Zurich Children’s Critical Illness Showcase Page

Zurich Intermediary Website

Main showcase

Critical Illness showcase

Income Protection showcase

Protection Guru has worked with Zurich to create a concise objective analysis of their children’s critical illness proposition.

OPTIONS

FLEXIBILITY

PREGNANCY & EARLY CHILDHOOD

HOSPITALISATION BENEFIT

DEATH BENEFIT

Zurich in their own words

Our children’s cover options provide financial protection for your client’s if any of their children are diagnosed with a critical illness or pass away. We offer two levels of coverage – Children’s Cover and Children’s Enhanced Cover- as well as additional tailored protection for those planning to add to their family in the future – Pregnancy and Early Childhood Cover. You can select any amount of cover between £10,000 – £100,000 and this amount will remain level for the duration of the policy, no matter the structure chosen for the adult cover.

Our children’s cover provides you with the ability to craft different solutions for your client’s based on their needs, their budget and whether or not they’re planning to start or add to their family.

The most flexible children’s critical illness cover in the market

In recent years, children’s critical illness cover has had an increased focus with more child specific conditions being added, pregnancy cover and death benefits. All of this comes at a cost. When children’s cover is “included as standard” the client is paying for the cover regardless of whether they have children or not. Zurich, however take a different approach and by providing their children’s cover essentially as a stand alone policy enable clients to add or remove the cover depending on their situation. Uniquely they also offer the ability to add or remove their Pregnancy and Early Childhood cover without affecting the main child critical illness cover.

Children's Cover

Core children's critical illness provides cover for the conditions most commonly claimed on. The cover amount can be between £10k and £100k with all conditions covered paying the full sum assured.

Children's Enhanced Cover

Children's Enhanced Critical Illness covers a wider range of conditions including child permanent dependence. The cover amount can be between £10k and £100k with all conditions covered paying the full sum assured.

Pregnancy & Early Childhood cover (PEC)

Specific cover designed for those planning to start or extend their family. Includes a range of benefits protecting from pregnancy through to early childhood. PEC will pay the full sum assured if the child suffers from one of ten congenital conditions. PEC also includes cover for complications of pregnancy.

The benefits of added flexibility

Cover to meet your client’s budget

Whilst we are sure clients would want the best possible cover available for their children, cost and budget will always be a factor. If your client has a more modest budget, Core Children’s critical illness covers the main conditions covered in critical illness plans to provide a good level of protection for your clients’ children.

If budget is less of an issue then Enhanced Children’s critical illness provides much wider coverage and mirrors the conditions covered within the Adult Enhanced Critical Illness plan plus cover for child permanent dependency all paying the full Child sum assured.

A sum assured of your clients’ choosing

As Zurich’s Child Critical Illness plans are effectively separate from the adult cover, a client can choose a sum assured for their children’s cover that suits them. Clients can set the sum assured at between £10k and £100k to ensure they have the protection they need in line with their budget. The sum assured chosen will remain level throughout the term of the plan irrespective of the structure of the adult plan.

No requirement for adult critical illness

Unlike many other cirtical illness plans in the market, Zurich do not require the parent to have critical illness cover for themselves in order to take out children’s cover. Instead the life assured can have just a life cover policy which they can then add children’s critical illness to.

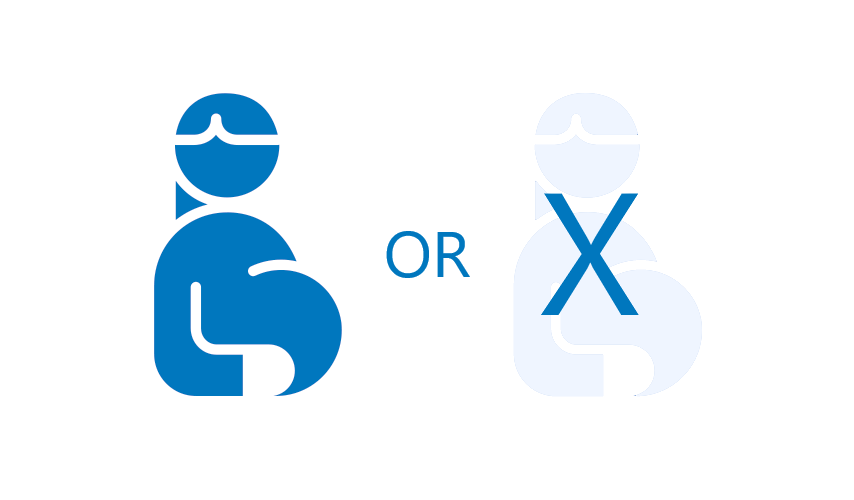

Why pay for something you cannot claim on?

Pregnancy complication and congenital conditions will usually be diagnosed either during pregnancy or very early in a child’s life. Therefore if your client has older children and is not planning on having any more children coverage for these condtions is irrelevant as it is hugely unlikely that they can claim on them.

Unlike other critical illness plans, Zurich offer their Pregnancy and Early Childhood Cover as an optional add on to their children’s cover which can be removed at any time. This means your clients do not need to pay for cover they cannot claim on.

Pregnancy & Early childhood cover

Zurich’s Pregnancy & Early Childhood cover provides Financial support in the event that the client (or their spouse/civil partner/partner) suffers from a range of pregnancy complications or their child is diagnosed with a range of congenital conditions or birth defects. The cover can be added or removed at any time to reflect a clients’ scenario so that they only pay for the cover that is relevant for them.

PRegnancy complications

Zurich will pay out £5,000 if the life assured or their partner are given a definite diagnsosis of one of the following:

- benign hydatidiform mole

- disseminated intravascular coagulation (DIC)

- eclampsia

- ectopic pregnancy

- foetal death in utero between 20 and 24 weeks’ gestation

- placental abruption

Birth defects

Zurich will pay out £5,000 if a child requires surgery following the diagnosis of one of the following:

- Cleft lip

- Cleft palate

- Congenital talipes equinovarus (Club foot) – requires treatment using the Ponseti method

- Developmental dysplasia of the hip

Congenital conditions

Zurich will pay out the full sum assured if a child is diagnosed with one of the following:

- Cerebral Palsy before age 7

- Craniosynostosis – requiring surgery

- Cystic Fibrosis

- Down’s Syndome

- Edward’s Syndrome

- Hydrocephalus before age 7 – treated with the insertion of a shunt

- Muscular dystrophy before age 7

- Osteogenesis imperfecta before age 7

- Patau’s syndrome

- Spina Bifida

What our doctors say about Pregnancy & Early Childhood cover

“Zurich has moved towards a more comprehensive and detailed policy for children’s critical illness coverage. The inclusion of specific age limits at 7 years old for certain conditions seems to align with typical age of diagnosis for these illnesses. However, these age restrictions may exclude a very small number of cases where diagnosis happens later in childhood.

The addition of cover for birth defects not only shows Zurich’s commitment to providing a more robust safety net for policyholders and their families, but also hopefully reflects a broader shift in the industry towards more inclusive coverage for congenital and developmental conditions affecting children.

These conditions, while treatable, can cause significant distress and disruption to the affected child and their family, so having coverage for these conditions can offer valuable financial support during a difficult time.”

Child Hospitalisation Benefit

Whatever level of Children’s cover is taken out your client will be provided with Children’s Hospitalisation Benefit. This is designed to help support parents with some of the costs incurred when a child is hospitalised for an extended period of time.

Core or enhanced Children's Cover

Zurich will pay £50 for every consecutive night a child spends in hospital from the 7th night of being hospitalised. This benefit will be paid for up to 30 nights (a potential maximum of £1,500) for any eligible child if hospitalisation occured after the 37th week of pregnancy.

Payment of hospitalisation benefit will not impact the main critical illness cover.

Pregnancy and Early Childhood Cover

Where Pregnancy & Early Childhood cover is added, Zurich will provide Premature Birth Hospital Stay Benefit that pays £50 for every night a child spends in hospital from the 7th night of being hospitalised. This benefit will be paid for up to 30 nights (a potential maximum of £1,500), however will provide cover if a child is born and hospitalised before the 37th week of pregnancy.

Payment for premature birth hospitalisation benefit will not impact the main critical illness cover.

What our doctors say about Premature birth hospitalisation benefit

“For many new parents, the joy of welcoming a child into the world can be mixed with anxiety and financial stress when their little one is born prematurely. A premature baby, defined as one born before the 37th week of pregnancy, often requires specialised care in a neonatal intensive care unit (NICU). These NICU stays can be extended and emotionally draining, with financial strains adding to the challenges.

Zurich, has recognized these challenges and introduced a new coverage option for these situations: the Premature Birth Hospital Stay Benefit.

This new coverage by Zurich provides a much-needed safety net for families. The premature hospital stay benefit will offer valuable support for a significant number of families, helping ease some of the financial strain during a challenging time.”

Child Death Benefit

A child death benefit is provided which reflects the cover being taken out. This is designed to provide cover based on the clients specific scenario so that they are not paying for a death benefit they cannot claim on.

Core or enhanced Children's Cover

Zurich will pay £5,000 in the event of the death of a child between the ages of 30 days and 22.

Payment of death benefit will not impact the main critical illness cover for any other children of the life assured.

This covers children born naturally to the life assured and also the children of their spouse, civil partner or partner.

Pregnancy and Early Childhood Cover

Zurich will pay £5,000 in the event of the death of a child between the ages of birth and 30 days including stillbirth after the 24th week of pregnancy.

Payment of death benefit will not impact the main critical illness cover for any other children of the life assured.

This covers children born naturally to the life assured and also the children of their spouse, civil partner or partner.

Child Conversion option

Zurich’s child conversion options enables the children covered to take out their own life with accelarated critical illness or stand alone critical illness plan without the need to go through underwriting.

Cover can be taken out between the ages of:

16 and 22

Sum assured can be up to:

£25,000

The following exclusions apply:

- Must not have been the subject of a claim, or an expected claim for Children’s Cover or Children’s Enhanced Cover under this policy.

- The new policy would not provide cover for any critical illness where the child is unable to be the subject of a valid claim under this policy because either parent had received counselling or medical advice in relation to an increased risk of the child suffering the condition before the Children’s Cover started.

Protection Guru has worked with Zurich to create a concise objective analysis of their product range. Zurich have had input to the design of this page and contributed to the cost of the construction and maintenance, however Protection Guru have maintained editorial control over the content to ensure objectivity.