For general enquiries, technical help and web support, making a claim and pre-sale underwriting enquiries:

(Lines open 8 – 6pm Monday to Friday)

Royal london in their own words…

“As a mutual, we’re different, we’re owned by customers – not shareholders or investors. We design products and services to help customers build financial resilience for the long term.

And, as a champion of impartial financial advice, we design services that support your advice and help you deliver lifetime value for your clients.”

Grow your business and deliver client value – Royal London for advisers

Craig Paterson, our Chief Underwriter, talks about how we approach claims to support your clients:

We are proud to be one of only 7 providers to be part of the Protection Distributors Group Claims Charter 2024 that works to ensure claimants are given the best support and claims are paid as quickly as possible.

Royal London’s menu plan

Everyone’s different

We understand everyone’s unique. That’s why our protection proposition isn’t one size fits all.

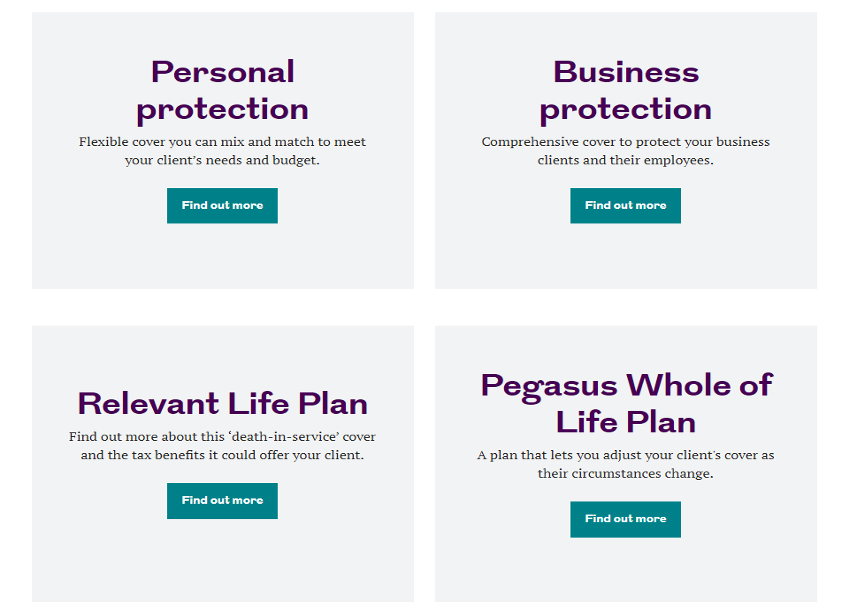

Our range of flexible cover options for personal and business gives your clients choice, so you can be confident you’re helping them get protection that’s as individual as they are. And with our sales tools and support, we can help you provide the tailored advice your clients value.

Mix and match

You can use our Personal Menu Plan and Business Menu Plan to mix and match covers (Life Cover, Critical Illness Cover, Life or Critical Illness Cover and Income Protection). It’s a simple way to create a protection plan that suits each client’s needs and budget.

Try our tool to help you with your menu plan conversations as it shows the difference between a traditional approach and a flexible menu solution Value of menu tool – Royal London for advisers

Grow your business

Strengthen your business model

When you do business with us, your Royal London contact can access rich client data and insights – helping you evidence the culture and quality of your business.

Enrich your client conversations

Take your business further with our useful tools and resources. From generating material to help engage potential clients, to clever calculators that help show the value of protection.

Ongoing technical support for your business

Our experts dedicate their time to crafting and delivering important technical and informative content to keep you up to date on the latest protection developments.

Deliver value for your clients

Here’s one of Royal London’s claimants, Andrew DaSilva, talking about his experience in making a claim. Andrew also happens to be a financial adviser, so it’s interesting to hear about his experience not just as a claimant, but as an adviser too.

Packed with flexibility, Royal London’s Personal Menu Plan lets you tailor cover to suit your individual clients’ needs and budget. And your business clients are covered too with our Business Menu Plan and Relevant Life Plan.

Some providers may charge a plan fee for each cover taken out, With Royal London there is a single menu plan fee of £2.60.

Helping Hand

Royal London believe good protection is about more than money, that’s why all their Menu Plans cover your clients’ personal and business needs and come with Helping Hand. It’s a support service that’s designed to help your clients maintain a healthy lifestyle, as well as be there for them during times of crisis. Helping Hand is there for your clients, whichever stage in life they’re at, and as a plan owner it doesn’t cost them anything extra to use. It includes a digital wellbeing support service plus 24/7 access to virtual GP services through RedArc dedicated nurses who will give tailored and personal support for as long as it’s needed. RedArc can also give your clients relevant literature, help to find useful organisations, and can organise additional services such as therapies, counselling or a second medical opinion, if it’s needed.

Helping Hand is there to offer support to your clients – even if they don’t make a claim.

Helping Hand is a package of support services, and each service is provided by third parties that aren’t regulated by either the Financial Conduct Authority or the Prudential Regulation Authority. These services aren’t part of Royal London’s terms and conditions and don’t form part of your client’s insurance contract with us, so can be amended or withdrawn at any time. This means that your client or their family’s access to these services could be amended or withdrawn by us in the future.

Cover now, underwrite later

Royal London will place your client’s plan on risk for up to 6 months while waiting for any medical information, needed to fully assess the application. Following an assessment by an underwriter, your client’s life cover can start immediately – so they can get peace of mind knowing they are protected.

Support with a personal touch

Directly access underwriters with your questions and speak to named case managers – all on board to help your business run smoothly.

Save time with our online experience

Royal London make it easy to write protection business with quick estimated decisions, pre-populated forms, and a clear dashboard to help you manage applications with our Send to Client tracker.

Specialist support for larger cases

If your client has particularly high-value or complex needs, our team is ready to provide the support you might need.

Adviser tools & support

Royal London’s protection team offers award winning service, dedicated support and useful tools to help you provide the tailored service your clients value.

Supporting your business

They offer a wide range of support, from client letters and calculators, pre-sales tools and profiling questionnaires. Whatever you need, their online tools will help you tailor your advice and get the most from your client conversations.

Their Business Support Unit can help you get to grips with a range of tools – including those developed by third-parties – to help you save time and deliver the best results for your clients.

CPD hub

Royal London can also support your learning with a range of educational modules on their CPD hub. There you’ll find accredited webinars and articles on a wide variety of pensions and protection topics that’ll help you build up those valuable CPD hours