Zurich’s Showcase Page

Zurich Intermediary Website

Critical Illness showcase

Children’s Critical Illness showcase

Income Protection showcase

New Business

Pre-Underwriting

Online pre-app tool available, more info here (please quote your pre-app reference number in your email)

Claims

Bereavement: [email protected]

Disability: [email protected]

Phone – 0370 2430827

Opening times – 09:00 – 17:00

(Monday to Friday)

Protection Guru has worked with Zurich to create a concise objective analysis of their product range.

Zurich in their own words

At Zurich, we believe that protection should be accessible to everyone and that no two lives are the same, so their cover should reflect that. We offer a range of personal and business protection options enabling you to craft different solutions for your client’s based on their needs and budget

View protection products

View business protection products

Personal Protection Products

LIFE INSURANCE

CRITICAL ILLNESS

CHILDREN’S COVER

INCOME PROTECTION

WHOLE OF LIFE

Life insurance

Life insurance offers financial protection for your client’s loved ones, with a lump-sum or monthly benefit paid if the life insured passes away.

Zurich offer the following options:

- Level, Increasing, Decreasing, Family Income Cover, single life, Joint Life First Event, Joint Life Second Event (Level and Increasing only)

- An option to add Children’s Cover or Children’s Enhanced Cover with any sum assured between £10k – £100k

- Additional tailored protection also available for those planning to add to their family in the future through Zurich’s unique Pregnancy and Early Childhood Cover

- Option to add Renewal or Conversion Option

Find out more

Critical Illness

Zurich’s critical illness policies are designed to be tailored so that your client only pays for the cover they need. The following options are available:

- Life insurance with critical illness cover

- Standalone Critical Illness

- Family Income Cover with critical illness cover

- Family Income Cover with standalone critical illness cover

The Life Assured can choose from the following cover:

Critical Illness

Where budget is a consideration, Zurich provide core critical illness which provides full cover for the conditions most commonly claimed on plus additional cover for carcinoma in situ of the breast and low grade prostate cancer. Zurich will pay the lower of 25% of the sum assured up to £25,000 for these two conditions.

Critical Illness Enhanced

For clients that want a more comprehensive plan, Zurich Critical Illness Enhanced covers them for a wider range of full payment and additional payment conditions. Again, for additional payment conditions Zurich will pay the lower of 25% of the sum assured or £25,000.

Find out more

Critical Illness Enhanced Plus

For clients that want the same breadth of condition coverage as Critical Illness Enhanced but with higher pay out levels for all additional payment conditions and 16 life changing critical illnesses if diagnosed before age 55. Under this option Zurich will pay the lower of 50% of the sum assured or £50,000 for all additional payment conditions.

Children’s Cover

Clients can choose whether to include core or enhanced child cover (or no child cover at all) and have the ability to add and remove Pregnancy & Early Childhood cover.

- Select any amount of cover between £10k – £100k

- Available on Life only policies and CI policies

- Option to add, remove, increase or decrease, change the quality of cover held at any point

Children's cover

Core children’s critical illness provides cover for the conditions most commonly claimed on. The cover amount can be between £10k and £100k with all conditions covered paying the full sum assured.

Children's Enhanced cover

Enhanced Children’s Critical Illness covers a wider range of conditions including child permanent dependence. The cover amount can be between £10k and £100k with all conditions covered paying the full sum assured.

Find out more

PREGNANCY & EARLY CHILDHOOD COVER (PEC)

Specific cover designed for those planning to start or extend their family. Includes a range of benefits protecting from pregnancy through to early childhood. PEC will pay the full sum assured if the child suffers from one of ten congenital conditions. PEC also includes cover for complications of pregnancy.

Income Protection

Zurich offer two levels of income protection cover:

Income Protection

Zurich Income Protetion provides;

- Cover up to 80% of net earnings

- Full or short term options

- Maternity, paternity & adoption cover

- Flexible defer periods

- Waiver of premium

- Special features for doctors & surgeons

Find out more

Income Protection Select

Shares all of the same features as Income Protection as well as:

- Family carer benefit

- Trauma benefit

- Hospital stay benefit

- Needlestick benefit

- Funeral benefit

Whole of life

Zurich’s Whole of Life Protection Plan is designed for those who want added comfort of knowing that their family will receive a lump sum after their death.

Reasons to recommend Whole of Life Protection Plan:

- Policies can be placed in trust to protect IHT liabilities

- Access to Wellbeing Support included as standard

- No claims cut-off periods

Find out more

Zurich Accelerate

Zurich Accelerate provides access to experts from around the world to offer a package of medical care services for cancer, heart and neurological conditions.

It gives your clients fast access to consultations and diagnostics. It can also help them access the latest precision cancer medicine and cancer clinical trials; as well as treatment abroad at some of the leading hospitals in the world.

VIRTUAL CONSULTANT

Fast access to UK consultants once they’ve received a referral from their GP.

PRIVATE DIAGNOSTICS PLUS

Fast access to medical diagnostics and tests that might not be available through public healthcare.

SECOND MEDICAL OPINION

Provides peace of mind that your client has the correct diagnosis and treatment plan in place. Offers them more choice when making health decisions with alternative options that may not be available in the UK.

PRECISION CANCER MEDICINE

There are over 200 types of cancer* but every tumour is unique. Precision Cancer Medicine provides support and customised treatment plans using the latest tumour profiling technology. If the cancer has a hereditary component, your client’s siblings and children can also have testing and counselling.

*Cancer Research UK, https://www.cancerresearchuk.org/about-cancer/what-is-cancer/how-cancer-starts/ types-of-cancer. Accessed February 2024.

CANCER CLINICAL TRIAL SUPPORT

Help in accessing cancer clinical trials and navigating the process of sourcing and applying for relevant trials.

GLOBAL TREATMENT PLUS

Provides fast access to hospitals and consultants around the world to get your client’s treatment underway. Follow up care and continuing medication expenses are also covered.

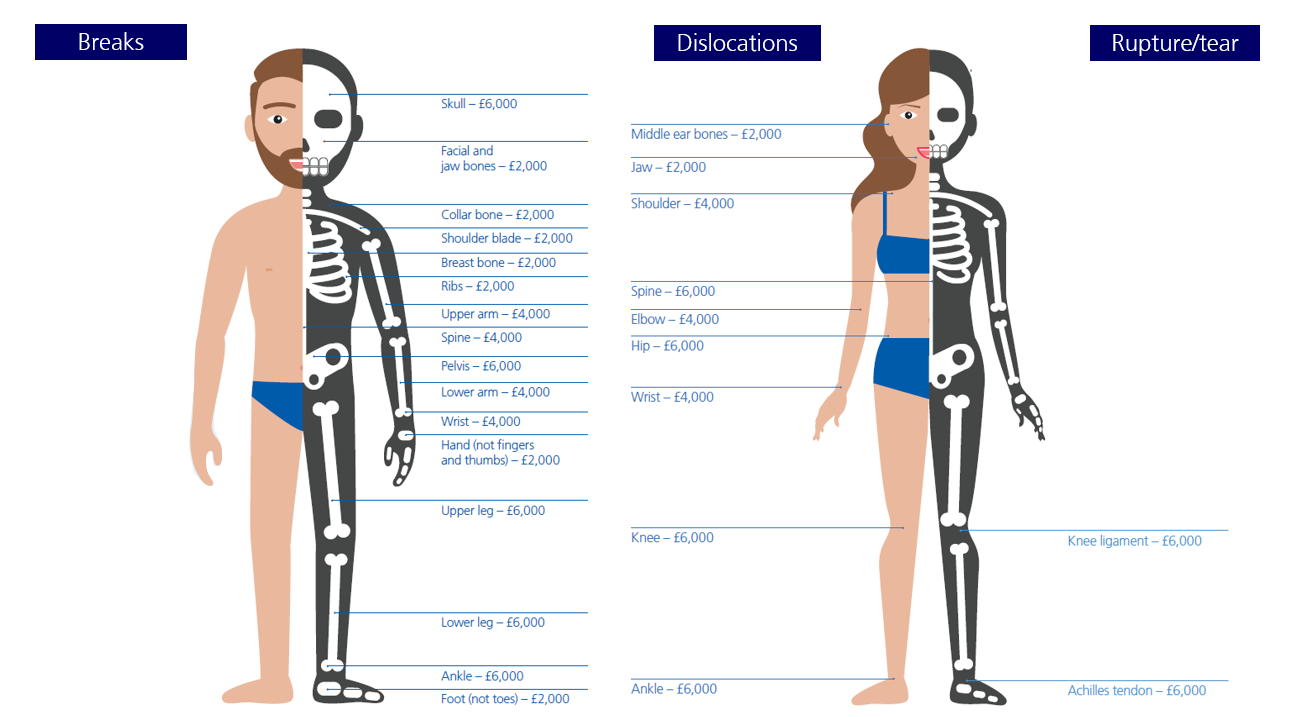

Multi-Fracture Cover

Zurich offer Multi-Fracture Cover as an optional add on to their personal Life, Critical Illness and Income Protection plans. In addition, Zurich also pay a lump sum if a client has a specified dislocation or ruptures either their knee ligament or achilles tendon. Multiple payouts can be made in a policy year up to a combined maximum of £6,000. Multi-Fracture Cover must be chosen at outset but can be removed at any point.

In 2022 Zurich paid out £1.4m in fracture cover claims!

Protection for every business

Business Protection

A range of options to protect key people, shareholders and partners. Zurich offer life cover and critical illness options.

Find out more

Relevant Life

A tax efficient way for a business to provide life cover to an employee. Particularly useful for small businesses with too few employees to set up a group scheme.

Find out more

Business whole of life

Provides life cover for a key individual for the whole of their life should they die or be diagnosed with a terminal illness.

Find out more

Adviser tools & support

Tools

Zurich have created a range of tools to support advisers, their businesses and aid discussions with clients. The tools include:

- Maximum monthly benefits caculator

- Dual deferred period maximum benefit calculator

- Medical evidence and BMI calculator

- Occupational guide tool

- Whole of life calculator

- Direct Debit collection date tool

- Relevant life calculator

Click here to access these tools

Life Protection Platform Support

Zurich’s Life Protection Platform is hugely powerful and provides advisers with a huge amount of information. It gives advisers the ability to manage not only their new business pipeline but also their in force policies removing the need for paper forms. To help advisers navigate the platform and get the most from the system, Zurich have provided a range of videos and answers to their most frequently asked questions. These cover:

- Quote and Apply

- Underwriting decisions

- Issuing policies

- Policy servicing

Business protection guide

Zurich Business Protection provides comprehensive cover for key people and owners. It includes the same critical illness conditions and features as our Personal Protection policies. Zurich have created a business protection guide to support advisers, that covers:

- Key Person

- Shareholder Protection

- Relevant Life

- An overview of different business types

- Technical information on setting up cover

Areas for improvement

- Do not currently offer as wide a range of value added services such as access to GP’s, Second Medical Opinions, Health Checks and Nutritional Support.

Protection Guru has worked with Zurich to create a concise objective analysis of their product range. Zurich have had input to the design of this page and contributed to the cost of the construction and maintenance, however Protection Guru have maintained editorial control over the content to ensure objectivity.