WELLBEING SUPPORT

REHABILITATION SUPPORT SERVICE

FRACTURE COVER

CARE CONCIERGE

additional cover you and your clients can count on

Umbrella Benefits delivers personalised additional cover and services that keep on working for your clients behind the scenes.

It’s our package of five added-value services and optional benefits that are ready to help protect your clients; Wellbeing Support, Care Concierge, Fracture Cover and Rehabilitation Support Service

| Access included as standard |

Additional cost | ||||

| £5.90 | |||||

| Available on | Wellbeing Support | Rehabilitation Support Service | Care Concierge | Fracture Cover | |

| Life | Yes | No | Yes | Yes | |

| Critical Illness Cover | Yes | No | Yes | Yes | |

| Income Protection | Yes | Yes | Yes | Yes | |

| Rental Income Protection | Yes | Yes | Yes | Yes | |

| Business Protection | Yes | Yes* | Yes | No | |

*Only included as standard with Executive Income Protection and Key Person Income Protection

Wellbeing Support

Wellbeing Support puts individual client needs at the centre of care, with personalised help just a phone call away.

The personalised service is delivered by RedArc’s experienced registered nurses, dedicated support can range from a reassuring chat, advice and guidance, to a clinical assessment and organising specialist services.

Why wellbeing support?

Access included as standard across all protection products

Available to the policyholder, their partner and their children living at home

Personalised practical and emotional telephone support at any time

Previous example situations that nurses have supported with:

- Mental health support – coping strategies, relaxation techniques and counselling.

- Oxygen therapy to help with symptoms of MS

- Long covid

- Headwear for cancer patients who have lost their hair

- Subscriptions to apps to support recovery e.g. HeadSpace and Careline 365.

- Debt and money worries

- Understanding breast cancer diagnosis

Find out more

Rehabilitation Support Service

Rehabilitation Support Service is a feature of all Legal & General’s income protection products.

Available at no extra cost, it gives your clients access to their in-house team of healthcare professionals, who’ll support their quicker return to good health and work.

What are the benefits?

The service helps your clients with a wide range of physical and mental health concerns to make sure symptoms aren’t prolonged or prevent things from getting worse.

They do this by offering:

- Tailored support and advice – Their experienced in-house medical team assess their needs

- Fast access to in-house healthcare professionals – They handle referrals so they can start treatment sooner

- A structured and phased approach – They will help them plan their return to work

If Legal & General’s in-house team cannot find the appropriate treatment, they may be able to put your clients in touch with one of their specialist partners, at no extra cost.

Rehabilitation

Support

Service

Roll your mouse over or touch to expand

Tailored treatment & support

In-house medical team

Specialist care & advice

Early intervention treatment access

Return to work planning

Find out more

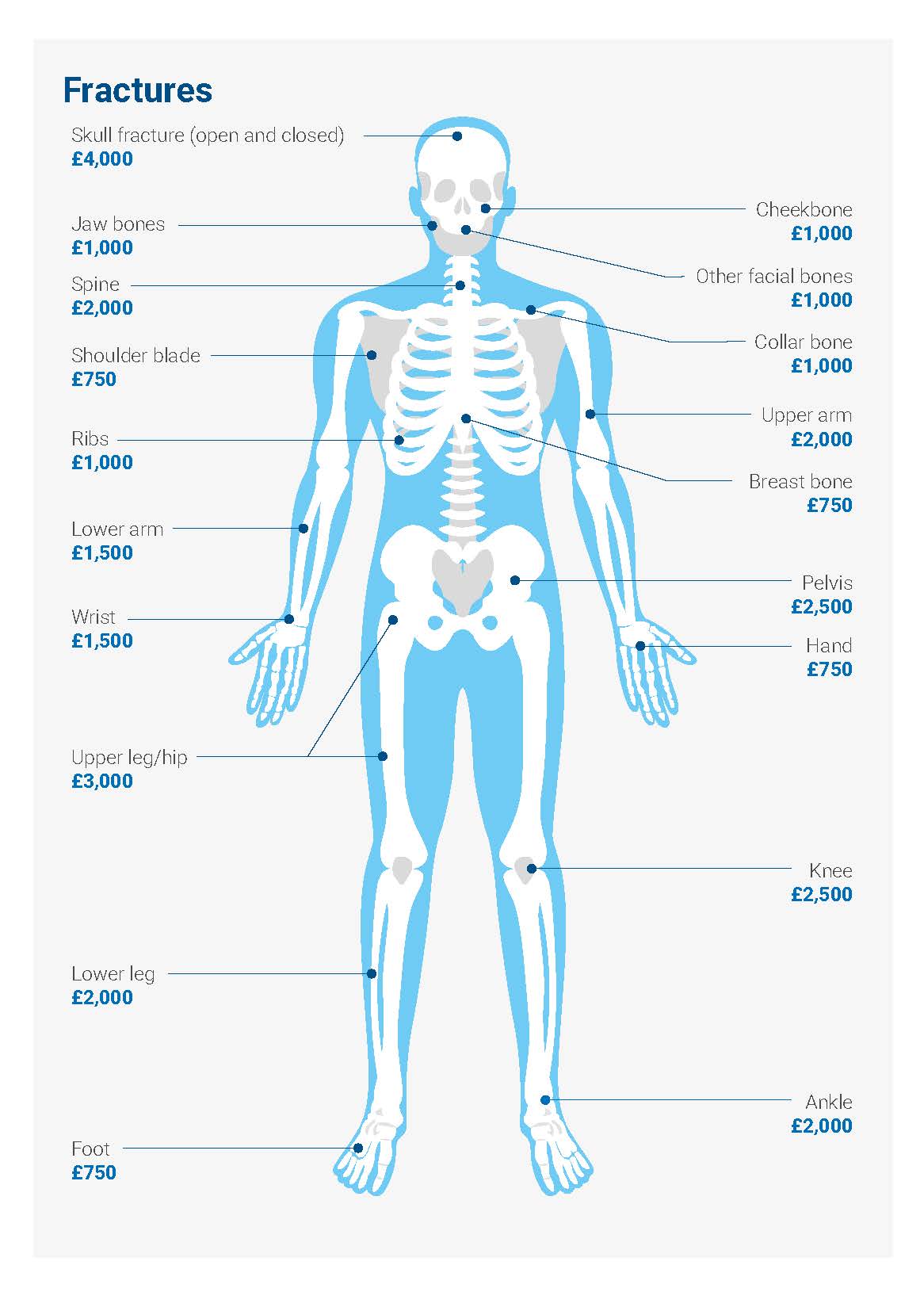

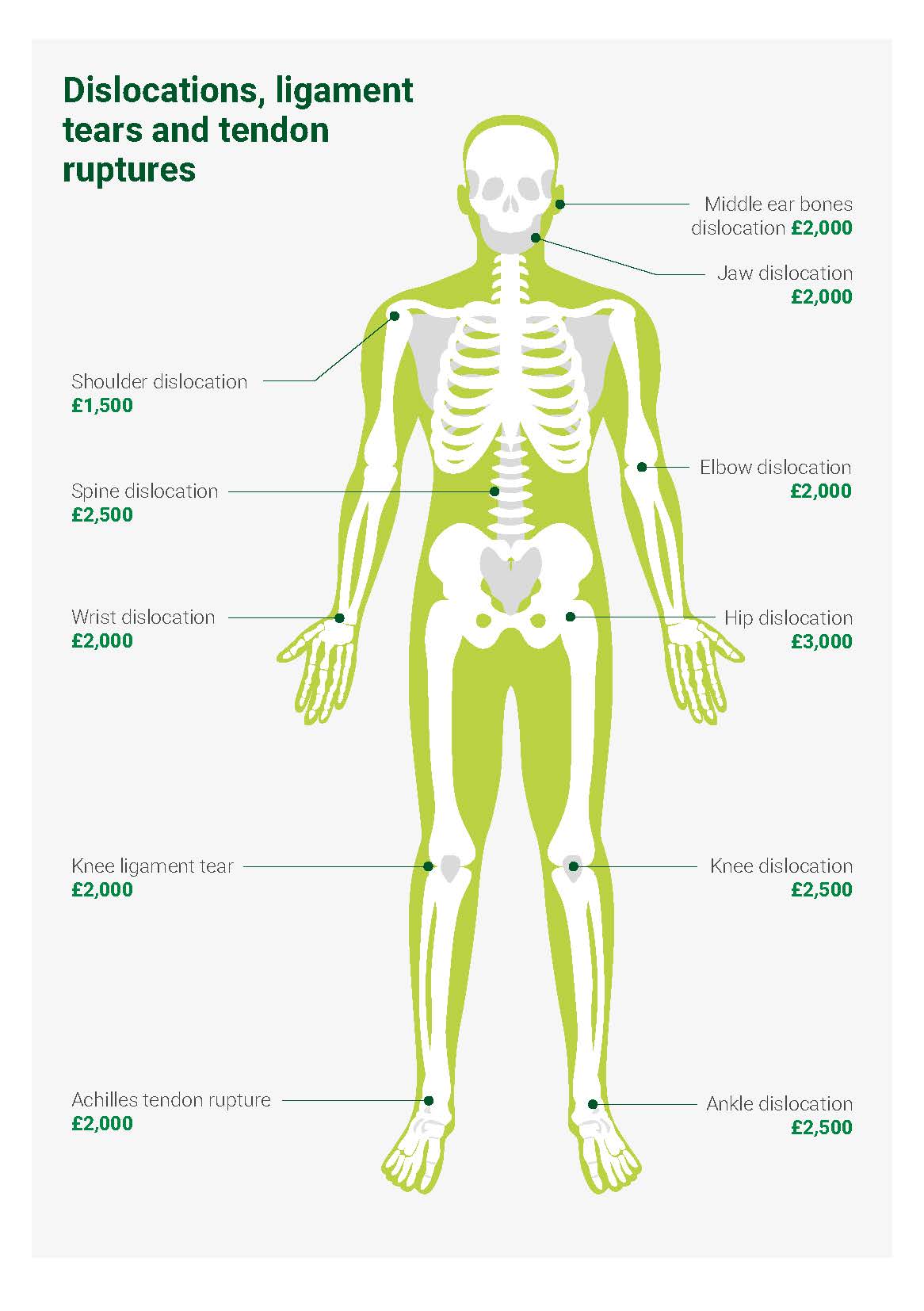

Fracture Cover

Provide your client with peace of mind that should they sustain one of the specified injuries, they’ll be covered – for an extra £5.90 a month.

Fracture Cover can be added to life insurance, critical illness, income protection and rental protection policies.

Key benefits:

- Multiple claims per year up to a maximum payout of £4,000

- Cover for 19 different fractures, 9 joint dislocations, Achilles tendon ruptures and knee ligament tears

Find out more

Care Concierge

A free personalised service to help your clients understand find and fund later life care.

Free access to experts in later life care via telephone

- Confidential 1:1 support

- Named care expert throughout journey

- Policyholders and their family can discuss the later life care needs of themselves or others

Impartial and tailored guidance

Understand

- Care assessment processes to access support from local authority

- Power of Attorney

- Home adaptations and home help options

Find

- Find care homes and home care services

Fund

- Identify eligibility for state care funding support and NHS funding entitlement

- Benefit entitlement check

Clients can self-serve via digital platform

- Care assistant – 5 questions to get your client started if they are unsure where to begin

- Information in articles on a range of later life care topics

- Care costs calculator – to understand how much care would cost

Find out more

Private Diagnostics and Fracture Cover are insured by AXIS Specialty London. The support and services are provided by Trustedoctor, a sister company of Further Underwriting International SLU.

View main showcase page