAIMS STATISTICS

Vitality in their own words

“Our core purpose is to make people healthier and enhance and protect their lives.

We take a unique approach to insurance. As well as offering the highest levels of protection, we also make it easier for your clients to take an active role in maintaining their wellbeing, helping them to understand their health and rewarding them for good lifestyle choices.

Long-term, this is good for your clients, because they enjoy better health and real financial benefits from their plan. It’s good for us, because fewer claims enables us to share the benefits of healthy living with your clients, in the form of better plans and rewards. And it’s good for society, because healthier, happier people enjoy better lives, are more productive at work and rely less on healthcare. It’s what we call Shared value insurance.”

Serious Illness Cover NOT Critical Illness

Serious illness cover has many benefits. It’s severity based payment structure enables Vitality to provide pay outs to clients for far less severe conditions, with the opportunity for multiple claims for the same or separate conditions as the severity of the condition worsens.

- In 2023, Vitality paid out £32.7m in Serious Illness Cover claims*

- 1 in 13 Serious Illness claimants in 2023 had claimed previously*

- 1 in 6 claims Vitality paid in 2023 would not have been covered by a typical core critical illness plan*

*VitalityLife Claims and Benefits Report, June 2024

Serious Illness Cover 1X

- 114 conditions covered with payouts between 25% and 100%

- 62 conditions covered in full plus 19 unique to Vitality

Serious Illness Cover 2x

- 143 conditions covered with payouts between 15% and 100%.

- 74 conditions covered in full plus 35 conditions unique to Vitality.

Serious Illness Cover 3x

- 174 conditions covered with payouts between 5% and 100%.

- 74 conditions covered in full plus 60 conditions unique to Vitality.

- More likely to pay out than any other insurer

The benefits of Serious Illness Cover

Serious illness cover has many benefits over traditional critical illness plans. Hover over the images below to find out more about the key benefits.

Child Serious Illness Cover

Child Serious Illness Cover is an optional benefit which can be added to any Life, Income Protection or Serious Illness Cover plan. It pays out a cash lump sum to help client’s if their child was to suffer a serious illness or accident and they needed to pay for any expected costs, like taking additional time off work.

Vitality have three levels of cover available:

- Child Serious Illness Cover 1X – covers 115 conditions

- Child Serious Illness Cover 2X – covers 144 conditions

- Child Serious Illness Cover 3X – covers 175 conditions

Dementia & Frailcare Cover conversion

All of Vitality’s Serious Illness Cover plans include Dementia and FrailCare Cover conversation as standard – to protect clients in later life and help cover rising care costs. Once their Serious Illness Cover term ends, if there is any remaining cover left – it will be converted to Dementia and FrailCare Cover, as long as they continue to pay their premiums. They won’t need to answer any new health questions and can cancel at any time.

Income Protection

Vitality offer a single all-in-one Income Protection plan, which provides comprehensive cover to clients, whilst having a unique focus on prevention.

Their approach to Income Protection ensures members are protected if they’re unable to work due to injury or illness. Vitality’s product also has unique features designed to support various sectors, from the self-employed to staff within the public sector.

Vitality Income Boost

When a member makes a qualifying claim, Vitality will pay up to an extra 20% of their monthly benefit, on top of their monthly claim payments, for six months. The extra amount a member receives will be based on their Vitality Status pre-claim. In summary, the more a member looks after their health through the Vitality Programme, the more Vitality will boost their monthly payouts.

Recovery benefit

Vitality help members on their way to recovery by giving them access to private healthcare and support, from the moment they make a relevant claim, with no cap on the level of support. Through their Recovery Benefit members will get access to: Physiotherapy, Counselling and Cancer support.

Earnings Guarantee

Vitality’s Earnings Guarantee gives members extra certainty when they need to claim. They’ll automatically guarantee a members benefit amount up to £1,500 per month regardless of their income at point of claim.

To guarantee a members benefit amount for earnings between £1,500 and £8,000, they can verify their income with Vitality within the first six months of the plan.

Premium Options

Vitality offer two premium options on their plan: either a fixed guaranteed premium or Optimiser. The guaranteed premium option is like any other and regardless of whether the client engages with the Vitality programme, their core premium will remain the same for the duration of the plan.

OPTIMISER

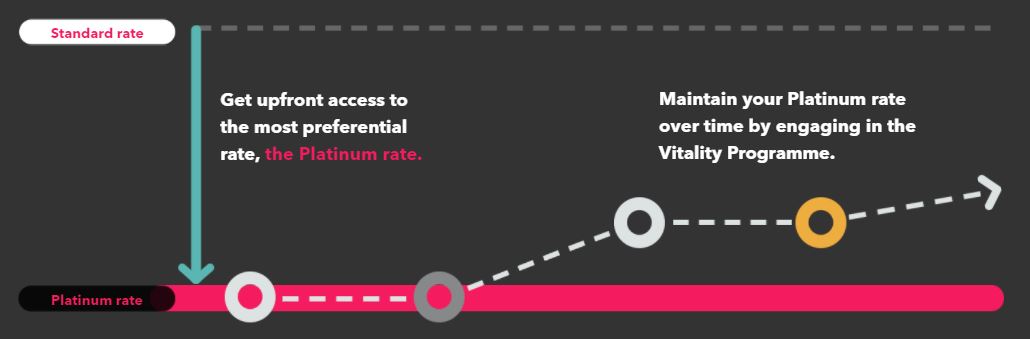

The unique Optimiser available on Vitality’s Personal Protection Plan gives clients access to the best available premium upfront, the Platinum rate, as well as the tools and incentives to help them make good lifestyle choices, in order to maintain their Platinum premium.

How Optimiser works:

Get access to the Platinum rate upfront: up to 30% lower premiums

- The Platinum rate is up to 30% lower than the standard term premium rate and up to 40% lower than the standard whole of life rate.

Maintain the Platinum rate over time

- Premiums are dynamic and change annually based on their Vitality status. Clients can keep premiums low by engaging in the Vitality Programme and maintaining Platinum status. If the client choses not to engage then their premium will increase, but only by a maximum 2.5% each year and they’ll have still had the upfront discount.

Vitality Status |

Stay on Bronze |

Reach Silver |

Reach Gold |

Reach Platinum |

Annual increase |

+2.5% |

+1.5% |

+0.5% |

0% |

The Vitality Programme

Everyone gets access to the Vitality Programme. Members who select Optimiser, and have a premium above £45 for single plans and £60 for joint life plans will automatically unlock Vitality’s full range of discounts and rewards, Vitality Plus, at an additional £4.75 per month, per member.

Vitality makes it cheaper and easier to get healthy through discounts and motivating rewards. There are lots of different ways to earn points, from completing annual health checks to activity tracking. Even going to the dentist or completing mindful activities on the Headspace app can earn members points.

Find out more

Claims Statistics

| Claims paid | Life Cover | Serious Illness Cover | Income Protection Cover |

| Percentage of claims paid | 99.7% | 87.8% | 95.4% |

| Total value of claims paid | £83.5m | £32.7m | £1.0m |

| Claims Declined | |||

| Suicide within 12 months | N/A | N/A | N/A |

| Did not meet criteria | N/A | 10.3%* | 4.4% |

| Non-Disclosure/Pre-existing condition | N/A | 0.7% | 0.2% |

| Other | 0.3% | 1.2% | N/A |

*Given the breadth of Vitality’s serious illness cover, it doesn’t surprise us that they receive a number of calls from clients looking to claim on less severe conditions that may not fully meet the definition.

Areas for improvement

- Could do more to convince advisers that their products are not just for healthy clients

- To ‘unlock’ certain features and benefits minimum premiums occasionally need to be met, which may be confusing for some clients/advisers.

- Vitality’s approach to indexation is the most complex on the market and difficult to explain to clients.