AIG Showcase Page

Protection Consultants: <[email protected]> <0345 600 6829>

Pre-Sales Underwriting: <0345 600 6812>

Customer Services Team: <[email protected]> <0345 600 6820>

Protection Guru has worked with AIG to create a concise objective analysis of their product range.

AIG in their own words

“At AIG, we’re experts in providing life insurance products to our customers and protecting the lives of over one million people. Everything we do is designed to help make protection as easy and as accessible as possible, and our individual protection options are designed to reduce the financial impact caused by death, illness or injury. And because we work with people experiencing some of the toughest times they’ll ever go through, all of our products include value added services as standard – extra support for no extra cost.

For us, it’s about looking after customers’ futures, families and finances, offering the one form of insurance that is entirely about looking after the people we love. Because the best things we do in life, we do for others.

We’re here for your CPD needs too. Built with you in mind, AIG Life Support is a simple online learning system with a range of CPD content, including podcasts and webinars. The learning modules bring you insights and advice to help you stay ahead of your profession and are available on desktop, tablet and mobile – learn where and when it suits you. For every module you complete, we’ll provide you with a certificate as evidence. Tick off your 15 hours learning with modules such as Introduction to Trusts, Objection Handling and Relevant Life. “

Access the academy here

Personal Protection Options

Personal Protection Options |

Life |

Critical Illness |

Family Income Benefit |

Income Protection |

YourLife Plan |

Y |

Y |

Y |

Y |

Key3 (available on an accelerated or standalone basis) |

N |

Y |

N |

N |

Instant Life Insurance |

Y |

N |

N |

N |

Solutions for all budgets

Life Protection

- Instant Life – A low cost simple product that provides a simplified online application that can take less than eight minutes. There’s no manual underwriting needed, therefore clients get an instant decision. For clients with a history of severe conditions such as cancer, heart attack and stroke Instant is not suitable.

- YourLife Plan – AIG’s full fat life product that provides a wide range of features and options for clients.

Critical Illness

- Key 3 – A simple, low cost critical illness product covering the “big three” conditions – cancer, heart attack and stroke of specified severity. Over 80% of adult critical illness claims paid out by AIG in 2022 were for illnesses covered by Key 3. * Based on AIG Claims Data for 2022

- YourLifePlan Core Cover – A low cost critical illness plan covering the fundamental critical illness conditions including outcome based definitions for fairer cover. Children’s cover can be added or removed at any time.

- YourLife Plan Enhanced Cover – AIG’s most comprehensive cover with definitions covering the impact of a wide range of illnesses and operations in order to provide fairer critical illness cover. Children’s cover can be added or removed at any time.

Income Protection

- 2 year benefit payment period – For those where cost may be a concern this provides an income protection benefit where a claim will be paid for up to two years and clients can claim multiple times throughout the term of the plan.

- Full benefit payment period – The full benefit payment period option enables clients to claim their income protection benefit for the entire term of the plan.

Specialist solutions

Business Protection

Business protection needs to cater for a wide range of business types including limited companies, sole traders, partnerships and LLPs. AIG offer a wide range of business protection solutions to help advisers put the right cover in place for their clients.

Relevant Life

Relevant life insurance allows business owners to provide their employees with death-in-service benefits outside a registered group life scheme. Straightforward and cost-effective, it can also be tax-efficient for the business and the employee. AIG’s plan also allows employees to switch the cover to a new employer or an individual policy, with no time constraints and no loss of terminal illness benefit.

High Net Worth

AIG offer high sums assured for term assurance cover, whole of life and critical illness on both personal and business protection. Their premium service team comprises of expert financial and medical underwriters and administrators, providing a dedicated point of contact throughout the application.

IHT Planning

AIG offer a number of different options to help mitigate IHT including Whole of Life and Term Assurance (both available on a joint life second death basis) which can address the needs of clients whose IHT liability is expected to last indefinitely or where the liability will erode over their lifetime i.e. via gifting or IHT friendly investments.

Non-UK Residents

As long as the policy owner is a resident in the UK, Jersey, Guernsey, Isle of Man or Gibraltar, AIG can consider cover for foreign nationals living in certain countries. AIG can also consider cover for British nationals (expats) resident almost anywhere in the world.

Care Cover

AIG’s Care Cover with Whole of Life enables the client to claim 75% of the sum assured up to a maximum of £300,000 if they are permanently unable to carry out three of six stated activities or have severe cognitive impairment. Death and Terminal Illness claims pay 100% of the sum assured.

Specialist Mortgage Cover

AIG offer a range of bespoke approaches for covering specialist mortgages including buy to let properties, a self-build or even a particularly high mortgage amount.

Supporting clients from day 1

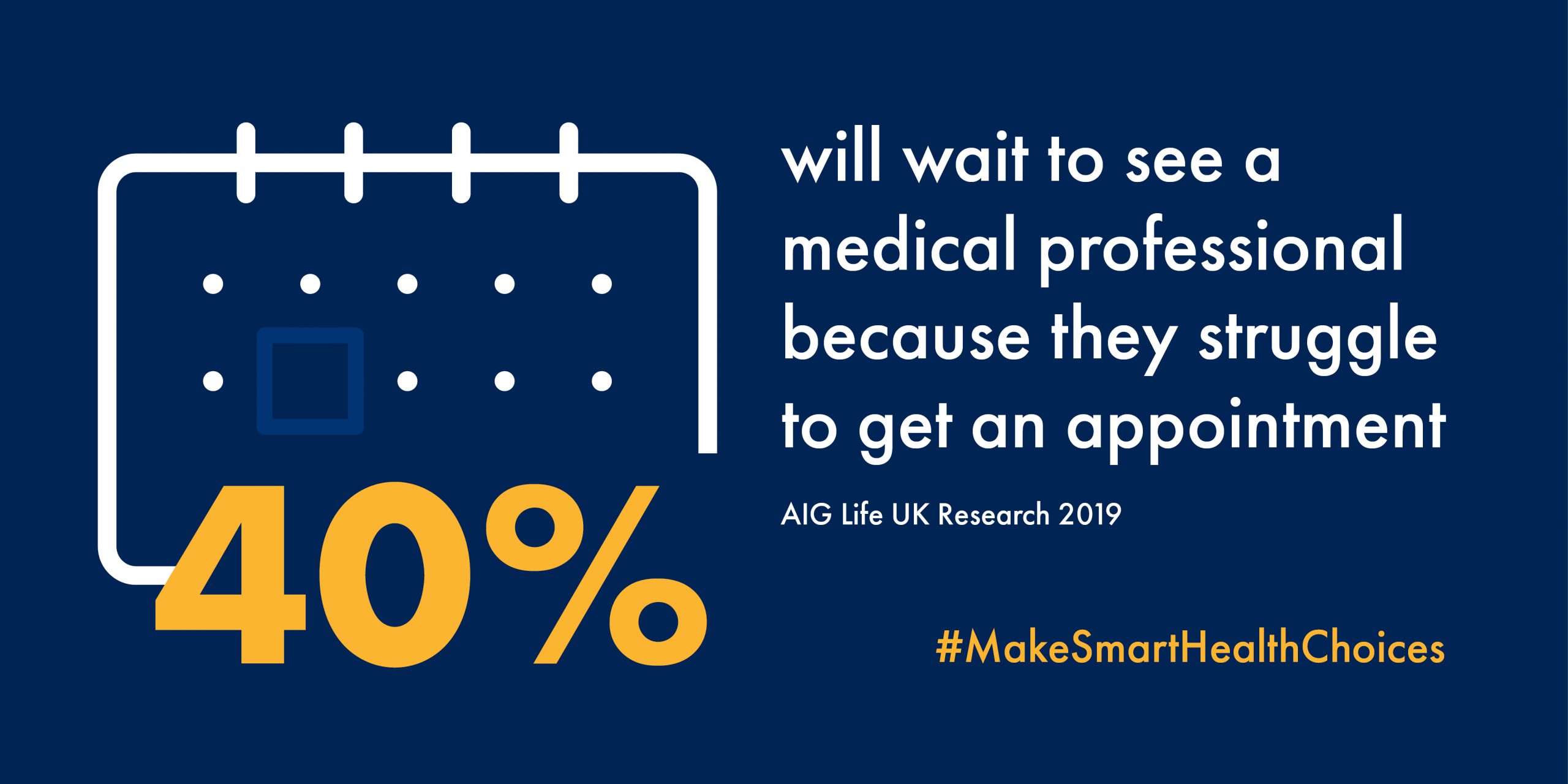

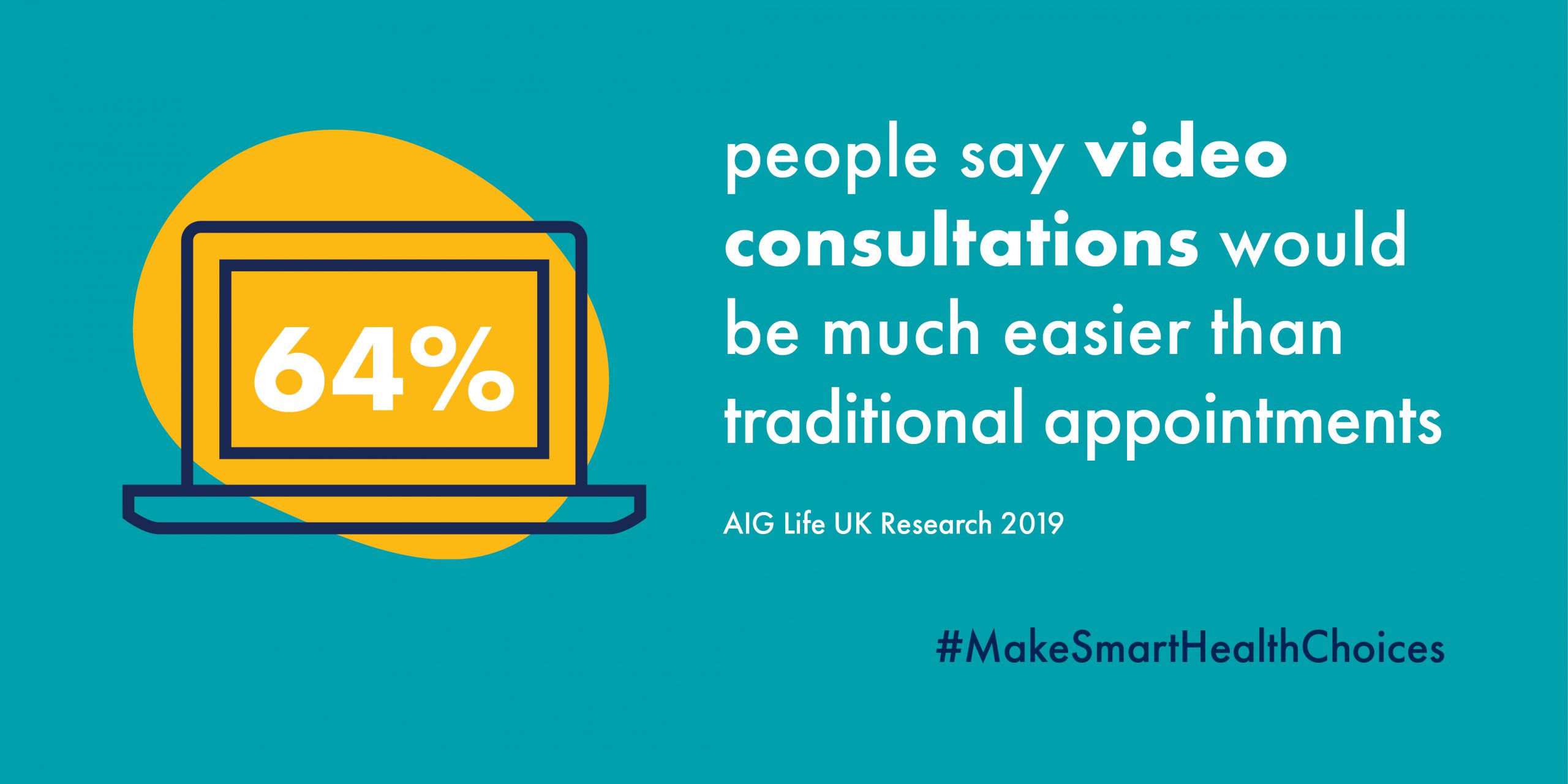

AIG are not just focused on helping clients at their time of need but also on providing services that they can use at any point during the term of the policy to help reduce the risk of the worst happening. Smart Health provides all new and existing AIG customers with 24/7 unlimited access to online GP’s, 365 days a year, access to an expert second medical opinion service and mental health support if their health fails, as well as a nutrition plan, fitness programme and online health check to help customers lead a healthier lifestyle.

*Smart Health is provided to AIG Life Limited customers by Teladoc Health. These services are non-contractual, which means they don’t form part of the insurance contract. If AIG Life’s partnership with Teladoc Health ends, these services could be changed or withdrawn in the future.

Roll your mouse over or touch to expand

24/7 Online GP

Second Medical opinion

Mental Health Support

Nutrition Plans

Fitness Programme

Online Health Check

Key Benefits of Smart Health

24/7 online GP

- Available at any time regardless of claim

- No additional cost

- Available to the life assured, their partner & children (up to age 21)

- Unlimited appointments per annum

- Private prescriptions provided (costs of medication not covered)

- Appointments available via the Smart Health app, online via video call or over the telephone

- Can refer/signpost the client to other services where beneficial

Second Medical Opinion

- Available at any time regardless of claim

- No additional cost

- Access to second medical opinions from a worldwide panel of peer recommended specialists

- Available to the life assured, their partner & children (up to age 21)

- A GP case manager will provide support from start to finish acting as the middle man between your client and one of the 50,000 specialists they have access to, helping to take the stress out of the situation.

- Can refer/signpost the client to other services where beneficial

- Available up to 36 months after a policy ends (critical illness only)

Mental Health Support

- No additional cost

- Available to the life assured, their partner & children (up to age 21)

- Access to a team of mental health professionals, including a team of psychologists who can provide tailored counselling for both adults and children

- Consultations available via video call or telephone

- Can refer/signpost the client to other services where beneficial

- Can provide Cognitive Behavioural Therapy (CBT), Cognitive Analytical Therapy (CAT), Phobia Therapy, Trauma focused therapy and Eye Movement Desensitisation Reprogramming (EMDR) for post-traumatic stress disorder (PTSD)

Nutrition Plan

- Provides a consultation with a qualified nutritionist and tailored weekly plans and menus

- Available at any time regardless of claim

- No additional cost

- Available to the life assured, their partner & children (up to age 21)

- Consultations available via video call or telephone

- Can refer/signpost the client to other services where beneficial

Fitness Programme

- Available at any time regardless of claim

- No additional cost

- Provides a bespoke fitness plan

- Available to the life assured, their partner & children (up to age 21)

- Signposts the client to other services

Online Health Check

- Available at any time regardless of claim

- No additional cost

- Available to the life assured, their partner & children (between 18 and 21)

- Available online

- Signposts the client to other services

Supporting Advisers

Tools & Calculators

To support advisers when giving advice, AIG provide a wide range of tools including;

Business Quality

AIG are committed to supporting advisers manage their business quality, to help spot opportunities and to improve the efficiency and profitability of their businesses.

2022 Claims Statistics

Life Protection |

Terminal Illness |

Critical Illness |

Children’s Critical Illness |

|

Total value of claims paid |

£131 million |

£29 million |

£40 million |

£1.5 million |

Number of families supported |

3,763 |

208 |

581 |

74 |

Claims Support Fund

AIG’s claims support fund is designed to add support beyond a financial payout. It is a discretionary fund that provides up to £500 to pay for services that can support the life assured or their family in the event of a valid claim.

How the support fund has been used

Post-op bras following a mastectomy

Flights for family from the Channel Islands to Southampton to accompany the claimant while he had treatment

Ironing service to help with post-op fatigue

Toll road charges and petrol for husband to visit his wife in hospital twice a day following coronary artery bypass surgery

Help towards cost of sit-stand chair following the diagnosis of a degenerative condition

£136,000 paid across 478 claims in 2022*

*Based on AIG Claims Data for 2022 (see here for more details)

Winstons Wish

AIG have partnered with Winston’s Wish, one of the UK’s leading child bereavement charities. Since 1992, they’ve been helping children who’ve lost a parent or sibling by listening to their grief, acting when they’re needed and knowing what to say when it’s time to talk.

Winston’s Wish is a national charity that is accessible to anyone regardless of an insurance policy. The service is available even if a policy ends.

Click the image to the left to access AIG’s Winstons Wish case studies.

Areas for improvement

- Could offer a more simple low cost income protection proposition

- Would like to see more detailed claims statistics across the different products (especially critical illness)

Protection Guru has worked with AIG to create a concise objective analysis of their product range. AIG have had input to the design of this page and contributed to the cost of the construction and maintenance, however Protection Guru have maintained editorial control over the content to ensure objectivity.