Scottish Widows Critical Illness Showcase Page

Website

Contact details

SCOTTISH WIDOWS’ CRITICAL ILLNESS PROPOSITION IN THEIR OWN WORDS

At Scottish Widows, we’ve made our Critical Illness Cover and definitions more inclusive, simpler to explain and easier to access than ever. We have one simple policy with no complicated add-ons and use clear and concise wording/imagery to support client understanding.

So, together, we can offer more of your clients the cover they need.

Simple, Clear & Concise

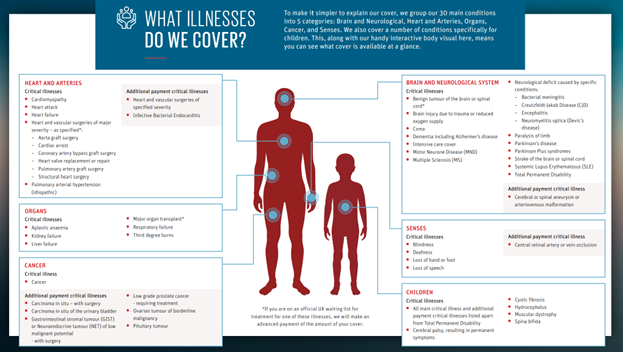

Scottish Widows critical illness covers a broad range of conditions. what is particularly impressive is that, whilst broad in coverage, their definitions are clear and concise and the documentation uses simple graphics to highlight what is covered. The body image used by Scottish Widows demonstrates the broad range of conditions covered which have been categorised into five easy to understand headings. The definitions have been carefully constructed to provide comprehensive cover with similar conditions grouped into single definitions as our independent panel of medical practitioners explain:

“A lot of thought has clearly gone into the format of this policy to allow greater understanding to the lay-person. This has been done through organising wordings into body systems with the addition of a graphical representation. Scottish Widows appear to have found the right balance of combining and simplifying wordings, without losing either coverage or clarity, which is impressive.”

Support both during & after claims

Claims made clear

In 2022, Scottish Widows paid more than £86 million in critical illness claims helping 1,552 customers and their families. This provided valuable financial support to these customers at a difficult time in their lives. Access their 2022 claims report for information on how they can provide your clients with financial, practical and emotional support during the claims process.

Claims Report

Advance Payments

If your client is on an official UK waiting list for surgery for certain illnesses, we’ll make an advanced payment of the current amount of cover they have.

We can also make an advanced payment of £3000 at claim stage for cancer claimants.

Claims case studies

Cover beyond the claim

Scottish Widows can provide clients with financial, practical, and emotional support during the claims process with a wide-ranging package of added benefits that support them during difficult times, and help advisers have a conversation about how you can help.

Options after a claim

Partnerships

Support from Day 1 with Red Arc

Scottish Widows’ policies offer your clients, their partners and children practical and emotional support from an experienced nurse through RedArc

Clinic in A Pocket - 24/7 Medical Expertise

Clinic in a Pocket TM gives your clients access to medical expertise from the comfort of their home or if they’re on the with us go.

MacMillan

Scottish Widows have a long standing partnership with Macmillan. They help people impacted financially and emotionally by a cancer diagnosis by referring them to Macmillan Cancer Support’s Financial Guidance team.

In particular, Scottish Widows have been working with Macmillan Cancer Nurse Specialists to enable more critical illness claims to be paid quickly and efficiently.

Read more about Scottish Widows Care

Inclusive underwriting

Scottish Widows pride themselves on easy access to more kinds of cover, including mental health issues, and instant decisions.

They recognise that all your clients are different. That’s why their underwriters work hard to offer bespoke and flexible underwriting decisions designed around individual needs. They want to make sure your clients can have financial protection in place quickly, so they also give you direct access to their underwriters for more complex cases.

Roll our mouse over or touch the stat to find out more

90%

9%

96%

Get an indication of the underwriting outcomes for your client’s medical condition

Find out how Scottish Widows approach underwriting in these underwriting stories

Children’s Cover

Children’s Critical Illness Cover is automatically included with all of Scottish Widows’ Critical Illness Cover policies. It covers any natural child, stepchild, legally adopted child or any child the person covered is the legal guardian for. Scottish Widows will pay out £30,000 or 50% of the main sum assured (whichever is lower) if the child is diagnosed with one of the illnesses in their list of definitions and is covered under the policy after birth and before 22 years.

They also cover 5 specific children’s conditions. Cover excludes terminal illness and Total Permanent Disability. Any payments made under Children’s Critical Illness Cover will not impact on the main cover.

£30,000 up to a maximum of £30,000

From birth to age 22

includes 5 specific children’s condtions

Supporting advisers

Consumer Duty Hub

Consumer Duty is a new and higher standard of consumer protection that has been introduced by the Financial Conduct Authority (FCA). It aims to ensure that the finance industry as a whole has a clearer focus on customer outcomes and protecting customers from unforeseeable harms.

Explore Scottish Widows’ Consumer Duty Hub for more information and tools in how you can meet the FCA’s requirements.

Visit Consumer Duty Hub

Continuous Professional Development

Contact your Scottish Widows Sales Representative for information on bespoke CPD session for you or your team.

For independent learning check out their CPD accredited online courses

Visit Professional development Hub

Key Benefits

- Simple definitions that offer broad critical illness coverage with excellent supporting material to help highlight the breadth of cover to clients via easily understandable graphics.

- Excellent mental health support

- An inclusive approach to underwriting with a willingness to provide terms where possible to as many clients as possible.

Protection Guru has worked with Scottish Widows to create a concise objective analysis of their product range. Scottish Widows have had input to the design of this page and contributed to the cost of this construction maintenance, however Protection Guru have maintained editorial control over the content to ensure objectivity.

Main page

Care page

Business Protection page