Scottish Widows Care

Website

Contact details

SCOTTISH WIDOWS’ CARE PROPOSITION IN THEIR OWN WORDS

Scottish Widows Care includes wellbeing services from RedArc support to Square Health’s mobile app, Clinic in a Pocket™, helping demonstrate the value of protection beyond a financial pay-out.

Access to the right care, right away

All Scottish Widows Protect policies come with additional care support services, available and accessible to your clients, their partners and their children straight away. At no extra cost. And as often as they need them. And all accessed without having to make a critical illness or life insurance claim.

Including:

- Practical advice and emotional support for a dedicated nurse for any long-term physical or mental health condition

- Help with bereavement, trauma or elderly care

- Help at home, therapies, specialist second opinion

- Easier access to a virtual GP and appointments 24/7.

Talking about added value services helps demonstrate the benefits of protection to a client. Kathryn Knowles of Cura Financial Services discusses how she handles the conversation with care.

Physical, Mental and Emotional Support

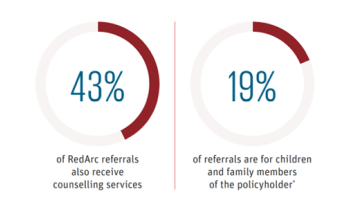

Scottish Widows provide your clients and their immediate family members with access to their own dedicated RedArc Personal Nurse – a highly experienced, qualified nurse who can provide emotional and practical support as often and as long as required

Support includes:

- Emotional support and practical advice for any long-term physical or mental. illness such as cancer, cardiac, depression, anxiety.

- Help with situations such as bereavement and trauma.

- Targeted resources such as self-help books, apps and factsheets.

- Information on help available locally and help navigating the NHS

- Wide range of additional services e.g. Help at home, face-to-face second medical opinion from UK-based specialists or a course of therapy e.g., counselling, complementary or occupational therapy

Immediate Access If your client or someone in their family needs help, advice or support from RedArc, just call our customer support team on 03339 398 111 and explain that you want a referral. Phone lines are open Monday–Friday 8am–6pm, standard UK phone charges apply.

At Claim Stage Scottish Widows’ claims team will explain how you or your family can access RedArc.

Guide to Scottish Widows Care

A flexible virtual GP service

Scottish Widows' partnership with Square Health in the provision of the Clinic in a Pocket™ platform provides clients, their children and their partners with free access to a UK doctor 24/7. So, they can talk through any health or medical concerns by remote consultation.

Accessed via Square Health’s fully encrypted Clinic in a Pocket™ app, your clients’ health history is encrypted and securely stored

The first step is for your clients to register – your client will receive their registration access code in their welcome pack, which is posted when the cover starts. After registering, your clients will be able to access these services directly from Square Health through their Clinic in a Pocket™ app for Android and Apple. Square Health will be on hand to help with installation, registration and the GP service itself.

Guide to clinic in a pocket

How can clinic in a pocket help?

Tailored Cancer Support

In 2021, Macmillan reached 2.4 million people affected by cancer.*

Scottish Widows have been a partner of Macmillan since 2019, with a further five-year partnership deal agreed in 2023. The partnership to supports clients affected by cancer and help support with the impact on their families, finances and emotional wellbeing.

Source: Macmillan cancer statistics factsheet, October 2022

If your client, or their loved ones, are going through a cancer journey, Scottish Widows can help. We can provide a referral process for customers, meaning a specialist Macmillan adviser will call your client back and find out how best they can be supported through this difficult time.

If your client is going through a cancer claim, they could also benefit from a Macmillan Nurse Specialist, which will support with the claims process.

Your clients can also call Macmillan’s Support Line for free on 0808 808 0000 (8am–8pm, seven days a week) or visit www.macmillan.org.uk

Keeping your clients informed

Each year Scottish Widows send you and your clients a statement of benefits summarising the cover they have in place. This gives details of the cover in your clients’ plan, what the cover costs, details of Scottish Widows Care and useful contact information.

It gives your client a timely and tangible reminder of the important cover they have, and gives you the opportunity to review your clients’ protection needs, remind them of the value of advice and build an ongoing relationship with them.

a timely tangible reminder of valuable cover

A chance to review your clients’ needs

An opportunity to strengthen ongoing relationship

Keeping clients covered

Retaining clients

We have a bespoke, proactive retention strategy designed with the aim of keeping your clients protected. Scottish Widows’ Business Development Managers can work with you to embed value into your protection sales, identifying potential growth and development areas as well as flagging any issues.

Scottish Widows have a specialist team that includes call handlers experienced in dealing with clients who have missed a payment or cancelled their direct debit.

Their focus is on the quality of the conversations they have with clients, not the number of calls they make.

The retention strategy is a practical and effective solution to the problem of lapses and loss of client engagement and our success in retaining clients speaks for itself.

What happens when a policy lapses?

Scottish Widows provide clients with every opportunity to keep their protection in place and, as well as talking to them, we will also write to them to encourage them to call us to discuss their premium payments.

As part of the overall support they provide to you and your clients, they will let you know the outcome of any conversations they have with your clients, whether this is positive and they are able to keep the policy in place, or whether the client still wishes to cancel their policy. If this happens they will let you know the reason your client has decided to cancel.

Scottish Widows allow 110 days before they lapse a policy and a number of letters are issued automatically to clients over that period to remind and encourage them to pay any missed premiums, so they can continue to stay protected.

View policy lapse timeline

Supporting advisers

Consumer Duty Hub

Consumer Duty is a new and higher standard of consumer protection that has been introduced by the Financial Conduct Authority (FCA). It aims to ensure that the finance industry as a whole has a clearer focus on customer outcomes and protecting customers from unforeseeable harms.

Explore Scottish Widows’ Consumer Duty Hub for more information and tools in how you can meet the FCA’s requirements.

Visit Consumer Duty Hub

Continuous Professional Development

Contact your Scottish Widows Sales Representative for information on bespoke CPD session for you or your team.

For independent learning check out their CPD accredited online courses

Visit Professional development Hub

Protection Guru has worked with Scottish Widows to create a concise objective analysis of their product range. Scottish Widows have had input to the design of this page and contributed to the cost of this construction maintenance, however Protection Guru have maintained editorial control over the content to ensure objectivity.

Main page

Critical Illness page

Business Protection page